Hypoxia Chamber Market Synopsis:

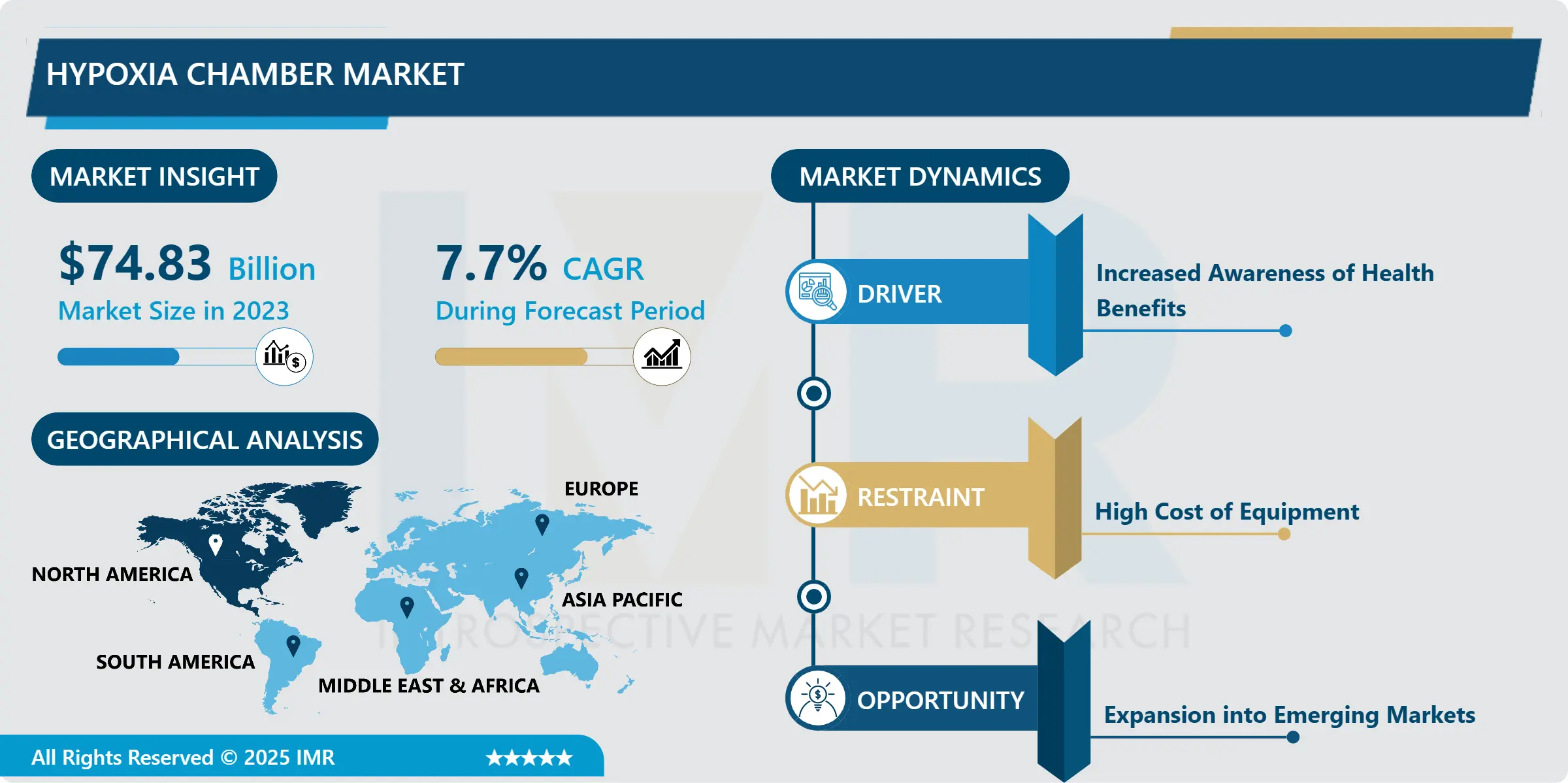

Hypoxia Chamber Market Size Was Valued at USD 74.83 Billion in 2023, and is Projected to Reach USD 145.89 Billion by 2032, Growing at a CAGR of 7.70% From 2024-2032.

Hypoxia chamber market relates to the industry that deals in manufacture as well as supply of artificial chambers which create conditions of hypoxia. These chambers are used for many purposes such as, exercise physiology, training of athletes at high altitudes, and as a therapeutic instrument in treating oxygen shortage ailments. They are also used in aerospace and military training services in order to familiarize with the staff with high altitude conditions. It argues that the market is growing due to the rising need for performance boost in sporting activities, technology growth in healthcare, and the discovery of the importance of controlled hypoxia.

In the recent past, the hypoxia chamber industry has experienced a robust growth due to increasing popularity of state-of-the-art medical and therapeutic technologies for certain disorders associated with oxygen deficiency. Hypoxia chamber otherwise referred to as altitude simulation chamber are places designed to simulate high altitude environments through low oxygen concentrations. This technology is mainly used in the clinical area to managing some illness inclusive of respiratory disease, sleep apnea syndrome and as a part of acclimatization training. In addition, an increasing number of athletes and individuals who want to enhance their endurance for their sport requiring oxygen dependency have heightened the awareness of hypoxia therapy and fuelled market growth.

The market is liked by steady increase in technology which is vivid by the different equipment manufacturers inventing different methods that would make the hypoxia chamber more effective and easy to use. Major players are now aiming to design and launch small and mobile machines for practice and home use thus expanding market customer base. Furthermore, the use of digital health technologies along with the monitoring systems which captures subject’s physiological data during hypoxia therapies also emerging. These include government approval on the use of hypoxia chamber as well as a nod from health institutions that supports the therapeutic value of hypoxia chamber. Because the healthcare industry is a constantly generating field, the demand for hypoxia chamber products will remain strong, and the industry will gradually shift its focus in R & D, partnerships, and other rehabilitation and sports medicine industries.

Concerning the regional split, North America holds the largest place in the hypoxia chamber market due to the highly developed healthcare systems, the high tendency to spend on healthcare services, and a relatively high popularity of hypoxia therapy for sports training and rehabilitation. At the same time, the Asia-Pacific market shows potential and continued growth due to increasing awareness of individual health, the availability of health care services, and increased attention to the prevention of diseases. With the people of the world paying more attention to healthy lifestyle and demanding advanced medical solution, the hypoxia chamber market will show space for growth through new product development and focusing on the so-called personalized medicine. In summary, the hypoxia chamber market is promising and highly diversified healthcare subsidiary market with continued growth prospects.

Hypoxia Chamber Market Trend Analysis:

Growing Adoption of Hypoxia Chambers Among Athletes

-

Many athletes have opted for hypoxia chambers and got to increase their red blood cell mass and also improved oxygen carry to the tissues from the lungs. This is more so elaborated by the endurance athletes like the runners, cyclists and the triathletes in a bid to find a comparative advantage in training. This paper will therefore seek to discuss how Hypoxic training has benefits to the athletes in enhancing their aerobic endurance which would be pivotal in the sum delivery of athletics. In addition, these chambers are being adopted by professionals teams and training facilities as they understand the benefits of simulate altitude training without having to go high up into the mountains.

- Of even more importance is the ability to incorporate newer technologies into the hypoxia chambers through the use of smart monitoring of the chambers and user friendly interfaces. These innovations facilitate the documentation of the training process, the assessment of physiological changes, and the synchronization of the training process with certain performance targets set for the user. For this reason, hypoxia chambers are making their way to people’s private, households or home gyms and even rehabilitation stations. This brings a democratisation of the technology and makes it possible for more than just professional athletes such as masseuse, fitness freaks who exercise for recreation, to use hypoxic training hence creating the demand in the market place.

Growth Opportunities in the Hypoxia Chamber Market

-

The market for hypoxia chambers is rapidly evolving based on the growing interest of athletes and health-conscious people in obtaining new training techniques that help to increase the body’s endurance and improve the utilization of oxygen. It has been demonstrated that training in conditions that replicate conditions at high altitude, in hypoxia chambers, enhances physical performance and rate of recovery from the stress of training. This trend is most attributable to elite level sport where the objective measurements of performance are significant for success. Consequently, a strong market from hypoxia training solutions exists to provide a competitive edge to the athletes. These chambers enables the users to train under these conditions of low concentrations of oxygen so that they are in a position to withstand situations of high altitude and hence enhance their general performance.

- Furthermore, the improvement of altitude training camps together with additional refinements in specialized hypoxic services will defend market opportunities for hypoxia chambers. Most of these enhanced training facilities can now be afforded by many athletes today and athletes no longer have to go up the mountains in order to acclimatize to high altitude training. This convenience has seen many training centers embracing hypoxia technology to help attract more participants in training especially by funneling both elite athletes and recreation fitness trainees. With the uptake of hypoxic training benefits increasing over time as more people seek ways to improve their performance and general fitness, the market should grow to meet the demand in response to the increasing population that is in need of an edge or improvement to their conditioning.

Hypoxia Chamber Market Segment Analysis:

Hypoxia Chamber Market is Segmented on the basis of Type, Application, End User, and Region

By Type, 84 x 35 mm Plates segment is expected to dominate the market during the forecast period

-

The market for hypoxia chambers is rapidly evolving based on the growing interest of athletes and health-conscious people in obtaining new training techniques that help to increase the body’s endurance and improve the utilization of oxygen. It has been demonstrated that training in conditions that replicate conditions at high altitude, in hypoxia chambers, enhances physical performance and rate of recovery from the stress of training. This trend is most attributable to elite level sport where the objective measurements of performance are significant for success. Consequently, a strong market from hypoxia training solutions exists to provide a competitive edge to the athletes. These chambers enables the users to train under these conditions of low concentrations of oxygen so that they are in a position to withstand situations of high altitude and hence enhance their general performance.

- Furthermore, the improvement of altitude training camps together with additional refinements in specialized hypoxic services will defend market opportunities for hypoxia chambers. Most of these enhanced training facilities can now be afforded by many athletes today and athletes no longer have to go up the mountains in order to acclimatize to high altitude training. This convenience has seen many training centers embracing hypoxia technology to help attract more participants in training especially by funneling both elite athletes and recreation fitness trainees. With the uptake of hypoxic training benefits increasing over time as more people seek ways to improve their performance and general fitness, the market should grow to meet the demand in response to the increasing population that is in need of an edge or improvement to their conditioning.

By End User, Biopharmaceutical Companies segment expected to held the largest share

-

Biopharmaceutical companies are of crucial importance at the discovery and production of biologics and pharmaceuticals and are located in the forefront of modern medicine. Research and development spans essential processes including formulation, testing for stability, and bulk production of drugs, for which these organizations devote a large amount in laboratory equipment. The capacity to develop high throughput assay operations effectively is critical in such industry because it would help to alleviate the bottlenecks affecting production processes and also fast track the time-to-market of potential new therapies for patients. This emphasis placed on production volume and innovations are important in the current business environment where the speed at which products are delivered and their quality often define the success or failure of the product in general.

- Furthermore, there is increased regulation of the industry which brings pressure from health authorities globally on biopharmaceutical companies. Adherence to these regulations necessitates the use of superior quality labware including laboratory plates as well as flasks in order to avoid compromises of the experiments as well as to achieve accurate results. In this sector there is a great demand for laboratory tools that can produce identical results time after time because a variance in results can prove expensive by way of loss of time or failure of the drugs under test. As such, the biopharmaceutical industry constitutes a large segment for lab equipment and presses for continuous enhancement of design and fabrication to support the increasing standards in complex bioprocessing and research.

Hypoxia Chamber Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

In this regard, North American and especially the United States can be named as leading in the consumption of hypoxia chamber due to the well-developed healthcare industry. The hospitals in the region are well equipped with modern technology hence can handle various diseases on rising such as respiratory diseases. Respiratory-related diseases are on the rise, and due to an increased elderly population, there is need for new therapeutic devices like hypoxia chamber. In addition, the rising interest in physical fitness and the constant shift towards demanding even more preventive healthcare explain the market’s healthy growth.

- Not only medicine but increased demand in altitude training is the driver that stimulates the market of hypoxia chamber. This training process is distinguished by improving physical performance due to mimicry of physical conditions at high altitudes, which affects the strengthening of endurance and oxygenation. Since many athletes and exercise freaks are striving for enhanced performance, the use of hypoxia chambers will increase significantly. Moreover, major industry stakeholders provide massive capital outlay in research and development activities that creates competitiveness, and thus, development of sophisticated hypoxia chamber technologies. These developments not only improve the therapeutic qualities of the chambers but also the versatility in use of the chambers which establishes that North America is a dominant market for hypoxia chambers.

Active Key Players in the Hypoxia Chamber Market:

-

Baker,

- STEMCELL Technologies Inc,

- Plas-Labs,

- HypOxygen,

- Coy Labs,

- Oxford Optronix Ltd,

- Scintica Instrumentation Inc.,

- CytoSMART Technologies B.V.

- Other Active Players

|

Global Hypoxia Chamber Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 74.83 Billion |

|

Forecast Period 2024-32 CAGR: |

7.70% |

Market Size in 2032: |

USD 145.89 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hypoxia Chamber Market by Type

4.1 Hypoxia Chamber Market Snapshot and Growth Engine

4.2 Hypoxia Chamber Market Overview

4.3 84 x 35 mm Plates

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 84 x 35 mm Plates: Geographic Segmentation Analysis

4.4 27 x 60 mm Plates

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 27 x 60 mm Plates: Geographic Segmentation Analysis

4.5 12 x 100 mm Plates

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 12 x 100 mm Plates: Geographic Segmentation Analysis

4.6 12 x 96-well Plates

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 12 x 96-well Plates: Geographic Segmentation Analysis

4.7 18 x 25 cm2 Flasks

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 18 x 25 cm2 Flasks: Geographic Segmentation Analysis

Chapter 5: Hypoxia Chamber Market by Application

5.1 Hypoxia Chamber Market Snapshot and Growth Engine

5.2 Hypoxia Chamber Market Overview

5.3 Cell Culture Imaging

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cell Culture Imaging: Geographic Segmentation Analysis

5.4 Drug Discovery

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Drug Discovery: Geographic Segmentation Analysis

5.5 Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others: Geographic Segmentation Analysis

Chapter 6: Hypoxia Chamber Market by End Use

6.1 Hypoxia Chamber Market Snapshot and Growth Engine

6.2 Hypoxia Chamber Market Overview

6.3 Biopharmaceutical Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Biopharmaceutical Companies: Geographic Segmentation Analysis

6.4 Clinical Laboratories

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Clinical Laboratories: Geographic Segmentation Analysis

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Hypoxia Chamber Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BAKER

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 STEMCELL TECHNOLOGIES INC

7.4 PLAS-LABS

7.5 HYPOXYGEN

7.6 COY LABS

7.7 OXFORD OPTRONIX LTD

7.8 SCINTICA INSTRUMENTATION INC.

7.9 CYTOSMART TECHNOLOGIES B.V

7.10 OTHER ACTIVE PLAYERS

Chapter 8: Global Hypoxia Chamber Market By Region

8.1 Overview

8.2. North America Hypoxia Chamber Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 84 x 35 mm Plates

8.2.4.2 27 x 60 mm Plates

8.2.4.3 12 x 100 mm Plates

8.2.4.4 12 x 96-well Plates

8.2.4.5 18 x 25 cm2 Flasks

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Cell Culture Imaging

8.2.5.2 Drug Discovery

8.2.5.3 Others

8.2.6 Historic and Forecasted Market Size By End Use

8.2.6.1 Biopharmaceutical Companies

8.2.6.2 Clinical Laboratories

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Hypoxia Chamber Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 84 x 35 mm Plates

8.3.4.2 27 x 60 mm Plates

8.3.4.3 12 x 100 mm Plates

8.3.4.4 12 x 96-well Plates

8.3.4.5 18 x 25 cm2 Flasks

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Cell Culture Imaging

8.3.5.2 Drug Discovery

8.3.5.3 Others

8.3.6 Historic and Forecasted Market Size By End Use

8.3.6.1 Biopharmaceutical Companies

8.3.6.2 Clinical Laboratories

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Hypoxia Chamber Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 84 x 35 mm Plates

8.4.4.2 27 x 60 mm Plates

8.4.4.3 12 x 100 mm Plates

8.4.4.4 12 x 96-well Plates

8.4.4.5 18 x 25 cm2 Flasks

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Cell Culture Imaging

8.4.5.2 Drug Discovery

8.4.5.3 Others

8.4.6 Historic and Forecasted Market Size By End Use

8.4.6.1 Biopharmaceutical Companies

8.4.6.2 Clinical Laboratories

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Hypoxia Chamber Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 84 x 35 mm Plates

8.5.4.2 27 x 60 mm Plates

8.5.4.3 12 x 100 mm Plates

8.5.4.4 12 x 96-well Plates

8.5.4.5 18 x 25 cm2 Flasks

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Cell Culture Imaging

8.5.5.2 Drug Discovery

8.5.5.3 Others

8.5.6 Historic and Forecasted Market Size By End Use

8.5.6.1 Biopharmaceutical Companies

8.5.6.2 Clinical Laboratories

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Hypoxia Chamber Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 84 x 35 mm Plates

8.6.4.2 27 x 60 mm Plates

8.6.4.3 12 x 100 mm Plates

8.6.4.4 12 x 96-well Plates

8.6.4.5 18 x 25 cm2 Flasks

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Cell Culture Imaging

8.6.5.2 Drug Discovery

8.6.5.3 Others

8.6.6 Historic and Forecasted Market Size By End Use

8.6.6.1 Biopharmaceutical Companies

8.6.6.2 Clinical Laboratories

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Hypoxia Chamber Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 84 x 35 mm Plates

8.7.4.2 27 x 60 mm Plates

8.7.4.3 12 x 100 mm Plates

8.7.4.4 12 x 96-well Plates

8.7.4.5 18 x 25 cm2 Flasks

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Cell Culture Imaging

8.7.5.2 Drug Discovery

8.7.5.3 Others

8.7.6 Historic and Forecasted Market Size By End Use

8.7.6.1 Biopharmaceutical Companies

8.7.6.2 Clinical Laboratories

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Hypoxia Chamber Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 74.83 Billion |

|

Forecast Period 2024-32 CAGR: |

7.70% |

Market Size in 2032: |

USD 145.89 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||