Hospital Emergency Department Market Synopsis:

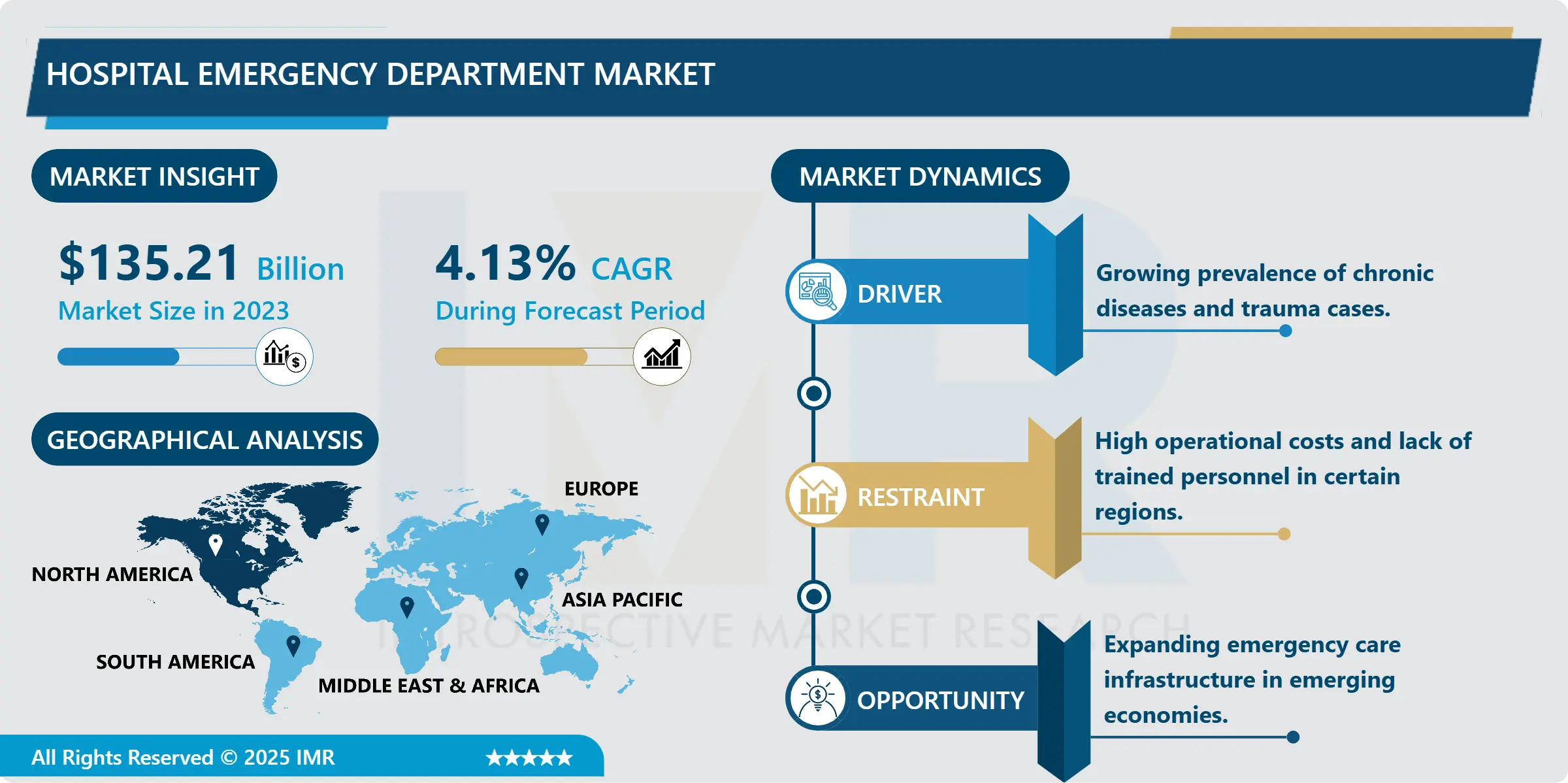

Hospital Emergency Department Market Size Was Valued at USD 135.21 Billion in 2023, and is Projected to Reach USD 194.62 Billion by 2032, Growing at a CAGR of 4.13% From 2024-2032.

The Hospital Emergency Department (ED) market refers to centres where eligible patients who need the attention of a medical professional due to severe disease, trauma or any other complications are handled. Emergency departments are operating units of hospitals consisting of special medical workers, diagnostic equipment, and therapeutic facilities. They work at all times of the day and night to address emergencies such as injury, heart disease or other health complications. This market also extends to emergency medical service providers, technological solutions, and systems which optimise the accessibility and productivity of the emergency departments.

Hospital Emergency Department industry has developed rapidly especially over the last few years owing to increased number of diseases, road accidents and increase aging population leading to high ER visits. With the rising incidences expected in the cardiovascular event, respiratory illness and trauma, the care emergencies services which are specialized have been sought increasingly. Besides, the developments in infrastructure imaging and tracking systems, as well as work flow systems, also improved the functioning of emergency departments. These are technically and often existentially sensitive departments, response times literally matter in life-and-death terms and therefore it is strategic, even essential to ensure that the complex technology and the processes required to harness it are seamlessly aligned to meet the demanding requirements.

Moreover, the market is experiencing growing government spending on healthcare services structures, particularly in developing nations, which is fast tracking the growth of Centers for emergency care. ERs are worth developing or expanding to address growing patient flows, maintaining quality of care and compliance with regulation. The COVID-19 pandemic is an example of the essential public health emergencies that have intensified the need to develop dynamic and high-reliability emergency care management strategies which challenge hospital systems around the world to prioritize scalable and effective ED solutions.

Hospital Emergency Department Market Trend Analysis:

Telemedicine Integration in Emergency Departments

-

An essential trend affecting the Hospital Emergency Department (ED) market is the usage of telemedicine as a critical asset in the field of emergency care. Telemedicine allows the ED physicians to phone interact with specialists, evaluate a patient before his arrival to understand the type of problem facing a patient on admission, and manage a patient’s care in a rural or underprivileged area where there could be little easy access to immediate medical care. Effective use of modern telemedicine tools for assessment in an emergency, it will be possible to significantly shorten the time for a face-to-face meeting, increase efficiency in the work of an emergency department, and make quicker and more effective decisions. To this extent, the remote capability has been of value in addressing high risk cases encompassing stroke, cardiac complications and trauma since these require fast access to specialist advice which may be a challenge given the limits to physical consultation over a long distance without the required technology.

- With the onset of the COVID-19 pandemic, the focus on, and utilization of, telemedicine particularly in emergency departments also increased as hospitals expanded their services to remain connected with patients who were unable to come into facilities. COVID has shifted patients’ preferences and created more convenient access points, enabling preliminary triage, initial assessment, and limited treatment that has helped reduce enrolment of crowed EDs and improve patients’ outcomes. Telemedicine has presented the facet of improving the quality of the healthcare service delivery and its efficiency through enabling faster access to care, and more rational distribution of actions and efforts. Telemedicine is still on the rise and it only serves to further increase the use of telemedicine technology in EDs thus contributing to the development of improved modernized emergency health care services.

Expanding Emergency Care Infrastructure in Emerging Economies

-

New generation countries represent a large growth area for the Hospital Emergency Department (ED) market because these countries are undergoing extensive development in the field of healthcare. General health care infrastructure investments in Asian, African and Latin American nations continue to rise with many governments playing a vital role in developing or expanding hospital facilities in line with population growth. This need for improvement in healthcare facilities leads to the generation of a large market for ED equipment manufacturers, technology vendors, and building contractors, all necessary to bring new high-quality emergency departments to previously under-represented regions. The increasing development of these regions in healthcare facilities show the increasing demand for better equipment and sound solutions backing up the delivery of emergency care.

- In addition, seeking globalization in treatment procedures has necessitated the need for specialized training coupled with availing portable technology tools to support ED professionals in the developing countries. Unique professional development programs, telemedicine systems, and other modern equipment are being searched in order to provide health care personnel with required tools and experience to face various medical urgencies properly. Such innovations are not only intended to enhance the quality of care but also to fuel the continued enhancement of emergency care across these emergent markets and in turn to continue to create a growing, healthy market for foreign suppliers of emergency health technology and services.

Hospital Emergency Department Market Segment Analysis:

Hospital Emergency Department Market is Segmented on the basis of Type Of Treatment, Service Type, and Region

By Type of Treatment, Trauma care segment is expected to dominate the market during the forecast period

-

In the Hospital Emergency Department market, treatment type segmentation indicates the variety of healthcare services needed to treat severe conditions quickly and efficiently. Trauma care forms one significant part since accident victims, falls, and physical trauma are common incidences, which require treatment within the emergency department. Due to the often time complicated nature of care in treating trauma cases such as surgeries or multi-specialty care, trauma care services are essential in any ED facility. Another important area is the treatment of cardiological disorders since cases of such problems as heart attacks and strokes are rather frequent, and only immediate diagnosis and treatment can save a patient’s life. Cardiac emergency cases are usually time-sensitive and therefore emergency departments are well fitted with cardiac equipment’s and qualified attendants.

- Respiratory care is already becoming a large part of it with rising rates of conditions like asthma, COPD and more recently COVID-19. These cases require admission and treatment to stabilize the patient as most of the-times patients on the ventilators and other respiratory support systems. This segment on infectious disease care has also evolved as individual emergency departments handle patients with infections that may be common diseases of the community, other’s acute manifestations of chronic ailments as well as diseases associated with the current pandemics. Psychiatric evaluation is a relatively new frontier in EDs because mental pathologies, including psychotic ones, suicidal thoughts, and anxiety are treated as emergencies and require immediate attention. Also, the others category have other infrequent but important emergencvprocedureslike toxicology and obstetrics, which contributes to the emergency departments’ diversified range of services. Altogether, these segments form the complete and complex continual treatment which contemporary EDs should provide.

By service Type, Triage Services segment expected to held the largest share

-

On this basis of services offered, the market for Hospital Emergency Department can be split by the type of service as follows: Triage Services. Triage is an important component of emergency departments usually because it serves to sort out patient according to their acuity, with the most serious cases receiving immediate attention. Implementation of triage not only contributes to the performance and organization of the flow of patients but also, minimizes the time spent by a patient waiting for his turn and proper use of resources in the emergency department: overall increasing it’s efficiency. Diagnostics Services are right behind it as fast and reliable diagnostic utilities like imaging (X-Ray, CT) as well as lab tests are crucial in diagnosing the disease/ailment that the patient has and thus require accurate decision making towards the right treatment plan. Due to development of diagnostic technology EDs are now capable of providing results faster than in the past and this promotes better patient results.

- Therapeutic Services include all forms of interventions that are offered in EDs including; prescribing of medications and IV fluids, carrying out of procedures and operations. These services are necessary for managing sick persons on critical status with likelihood of having life threatening conditions. Monitoring Services involve constant evaluation of patient conditions including heart, respiratory rates, blood pressure and other key aspects to instantly adapt upcoming actions based on change of status of the patient especially those in the ICU. After care services bring a conclusion to the service delivery cycle and include treatment and counselling, identification of suitable next steps, as well any recommendations for medical practitioners to follow up. All of this makes possible a much more refined segmentation of services, patient care needs in the emergency departments, which can then reduce a broad spectrum of patients’ needs starting from the initial assessment and ending up with how they will be treated in the future.

Hospital Emergency Department Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

Hospital Emergency Department market has evaluated and foreseen that North America will remain the market leader in this global market with the market share estimated to be around 35% in 2023. This has been attributed uniquely to the high healthcare spending by the region, the advanced emergency medical services and health systems of integrated care. The United States and Canada mainly have witnessed growth plans to improve quality and flexibility of the ED, responding to growing incidence of chronic illnesses, trauma, and patient population demography. The emergency departments in the delivery region can boast of having modern technological tools, and are staffed by professional health care professionals to provide quality emergency care.

- The other and equally important factor that has placed North America in a vantage position is its advocacy for technology advancement. The use of more intelligent patient monitoring systems, data analysis for efficient work flow and tele-medicine have amplified the efficiency of diagnosing patients, and reduced time spent waiting. The region has overall strong legal environment for medical services and colossal investment to medical research and development creating several benchmarks in emergency treatment, thus strengthening its position being a worldwide leader in this segment. North America’s focus on keeping up with improvement over time and coping with new upcoming trend in healthcare makes it strong to sustain the Hospital Emergency Department market.

Active Key Players in the Hospital Emergency Department Market:

-

Abbott Laboratories (USA)

- Becton, Dickinson and Company (USA)

- Cardinal Health (USA)

- Cerner Corporation (USA)

- GE Healthcare (USA)

- Koninklijke Philips N.V. (Netherlands)

- Medtronic (Ireland)

- Smith & Nephew (UK)

- Stryker Corporation (USA)

- Thermo Fisher Scientific (USA)

- Toshiba Corporation (Japan)

- Zimmer Biomet Holdings (USA)

- Other Active Players

|

Global Hospital Emergency Department Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 135.21 Billion |

|

Forecast Period 2024-32 CAGR: |

4.13 % |

Market Size in 2032: |

USD 194.62 Billion |

|

Segments Covered: |

By Type of Treatment |

|

|

|

By Facility Type |

|

||

|

By Service Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hospital Emergency Department Market by Type of treatment

4.1 Hospital Emergency Department Market Snapshot and Growth Engine

4.2 Hospital Emergency Department Market Overview

4.3 Trauma Care

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Trauma Care: Geographic Segmentation Analysis

4.4 Cardiac Care

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Cardiac Care: Geographic Segmentation Analysis

4.5 Respiratory Care

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Respiratory Care: Geographic Segmentation Analysis

4.6 Infectious Disease Care

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Infectious Disease Care: Geographic Segmentation Analysis

4.7 Psychiatric Care

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Psychiatric Care: Geographic Segmentation Analysis

4.8 Others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Others: Geographic Segmentation Analysis

Chapter 5: Hospital Emergency Department Market by Facility Type

5.1 Hospital Emergency Department Market Snapshot and Growth Engine

5.2 Hospital Emergency Department Market Overview

5.3 General Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 General Hospitals: Geographic Segmentation Analysis

5.4 Specialty Hospitals

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Specialty Hospitals: Geographic Segmentation Analysis

5.5 Trauma Centers

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Trauma Centers: Geographic Segmentation Analysis

5.6 Ambulatory Surgical Centers

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Ambulatory Surgical Centers: Geographic Segmentation Analysis

Chapter 6: Hospital Emergency Department Market by End User

6.1 Hospital Emergency Department Market Snapshot and Growth Engine

6.2 Hospital Emergency Department Market Overview

6.3 Triage Services

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Triage Services: Geographic Segmentation Analysis

6.4 Diagnostics Services

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Diagnostics Services: Geographic Segmentation Analysis

6.5 Therapeutic Services

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Therapeutic Services: Geographic Segmentation Analysis

6.6 Monitoring Services

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Monitoring Services: Geographic Segmentation Analysis

6.7 Aftercare Services

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Aftercare Services: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Hospital Emergency Department Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BECTON

7.4 DICKINSON AND COMPANY (USA)

7.5 CARDINAL HEALTH (USA)

7.6 CERNER CORPORATION (USA)

7.7 GE HEALTHCARE (USA)

7.8 KONINKLIJKE PHILIPS N.V. (NETHERLANDS)

7.9 MEDTRONIC (IRELAND)

7.10 SMITH & NEPHEW (UK)

7.11 STRYKER CORPORATION (USA)

7.12 THERMO FISHER SCIENTIFIC (USA)

7.13 TOSHIBA CORPORATION (JAPAN)

7.14 ZIMMER BIOMET HOLDINGS (USA)

7.15 OTHER ACTIVE PLAYERS

Chapter 8: Global Hospital Emergency Department Market By Region

8.1 Overview

8.2. North America Hospital Emergency Department Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type of treatment

8.2.4.1 Trauma Care

8.2.4.2 Cardiac Care

8.2.4.3 Respiratory Care

8.2.4.4 Infectious Disease Care

8.2.4.5 Psychiatric Care

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size By Facility Type

8.2.5.1 General Hospitals

8.2.5.2 Specialty Hospitals

8.2.5.3 Trauma Centers

8.2.5.4 Ambulatory Surgical Centers

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Triage Services

8.2.6.2 Diagnostics Services

8.2.6.3 Therapeutic Services

8.2.6.4 Monitoring Services

8.2.6.5 Aftercare Services

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Hospital Emergency Department Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type of treatment

8.3.4.1 Trauma Care

8.3.4.2 Cardiac Care

8.3.4.3 Respiratory Care

8.3.4.4 Infectious Disease Care

8.3.4.5 Psychiatric Care

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size By Facility Type

8.3.5.1 General Hospitals

8.3.5.2 Specialty Hospitals

8.3.5.3 Trauma Centers

8.3.5.4 Ambulatory Surgical Centers

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Triage Services

8.3.6.2 Diagnostics Services

8.3.6.3 Therapeutic Services

8.3.6.4 Monitoring Services

8.3.6.5 Aftercare Services

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Hospital Emergency Department Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type of treatment

8.4.4.1 Trauma Care

8.4.4.2 Cardiac Care

8.4.4.3 Respiratory Care

8.4.4.4 Infectious Disease Care

8.4.4.5 Psychiatric Care

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size By Facility Type

8.4.5.1 General Hospitals

8.4.5.2 Specialty Hospitals

8.4.5.3 Trauma Centers

8.4.5.4 Ambulatory Surgical Centers

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Triage Services

8.4.6.2 Diagnostics Services

8.4.6.3 Therapeutic Services

8.4.6.4 Monitoring Services

8.4.6.5 Aftercare Services

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Hospital Emergency Department Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type of treatment

8.5.4.1 Trauma Care

8.5.4.2 Cardiac Care

8.5.4.3 Respiratory Care

8.5.4.4 Infectious Disease Care

8.5.4.5 Psychiatric Care

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size By Facility Type

8.5.5.1 General Hospitals

8.5.5.2 Specialty Hospitals

8.5.5.3 Trauma Centers

8.5.5.4 Ambulatory Surgical Centers

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Triage Services

8.5.6.2 Diagnostics Services

8.5.6.3 Therapeutic Services

8.5.6.4 Monitoring Services

8.5.6.5 Aftercare Services

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Hospital Emergency Department Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type of treatment

8.6.4.1 Trauma Care

8.6.4.2 Cardiac Care

8.6.4.3 Respiratory Care

8.6.4.4 Infectious Disease Care

8.6.4.5 Psychiatric Care

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size By Facility Type

8.6.5.1 General Hospitals

8.6.5.2 Specialty Hospitals

8.6.5.3 Trauma Centers

8.6.5.4 Ambulatory Surgical Centers

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Triage Services

8.6.6.2 Diagnostics Services

8.6.6.3 Therapeutic Services

8.6.6.4 Monitoring Services

8.6.6.5 Aftercare Services

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Hospital Emergency Department Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type of treatment

8.7.4.1 Trauma Care

8.7.4.2 Cardiac Care

8.7.4.3 Respiratory Care

8.7.4.4 Infectious Disease Care

8.7.4.5 Psychiatric Care

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size By Facility Type

8.7.5.1 General Hospitals

8.7.5.2 Specialty Hospitals

8.7.5.3 Trauma Centers

8.7.5.4 Ambulatory Surgical Centers

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Triage Services

8.7.6.2 Diagnostics Services

8.7.6.3 Therapeutic Services

8.7.6.4 Monitoring Services

8.7.6.5 Aftercare Services

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Hospital Emergency Department Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 135.21 Billion |

|

Forecast Period 2024-32 CAGR: |

4.13 % |

Market Size in 2032: |

USD 194.62 Billion |

|

Segments Covered: |

By Type of Treatment |

|

|

|

By Facility Type |

|

||

|

By Service Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||