Hepatitis Drugs Market Synopsis:

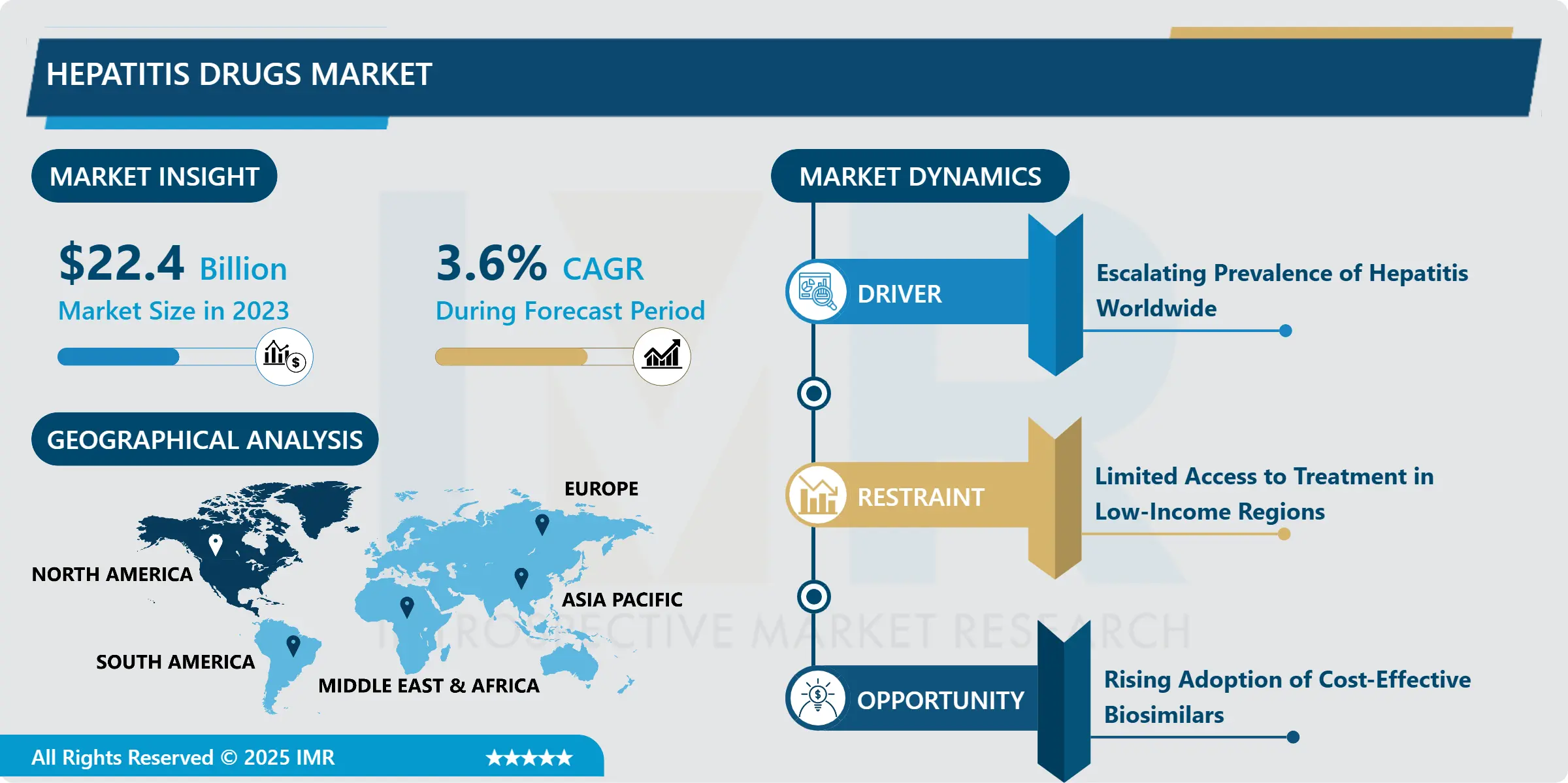

Hepatitis Drugs Market Size Was Valued at USD 22.4 Billion in 2023, and is Projected to Reach USD 30.79 Billion by 2032, Growing at a CAGR of 3.60% From 2024-2032.

The Hepatitis Drugs Market refers to the medication that help in the control and treatment of viral hepatitis which comprise Hepatitis A, B, C, and D. These drugs work at this stage to prevent the spread of viral illness, enhance immune system functions as well increase in virus replication and move through these stages.

Rising Global Incidence of Hepatitis: Thus, such diseases as hepatitis, especially the chronic form of the disease, including hepatitis B and C, are the main drivers of this market. Currently, there are more than 296 million hepatitis B patients, and more than 58 million hepatitis C patients worldwide, and they urgently need effective curative methods. Awareness and government screening that have added to the increase of patients with hepatitis have also boosted the consumption of hepatitis therapies.

Changes in drug compositions which are direct acting antiviral compounds have enhanced the success of treatment and also reduced the time taken in treatment. These advancement in conjunction with the research-based efforts to find curative therapies especially for hepatitis C has boosted the market. It is also the growing availability of new drugs in the global market that is fuelling their use.

Hepatitis Drugs Market Trend Analysis:

Combination therapies

-

The use of combination therapies is becoming more popular with the possibilities of increasing effectiveness of treatment as the disables of several virus life cycle processes. For instance, integrating DAAs with immune modulators has been proved to offer similar success for SVR. This trend is positively driving the rate of new combinations alongside clinical trials and regulatory approvals.

- The entrance of biosimilar versions of some of the most used Hepatitis drugs is thus changing market trends. Biosimilars appear to be cheaper substitutes; their availability is quite high now in the developing world. Biosimilars are being encouraged by governments and healthcare brands where the financial incentives for the products are limited such as in the developing world.

Development of Curative Therapies

-

Due to a high rate of hepatitis incidence and a growing focus on investment in healthcare infrastructure, Asia-Pacific and African countries remain untapped markets. Buhari stated that there is concern for better and effective access to antiviral treatments in these regions, which indicates opportunity for tremendous growth for manufacturers involved in production and supply of such products.

- The continual advancement of other curative therapies and especially for chronic hepatitis B and C is a disruptive innovation in the market. Leading players in new technologies such as gene editing therapy as well as immunotherapy will be the key beneficiaries because they fill clinical gaps.

Hepatitis Drugs Market Segment Analysis:

Hepatitis Drugs Market is Segmented on the basis of type, Drug Class, Mode Of Administration, and Region

By Type, Hepatitis B Drugs segment is expected to dominate the market during the forecast period

-

By type, the Hepatitis Drugs Market has been classified into Hepatitis B, C, A, and D drugs. Hepatitis B and C drugs are more popular in the market because the diseases are chronic and their complications include cirrhosis and liver cancer. Hepatitis A drugs are used largely for acute cases so they have less market than drugs used for Hepatitis D that has a growing specialization market because of increased awareness.

By Drug Class, Direct-acting Antivirals (DAAs) segment expected to held the largest share

-

The Hepatitis drugs are classified as Direct-acting Antivirals (DAAs), Interferons, Nucleoside and Nucleotide Analogues and Immune Modulators. DAAs are ahead in the segment in terms of efficacy and absorption compared to interferons although they are not preferred due to side effects but hold importance in certain cases. NA are essential in the treatment of chronic hepatitis B while there is growing interest of Immunomodulators for their probability to enhancing host immunity.

Hepatitis Drugs Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

Currently, the Hepatitis Drugs Market is dominated by North America, primarily because of factors such as well-developed medical facilities, favorable sentiments toward the use of new treatments, and a high prevalence of hepatitis ailment across peoples. There is a high emphasis on research and development horned through government policies and funding of the region has helped to increase availability of advanced treatments.

- North America has taken the lead in the region due to the growth of the U.S. pharmaceutical sector and the focus on hepatitis control programmes. Also, insurance acceptance and reimbursements other policies have contributed to expansion of high-cost therapies ensuring steady market trend.

Active Key Players in the Hepatitis Drugs Market:

-

AbbVie Inc. (USA)

- Bristol-Myers Squibb (USA)

- Dr. Reddy's Laboratories (India)

- Gilead Sciences (USA)

- GlaxoSmithKline (UK)

- Johnson & Johnson (USA)

- Merck & Co., Inc. (USA)

- Novartis AG (Switzerland)

- Roche (Switzerland)

- Zydus Cadila (India)

- Other Active Players

|

Global Hepatitis Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22.40 Billion |

|

Forecast Period 2024-32 CAGR: |

3.60% |

Market Size in 2032: |

USD 30.79 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Drug Class |

|

||

|

By Mode Of Administration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hepatitis Drugs Market by Type

4.1 Hepatitis Drugs Market Snapshot and Growth Engine

4.2 Hepatitis Drugs Market Overview

4.3 Hepatitis B Drugs

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hepatitis B Drugs: Geographic Segmentation Analysis

4.4 Hepatitis C Drugs

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Hepatitis C Drugs: Geographic Segmentation Analysis

4.5 Hepatitis A Drugs

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Hepatitis A Drugs: Geographic Segmentation Analysis

4.6 Hepatitis D Drugs

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Hepatitis D Drugs: Geographic Segmentation Analysis

Chapter 5: Hepatitis Drugs Market by Drug Class

5.1 Hepatitis Drugs Market Snapshot and Growth Engine

5.2 Hepatitis Drugs Market Overview

5.3 Direct-acting Antivirals (DAAs)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Direct-acting Antivirals (DAAs): Geographic Segmentation Analysis

5.4 Interferons

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Interferons: Geographic Segmentation Analysis

5.5 Nucleoside and Nucleotide Analogues

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Nucleoside and Nucleotide Analogues: Geographic Segmentation Analysis

5.6 Immune Modulators

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Immune Modulators: Geographic Segmentation Analysis

Chapter 6: Hepatitis Drugs Market by Mode of Administration

6.1 Hepatitis Drugs Market Snapshot and Growth Engine

6.2 Hepatitis Drugs Market Overview

6.3 Oral Drugs

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Oral Drugs: Geographic Segmentation Analysis

6.4 Injectable Drugs

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Injectable Drugs: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Hepatitis Drugs Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 GILEAD SCIENCES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ABBVIE INC. (USA)

7.4 JOHNSON & JOHNSON (USA)

7.5 BRISTOL-MYERS SQUIBB (USA)

7.6 MERCK & CO. INC. (USA)

7.7 ROCHE (SWITZERLAND)

7.8 GLAXOSMITHKLINE (UK)

7.9 NOVARTIS AG (SWITZERLAND)

7.10 DR. REDDY'S LABORATORIES (INDIA)

7.11 ZYDUS CADILA (INDIA).

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Hepatitis Drugs Market By Region

8.1 Overview

8.2. North America Hepatitis Drugs Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Hepatitis B Drugs

8.2.4.2 Hepatitis C Drugs

8.2.4.3 Hepatitis A Drugs

8.2.4.4 Hepatitis D Drugs

8.2.5 Historic and Forecasted Market Size By Drug Class

8.2.5.1 Direct-acting Antivirals (DAAs)

8.2.5.2 Interferons

8.2.5.3 Nucleoside and Nucleotide Analogues

8.2.5.4 Immune Modulators

8.2.6 Historic and Forecasted Market Size By Mode of Administration

8.2.6.1 Oral Drugs

8.2.6.2 Injectable Drugs

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Hepatitis Drugs Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Hepatitis B Drugs

8.3.4.2 Hepatitis C Drugs

8.3.4.3 Hepatitis A Drugs

8.3.4.4 Hepatitis D Drugs

8.3.5 Historic and Forecasted Market Size By Drug Class

8.3.5.1 Direct-acting Antivirals (DAAs)

8.3.5.2 Interferons

8.3.5.3 Nucleoside and Nucleotide Analogues

8.3.5.4 Immune Modulators

8.3.6 Historic and Forecasted Market Size By Mode of Administration

8.3.6.1 Oral Drugs

8.3.6.2 Injectable Drugs

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Hepatitis Drugs Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Hepatitis B Drugs

8.4.4.2 Hepatitis C Drugs

8.4.4.3 Hepatitis A Drugs

8.4.4.4 Hepatitis D Drugs

8.4.5 Historic and Forecasted Market Size By Drug Class

8.4.5.1 Direct-acting Antivirals (DAAs)

8.4.5.2 Interferons

8.4.5.3 Nucleoside and Nucleotide Analogues

8.4.5.4 Immune Modulators

8.4.6 Historic and Forecasted Market Size By Mode of Administration

8.4.6.1 Oral Drugs

8.4.6.2 Injectable Drugs

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Hepatitis Drugs Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Hepatitis B Drugs

8.5.4.2 Hepatitis C Drugs

8.5.4.3 Hepatitis A Drugs

8.5.4.4 Hepatitis D Drugs

8.5.5 Historic and Forecasted Market Size By Drug Class

8.5.5.1 Direct-acting Antivirals (DAAs)

8.5.5.2 Interferons

8.5.5.3 Nucleoside and Nucleotide Analogues

8.5.5.4 Immune Modulators

8.5.6 Historic and Forecasted Market Size By Mode of Administration

8.5.6.1 Oral Drugs

8.5.6.2 Injectable Drugs

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Hepatitis Drugs Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Hepatitis B Drugs

8.6.4.2 Hepatitis C Drugs

8.6.4.3 Hepatitis A Drugs

8.6.4.4 Hepatitis D Drugs

8.6.5 Historic and Forecasted Market Size By Drug Class

8.6.5.1 Direct-acting Antivirals (DAAs)

8.6.5.2 Interferons

8.6.5.3 Nucleoside and Nucleotide Analogues

8.6.5.4 Immune Modulators

8.6.6 Historic and Forecasted Market Size By Mode of Administration

8.6.6.1 Oral Drugs

8.6.6.2 Injectable Drugs

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Hepatitis Drugs Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Hepatitis B Drugs

8.7.4.2 Hepatitis C Drugs

8.7.4.3 Hepatitis A Drugs

8.7.4.4 Hepatitis D Drugs

8.7.5 Historic and Forecasted Market Size By Drug Class

8.7.5.1 Direct-acting Antivirals (DAAs)

8.7.5.2 Interferons

8.7.5.3 Nucleoside and Nucleotide Analogues

8.7.5.4 Immune Modulators

8.7.6 Historic and Forecasted Market Size By Mode of Administration

8.7.6.1 Oral Drugs

8.7.6.2 Injectable Drugs

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Hepatitis Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22.40 Billion |

|

Forecast Period 2024-32 CAGR: |

3.60% |

Market Size in 2032: |

USD 30.79 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Drug Class |

|

||

|

By Mode Of Administration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||