Hemophilia Gene Therapy Market Synopsis:

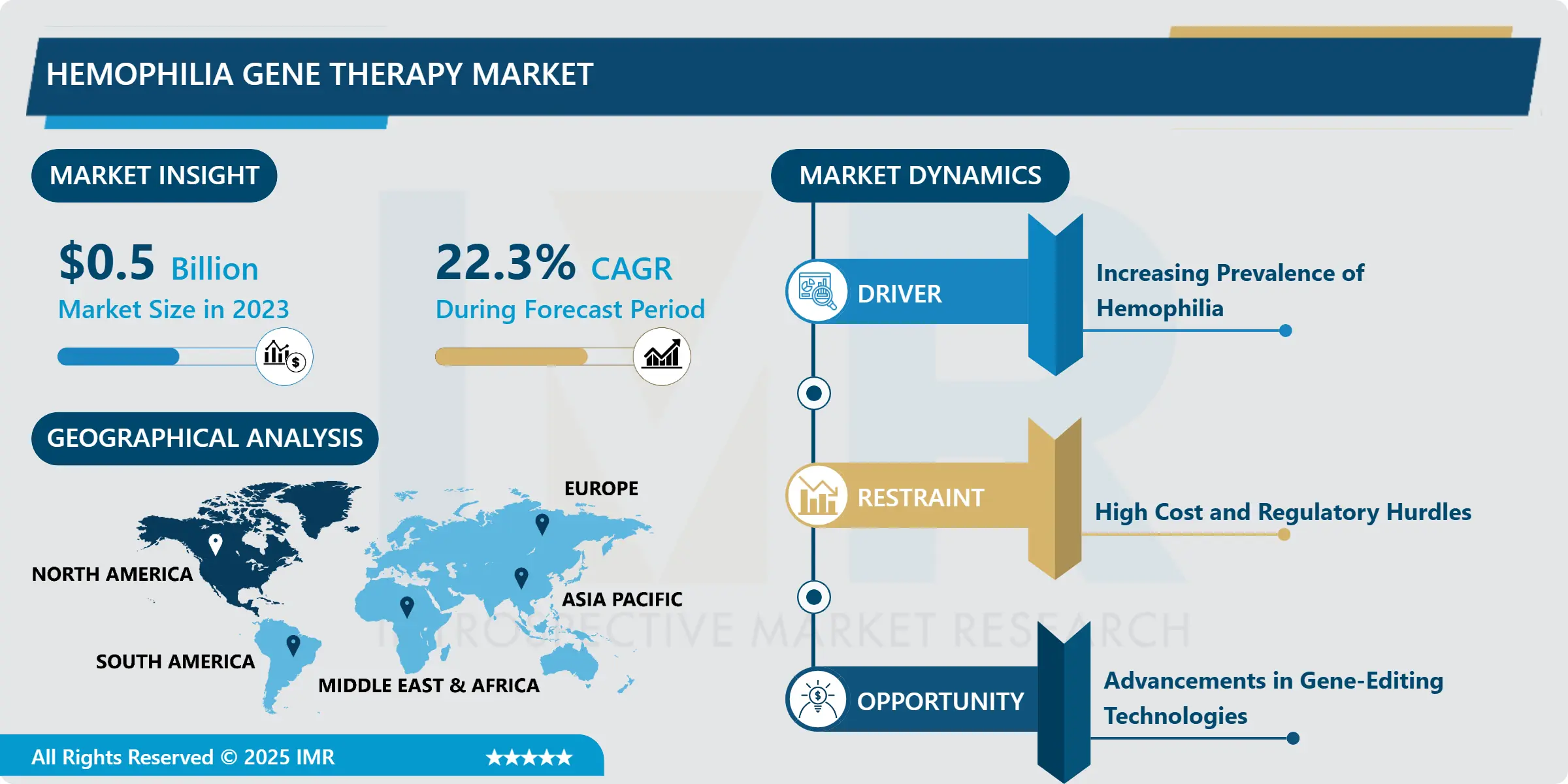

Hemophilia Gene Therapy Market Size Was Valued at USD 0.5 Billion in 2023, and is Projected to Reach USD 3.06 Billion by 2032, Growing at a CAGR of 22.3% From 2024-2032.

Hemophilia gene therapy is an advanced clinical treatment targeting to address the defects that cause the disease known as hemophilia, a hereditary disease where blood fails to coagulate properly. Gene therapy is defined as the process of modifying or introducing genetic material within a patients body with a view of correcting or preventing diseases. Given the case of hemophilia, gene therapy seeks to introduce a normal copy of the gene for clotting factors (Factor VIII for Hemophilia A or Factor IX for Hemophilia B) into the patients’ cells, therefore allowing the body to make adequate clotting factors. This approach may represent the possibility of developing a cure for hemophilia or, at least, long-term or permanent treatment that does not require factor replacement at least some of the time. Market prospects of the gene therapy for hemophilia is rapidly developing as a novel market segment in the framework of the global gene therapy market with the potential of novation to suggest significant impacts on, particularly taking into account the progress in gene-editing technologies, viral vector systems, and personalized medicine.

The current global growth of the Hemophilia gene therapy market is in its embryonic stage because of the constantly rising number of individuals affected by hemophilia across the globe and the need for advanced treatment modalities. Hemophilia is a genetic bleeding disorder and is prevalent; with Hemophilia A recorded as the most common type. Traditional therapy requires intravenous injections of clotting factors at varying intervals, which are inconvenient and expensive. Gene therapy was found to be promising because the approach differs from conventional treatments in that it addresses the source of the problem and not just the symptoms, which leads to potential long-term effectiveness or cures required infrequently which leads to more limited treatments in the future. At present a number of hemophilia gene therapy products have been in clinical trials and few are in the approved state of some particular regions, which is anticipated to foster the growth of the market throughout the years to come.

In addition, favorable regulation by different bodies like U.S FDA for the approval of gene therapies and EMA for fast approval process is another factor that has enhanced the growth of the market. Hemophilia gene therapy market is a highly innovative market with continuous research and development activities and technological progress and a high degree of competition among large pharma companies and many biotech companies. The market is expected to register a high growth with increased development of new therapies, their testing and increased awareness along with acceptance among patients, healthcare practitioners and health insurance entities.

Hemophilia Gene Therapy Market Trend Analysis:

Increasing Adoption of Personalized Medicine

- One major trend of the hemophilia gene therapy market is that it is increasingly being more individualized. This approach fine tunes the treatment plan given to each patient, depending on their genes, way of life among other parameters. Gene therapy nicely occupies this niche because it is intended to directly deal with the genetic basis of hemophilia. One of the benefits of the development of gene therapy for individual treatment is the customization of the therapy that has minimal side effects that are toxic to the patient’s body. As more advanced technologies such as CRISPR, are developed the safety and effectiveness of such therapies are likely to increase thus the increased rate of adoption of hemophilia gene therapies. Furthermore, the idea of having gene therapies that can deliver relatively long term therapeutic impacts–impacts that can last for years at a time–fits the changing global trend where patients prefer to be treated with longer lasting solutions.

Growing Investment and Research Funding

- The market for hemophilia gene therapy has a high growth potential that can be explained by the rising investment in R & D in the biopharmaceutical sector. State agencies, private money and venture capitalists are stepping up their support for hemophilia gene therapy projects because of the prospects of having one-time solutions for customers and decreased costs on the health care part. Drug makers in the medical sector are also partnering with academic institutions and biotechnology companies to advance the gene therapies, developing new gene-editing techniques, viral delivery systems, and matched treatment plan. These partnerships and the amount of funding obtained are expected to catalyse the invention and marketisation of functional gene treatments for haemophilia helping create profitable niche markets for business in the field. Furthermore, as gene therapies come into the market, more of the patient population will be able to afford gene therapies hence expanding the market size for the products.

Hemophilia Gene Therapy Market Segment Analysis:

Hemophilia Gene Therapy Market is Segmented on the basis of type, End User, and Region.

By Type, Hemophilia A, segment is expected to dominate the market during the forecast period

- Among all hemophilia types, hemophilia A is most prevalent and contributes to a massive market share of the hemophilia gene therapy during the forecast period. This is a hereditary disorder resulting from absence or reduced level of clotting factor VIII hence prolonged bleeding. The interest in the market here has been instigated by the availability of gene therapies offered with the intention of giving patients with Hemophilia A a long term or permanent treatment. Published research and clinical investigation studies have indicated a prior possibility of Hemophilia A gene therapies and prominent genetherapy products have reached clinical stages with market approvals of accelerated nature in such strategic markets like United States and Europe. Therefore, Hemophilia A will emerge as the biggest segment in the overall hemophilia gene therapy market, thereby promoting revenue and patient acceptance.

By End User, Hospitals segment expected to held the largest share

- The market is analyzed by stating that the hospitals segment is anticipated to dominate the hemophilia gene therapy market due to hospital’s offering the primary avenue for gene therapy treatments. Hospitals can afford to make all necessary infrastructure investments, attract professionally trained and qualified personnel, and meet the legal requirements necessary to introduce such advanced methods of treatment as gene therapy. Since gene therapy entails many procedures such as viral vector delivery and follow-up, delivering these therapies in hospital environments is the safest and most effective way to give patients therapies. However, with advancement in gene therapy technologies and as they become accessible to the broader societies, the hospitals are expected to be the biggest end-users of hemophilia gene treatments.

Hemophilia Gene Therapy Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America constituting a large share of the hemophilia gene therapy market in 2023. These are some of the reasons as to why the region has had a greater influence, for instance, high incidences of hemophilia, advanced healthcare, increased research and development spending and correct regulatory measures’ status. North America, especially USA has been at the forefront regarding approval of gene therapies, where FDA has recently provided fast-track approvals to Hemophilia gene therapies. It also weighs the support of large pharma players and the biotechs located in the region and consequently supports the notion the region is a market leader.

Active Key Players in the Hemophilia Gene Therapy Market:

- BioMarin Pharmaceutical Inc. (USA)

- Bluebird Bio, Inc. (USA)

- CSL Behring (USA)

- Gene Therapy Ltd. (UK)

- Gilead Sciences, Inc. (USA)

- Grifols (Spain)

- Novartis International AG (Switzerland)

- Novo Nordisk (Denmark)

- Pfizer Inc. (USA)

- Sangamo Therapeutics, Inc. (USA)

- Spark Therapeutics, Inc. (USA)

- Takeda Pharmaceutical Company (Japan)

- Ultragenyx Pharmaceutical Inc. (USA)

- Uniqure N.V. (Netherlands)

- Valeant Pharmaceuticals (Canada)

- Other Active Players

|

Hemophilia Gene Therapy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.5 Billion |

|

Forecast Period 2024-32 CAGR: |

22.3% |

Market Size in 2032: |

USD 3.06 Billion |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hemophilia Gene Therapy Market by Type

4.1 Hemophilia Gene Therapy Market Snapshot and Growth Engine

4.2 Hemophilia Gene Therapy Market Overview

4.3 Hemophilia A

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hemophilia A: Geographic Segmentation Analysis

4.4 Hemophilia B

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Hemophilia B: Geographic Segmentation Analysis

Chapter 5: Hemophilia Gene Therapy Market by End User

5.1 Hemophilia Gene Therapy Market Snapshot and Growth Engine

5.2 Hemophilia Gene Therapy Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospitals: Geographic Segmentation Analysis

5.4 Specialty Clinics

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Specialty Clinics: Geographic Segmentation Analysis

5.5 Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Hemophilia Gene Therapy Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BIOMARIN PHARMACEUTICAL INC. (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BLUEBIRD BIO INC. (USA)

6.4 CSL BEHRING (USA)

6.5 GENE THERAPY LTD. (UK)

6.6 GILEAD SCIENCES INC. (USA)

6.7 GRIFOLS (SPAIN)

6.8 NOVARTIS INTERNATIONAL AG (SWITZERLAND)

6.9 NOVO NORDISK (DENMARK)

6.10 PFIZER INC. (USA)

6.11 SANGAMO THERAPEUTICS INC. (USA)

6.12 SPARK THERAPEUTICS INC. (USA)

6.13 TAKEDA PHARMACEUTICAL COMPANY (JAPAN)

6.14 ULTRAGENYX PHARMACEUTICAL INC. (USA)

6.15 UNIQURE N.V. (NETHERLANDS)

6.16 VALEANT PHARMACEUTICALS (CANADA)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Hemophilia Gene Therapy Market By Region

7.1 Overview

7.2. North America Hemophilia Gene Therapy Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Type

7.2.4.1 Hemophilia A

7.2.4.2 Hemophilia B

7.2.5 Historic and Forecasted Market Size By End User

7.2.5.1 Hospitals

7.2.5.2 Specialty Clinics

7.2.5.3 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Hemophilia Gene Therapy Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Type

7.3.4.1 Hemophilia A

7.3.4.2 Hemophilia B

7.3.5 Historic and Forecasted Market Size By End User

7.3.5.1 Hospitals

7.3.5.2 Specialty Clinics

7.3.5.3 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Bulgaria

7.3.6.2 The Czech Republic

7.3.6.3 Hungary

7.3.6.4 Poland

7.3.6.5 Romania

7.3.6.6 Rest of Eastern Europe

7.4. Western Europe Hemophilia Gene Therapy Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Type

7.4.4.1 Hemophilia A

7.4.4.2 Hemophilia B

7.4.5 Historic and Forecasted Market Size By End User

7.4.5.1 Hospitals

7.4.5.2 Specialty Clinics

7.4.5.3 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 Netherlands

7.4.6.5 Italy

7.4.6.6 Russia

7.4.6.7 Spain

7.4.6.8 Rest of Western Europe

7.5. Asia Pacific Hemophilia Gene Therapy Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Type

7.5.4.1 Hemophilia A

7.5.4.2 Hemophilia B

7.5.5 Historic and Forecasted Market Size By End User

7.5.5.1 Hospitals

7.5.5.2 Specialty Clinics

7.5.5.3 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Hemophilia Gene Therapy Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Type

7.6.4.1 Hemophilia A

7.6.4.2 Hemophilia B

7.6.5 Historic and Forecasted Market Size By End User

7.6.5.1 Hospitals

7.6.5.2 Specialty Clinics

7.6.5.3 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkey

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Hemophilia Gene Therapy Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Type

7.7.4.1 Hemophilia A

7.7.4.2 Hemophilia B

7.7.5 Historic and Forecasted Market Size By End User

7.7.5.1 Hospitals

7.7.5.2 Specialty Clinics

7.7.5.3 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Hemophilia Gene Therapy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.5 Billion |

|

Forecast Period 2024-32 CAGR: |

22.3% |

Market Size in 2032: |

USD 3.06 Billion |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||