Hearing Protection Devices Market Synopsis:

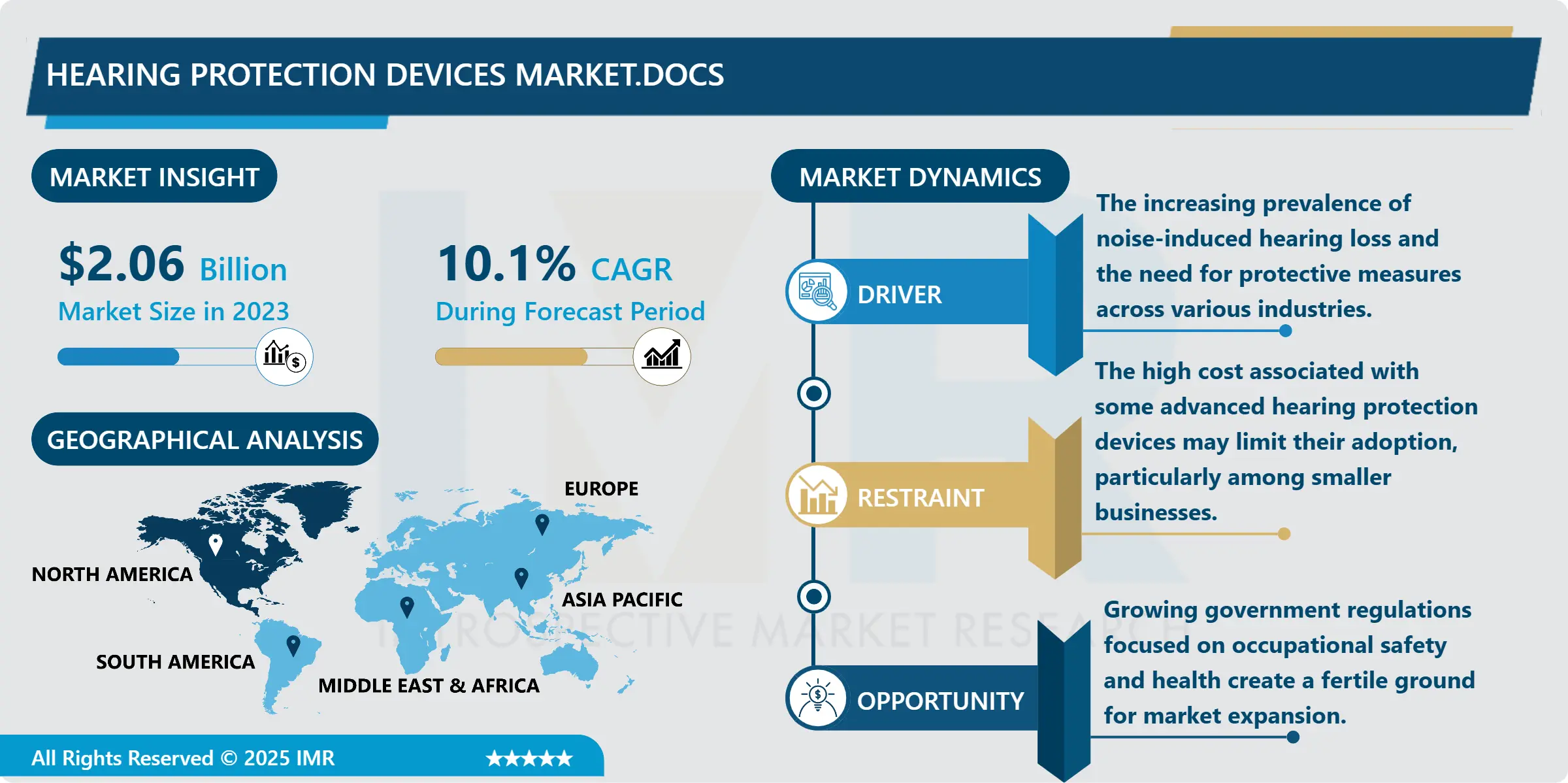

Hearing Protection Devices Market Size Was Valued at USD 2.06 Billion in 2023, and is Projected to Reach USD 4.89 Billion by 2032, Growing at a CAGR of 10.1% From 2024-2032.

Hearing protection devices, HPDs, mean equipment which is aimed at protecting the hearing of people more exposed to noisy surroundings. They identify gadgets that help decrease sound energy going into the earthus eliminating NIHLs and other related hearing impairment. Some of the most familiar types of HPDs are earplugs, earmuffs, and custom-fit devices that are in demand in construction, manufacturing, entertainment, hunting and concert going, among others. The efficiency of such devices is expressed by the Noise Reduction Rating which represents the degree of sound attenuation.

The Hearing Protection Devices market is currently growing through the increasing concerns of Noise Induced Hearing Loss and the mounting legislations meant to safeguard workers in noisy sectors. The fact is that World Health Organization has stated that there are over one and half billion people who suffer from the hearing loss. Thus, companies have to implement more strict safety measures that create a need for HPDs. Also, the increasing number of recreational and sports events that result in noise exposure, for instance; motor racing and shooting sports add to the market demand. This trend in its expansion is further anchored on the development of new technologies, as producers seek to come up with not only more efficient, but also more comfortable hearing protection devices.

The market is highly competitive and populated with indigenous and international companies’ presence leading to the formation of the industry. Subcategories in the market are disposable earplugs, reusable earplugs, and earmuffs as they have the different functions and meet various customers’ needs. The disposable segment is much more popular in the areas that accept high hygiene standards, and the earmuffs are used in constructions and manufacturing areas due to their higher protection classes. Also, the amenities have improved market access, whereby consumers can purchase hearing protective equipment from an e-commerce platform. More people are also being employed across the world, and there is increased pressure of people shifting to urban centers that expose them to much noise that may harm them.

Hearing Protection Devices Market Trend Analysis:

Growing Adoption of Smart Hearing Protection Devices

- During the current couple of years, the adaptation of smart hearing protection device has received much attention due to the technological implementation and necessity for better safety measures in noisy working conditions. New gadgets come with built-in communication features, noise reduction and interconnectivity solutions for coupling with phones and other technological gadgets. This integration allows users to receive vital notification and message while wearing their hearing protection thus solving a key problem that many sectors including construction and manufacturing have. That way, these smart HPDs make a coordinated one that is far more efficient and effective in contrast to conventional devices while keeping their hearing protected and at the same time, staying aware of their surroundings.

- With labour safety concerns and efficiency becoming more important to industries, the demand for the smart hearing protection devices market is expected to show further growth. Technology firms are pumping their funds into R&D to develop sophisticated features into its products and this has seen the production of gadgets that not only provide the user with powerful hearing protection but also with more features that holds value. These developments meet the new antecedent of workers to address and interact through bullhorn and display devices without exposing them to injury. As the trend towards smart technology continues to intensify, much more options are expected to exhibit themselves in the Hearing Protection Devices market space and bring about more change.

Increasing Focus on Occupational Health and Safety Regulations

- The increasing demand for products that provide safety at workplaces due to Hearing Protection Devices (HPD) is greatly improving the overall market due to increased regulatory pressures for such legislations. Governments all over the world are incorporating measures that control unsafe working conditions – particularly loudness which is known to contribute to loss of hearing. For instance, in the United States, the Occupational Safety and Health Administration OSHA has set specific permissible exposure levels of noise at workplace and require employers to supply appropriate hearing conservation for employees in noisy places. Frameworks like these not only pressure companies into developing and establishing compliant hearing protection products but also help generate a large market for HPDs as organizations continue to address their employees’ health concerns.

- The on-going encouragement of enhanced safety and health of employees by industries will likely lead to increased requirements for advanced hearing protection products. Manufacturers want HPDs that meet their legal requirements, as well as promote comfort and effectiveness for users. This is a vast market that has the potential of becoming a gold mine for the manufacturers to produce sophisticated products that can be embedded with current state of art technologies as well as ergonomic features. ince the products are to be comfortable, easy to use and compliant with standards, manufacturers are able to appeal to other sectors of customers such as the industrial and the recreational sector. Thus, it can be stated that the reaction allied to highly regulated standards regarding the incorporation of enhanced safety features along with strict norms is expected to foster healthy growth in the electronic HPD market with a burgeoning avenue towards establishing significant solutions pertaining to the needs of the various user segments involved.

Hearing Protection Devices Market Segment Analysis:

Hearing Protection Devices Market is Segmented on the basis of Type, Application, End User, and Region.

By Product Type, earplug segment is expected to dominate the market during the forecast period

- Depending on the type of the Hearing Protection Devices the market can be divided into a number of segments namely, the earplugs, earmuffs and the hearing bands. The most common type of earplugs that is used when exposed to loud noise is classified into two types: the disposable and reusable types. hygiene type of earplugs are of foam material or similar materials and the type that can only be used once making them easier to use and hygienically suitable. Conventional earplugs are designed with hard materials and are used over and over again after washing hence cost effective for long term use. Earmuffs are another type of hearing protection; they are bigger than plugs, covering the whole ear; they are much common at noisy workplaces and usually decorated with soft padding. There is also a hearing bands which are somewhat less popular but are flexible bands that hold the earplugs and can be worn around the neck when not in use, thus making them suitable for employees who need protection only occasionally. These kinds of hearing protection products address different user needs, preferences and noise exposure levels hence the versatility of hearing protection industry.

By Technology, Earmuffs segment expected to held the largest share

- The Hearing Protection Devices market is segmented by technology into two main categories: The other two categories include the passive hearing protection and the active electronic hearing protection. Personal protective devices that do not actively cancel noise include the classic ear plugs and muffs that mechanically prevent sound waves from entering the ear drum reducing the amount of sound that enters the human ears. Electronic hearing protection on the other hand is more sophisticated and has extra features to the users and safety. This category includes active noise cancellation gadgets that use microphones to record external noise then generate the sound waves that are direct opposite to them. Further, advanced hearing protection gear comes incorporated with features like Bluetooth, to facilitate interaction and client’s situational awareness while under protection of their ears. These technological developments enhance comfort and functionality of products in addition to addressing the special requirements of people in different contexts – occupational and leisure.

Hearing Protection Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- As per Analysis, the hearing protection devices market share of North America is estimated to reach up to 35% in the year 2023. This stronghold can be attributed to painfully strict occupational safety regulation within the region most especially in the American region where organizations such as OSHA have set down strict measures to ensure that employees are not over exposed to noise. These measures not only inform people and the employers on the dangers posed by hearing loss from noise but also encourage the use of high quality HPDs as a way of meeting legal requirements. Also, a significant manufacturing sector comprising construction industries, manufacturing industries and mining industries, also adds to the high demand of sturdy hearing protection products thus further cementing the North America market.

- That dominance is reinforced by substantial local presence of key manufacturers and suppliers who remain keen on the development of enhanced hearing protection solutions. Technology industrialist in North America provide hefty towards research and development, the result is invention of consumer-friendly innovative devices in conformity to the new industry trends. This competing market place call for constant innovation as firm try to offer a product that is comfortable, durable and effective. The trend towards greater worker health and safety consciousness and a continued commitment to R&D in hearing protection devices means that North America should continue to dominate the HPD market for the medium term at least.

Active Key Players in the Hearing Protection Devices Market:

- 3M (USA)

- Amplifon (Italy)

- E.A.R. Inc. (USA)

- Honeywell International Inc. (USA)

- Mack's (USA)

- Moldex-Metric, Inc. (USA)

- Noise Buster (UK)

- Peltor (Sweden)

- Phonak (Switzerland)

- Sperian (France)

- Starkey Hearing Technologies (USA)

- Uvex Safety Group (Germany)

- Westone Laboratories, Inc. (USA)

- Widex (Denmark)

- Zound Industries (Sweden)

- Other Active Players

|

Global Hearing Protection Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.06 Billion |

|

Forecast Period 2024-32 CAGR: |

10.1% |

Market Size in 2032: |

USD 4.89 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hearing Protection Devices Market by Product Type

4.1 Hearing Protection Devices Market Snapshot and Growth Engine

4.2 Hearing Protection Devices Market Overview

4.3 Earplugs

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Earplugs: Geographic Segmentation Analysis

4.4 Disposable Earplugs

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Disposable Earplugs: Geographic Segmentation Analysis

4.5 Reusable Earplugs

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Reusable Earplugs: Geographic Segmentation Analysis

4.6 Earmuffs

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Earmuffs: Geographic Segmentation Analysis

4.7 Hearing Bands

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Hearing Bands: Geographic Segmentation Analysis

Chapter 5: Hearing Protection Devices Market by Technology

5.1 Hearing Protection Devices Market Snapshot and Growth Engine

5.2 Hearing Protection Devices Market Overview

5.3 Passive Hearing Protection

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Passive Hearing Protection: Geographic Segmentation Analysis

5.4 Electronic Hearing Protection

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Electronic Hearing Protection: Geographic Segmentation Analysis

5.5 Active Noise Cancelling

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Active Noise Cancelling: Geographic Segmentation Analysis

5.6 Smart Hearing Protection Devices

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Smart Hearing Protection Devices: Geographic Segmentation Analysis

Chapter 6: Hearing Protection Devices Market by End User

6.1 Hearing Protection Devices Market Snapshot and Growth Engine

6.2 Hearing Protection Devices Market Overview

6.3 Industrial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Industrial: Geographic Segmentation Analysis

6.4 Healthcare

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Healthcare: Geographic Segmentation Analysis

6.5 Military and Defence

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Military and Defence: Geographic Segmentation Analysis

6.6 Recreational Activities

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Recreational Activities: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Hearing Protection Devices Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AMPLIFON (ITALY)

7.4 E.A.R. INC. (USA)

7.5 HONEYWELL INTERNATIONAL INC. (USA)

7.6 MACK'S (USA)

7.7 MOLDEX-METRIC INC. (USA)

7.8 NOISE BUSTER (UK)

7.9 PELTOR (SWEDEN)

7.10 PHONAK (SWITZERLAND)

7.11 SPERIAN (FRANCE)

7.12 STARKEY HEARING TECHNOLOGIES (USA)

7.13 UVEX SAFETY GROUP (GERMANY)

7.14 WESTONE LABORATORIES INC. (USA)

7.15 WIDEX (DENMARK)

7.16 ZOUND INDUSTRIES (SWEDEN)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Hearing Protection Devices Market By Region

8.1 Overview

8.2. North America Hearing Protection Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Earplugs

8.2.4.2 Disposable Earplugs

8.2.4.3 Reusable Earplugs

8.2.4.4 Earmuffs

8.2.4.5 Hearing Bands

8.2.5 Historic and Forecasted Market Size By Technology

8.2.5.1 Passive Hearing Protection

8.2.5.2 Electronic Hearing Protection

8.2.5.3 Active Noise Cancelling

8.2.5.4 Smart Hearing Protection Devices

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Industrial

8.2.6.2 Healthcare

8.2.6.3 Military and Defence

8.2.6.4 Recreational Activities

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Hearing Protection Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Earplugs

8.3.4.2 Disposable Earplugs

8.3.4.3 Reusable Earplugs

8.3.4.4 Earmuffs

8.3.4.5 Hearing Bands

8.3.5 Historic and Forecasted Market Size By Technology

8.3.5.1 Passive Hearing Protection

8.3.5.2 Electronic Hearing Protection

8.3.5.3 Active Noise Cancelling

8.3.5.4 Smart Hearing Protection Devices

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Industrial

8.3.6.2 Healthcare

8.3.6.3 Military and Defence

8.3.6.4 Recreational Activities

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Hearing Protection Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Earplugs

8.4.4.2 Disposable Earplugs

8.4.4.3 Reusable Earplugs

8.4.4.4 Earmuffs

8.4.4.5 Hearing Bands

8.4.5 Historic and Forecasted Market Size By Technology

8.4.5.1 Passive Hearing Protection

8.4.5.2 Electronic Hearing Protection

8.4.5.3 Active Noise Cancelling

8.4.5.4 Smart Hearing Protection Devices

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Industrial

8.4.6.2 Healthcare

8.4.6.3 Military and Defence

8.4.6.4 Recreational Activities

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Hearing Protection Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Earplugs

8.5.4.2 Disposable Earplugs

8.5.4.3 Reusable Earplugs

8.5.4.4 Earmuffs

8.5.4.5 Hearing Bands

8.5.5 Historic and Forecasted Market Size By Technology

8.5.5.1 Passive Hearing Protection

8.5.5.2 Electronic Hearing Protection

8.5.5.3 Active Noise Cancelling

8.5.5.4 Smart Hearing Protection Devices

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Industrial

8.5.6.2 Healthcare

8.5.6.3 Military and Defence

8.5.6.4 Recreational Activities

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Hearing Protection Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Earplugs

8.6.4.2 Disposable Earplugs

8.6.4.3 Reusable Earplugs

8.6.4.4 Earmuffs

8.6.4.5 Hearing Bands

8.6.5 Historic and Forecasted Market Size By Technology

8.6.5.1 Passive Hearing Protection

8.6.5.2 Electronic Hearing Protection

8.6.5.3 Active Noise Cancelling

8.6.5.4 Smart Hearing Protection Devices

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Industrial

8.6.6.2 Healthcare

8.6.6.3 Military and Defence

8.6.6.4 Recreational Activities

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Hearing Protection Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Earplugs

8.7.4.2 Disposable Earplugs

8.7.4.3 Reusable Earplugs

8.7.4.4 Earmuffs

8.7.4.5 Hearing Bands

8.7.5 Historic and Forecasted Market Size By Technology

8.7.5.1 Passive Hearing Protection

8.7.5.2 Electronic Hearing Protection

8.7.5.3 Active Noise Cancelling

8.7.5.4 Smart Hearing Protection Devices

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Industrial

8.7.6.2 Healthcare

8.7.6.3 Military and Defence

8.7.6.4 Recreational Activities

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Hearing Protection Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.06 Billion |

|

Forecast Period 2024-32 CAGR: |

10.1% |

Market Size in 2032: |

USD 4.89 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||