Glycated Albumin Market Synopsis:

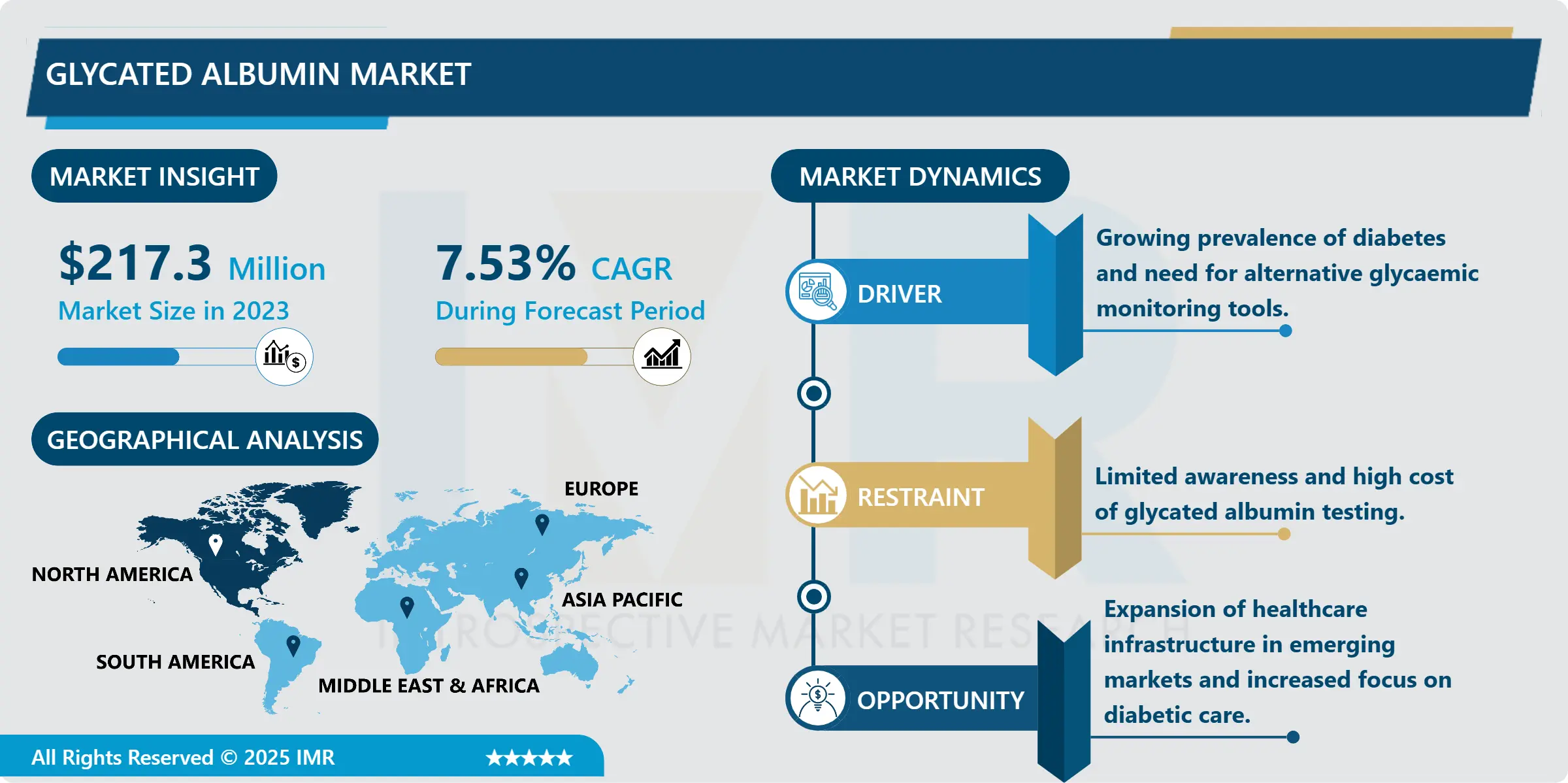

Glycated Albumin Market Size Was Valued at USD 217.30 Million in 2023, and is Projected to Reach USD 417.66 Million by 2032, Growing at a CAGR of 7.53 % From 2024-2032.

The Glycated albumin Market refers to equipment used for screening and testing glycated albumin in the body and different reagents used in the process. Glycated albumin gives the recent data about the control of the blood glucose level within 2 to 4 weeks; therefore, assessment of the glycaemic control in diabetic patients and the efficiency of diabetes management is necessary. HbA1c and glycated albumin are used in many laboratories simultaneously; especially when HbA1c approaches inaccuracy, such as in anaemia, pregnancy, or renal disease.

Glycated albumin market is expanding at a very fast pace due to a high prevalence of diabetes in countries over globally and growing awareness among people to look for other similar diagnostic tests instead of glucose test. Given that, diabetes epidemic has been linked to factors such as; lifestyle, urbanisation and ageing, there is growing need to achieve better, more frequent and shorter duration of glycemia control. They have described that it was possible to get general long-term blood glucose informatics but the utility of HbA1c could not be good for all the cases especially for those patients who have variable or sometimes high peaks and troughs of their glucose levels or for those patients in whose bodies red blood cell turnovers were higher. Thus, in order to receive more individualized measurement results in this area,_identifier for people, patients, and healthcare providers, the tests for assessment of glycated albumin levels are considered to be the most popular, enhancing the demand for glycated albumin testing solutions in clinical practice.

Healthcare organizations and national governments around the world are seeking to increase the diabetes management ratio and, in so doing, are recommending the use of glycated albumin tests in diabetes care. Moreover, tutorials are learnt that recent innovation in testing techniques such as the growing sophistication of assay technologies are enhancing glycated albumin testing. Building on these advancements together with the lifting of barriers that comes with practical accessibility of the glycated albumin testing kits in the hospital, diagnosing, and other organizations set the stage for more massive market significantly. However, the usage of glycated albumin testing is relatively costly and there exist some regions where the patients and physicians’ knowledge about the test is limited, which may be a problem.

Glycated Albumin Market Trend Analysis:

Increasing Adoption of Point-of-Care Glycated Albumin Testing

-

The factors affecting the Glycated Albumin Market include moving towards POC testing solutions because of the abilities to diagnose a patient and a physician quickly with cost-efficiency. This means that the POC glycated albumin tests contributing to the fact that the glycemic control can be evaluated in short time useful predominantly for the diabetic patients in the outpatient/community health. These POC systems are not highly reliant on laboratory support And results can be obtained in as little as a few minutes conveniently for the patients and therefore encouraging increased testing. This is why the constant development of POC technologies and advent of new devices in glycated albumin testing as more accurate and easier to use are going to expand the ability and the frequency of glycemic control monitoring.

Growing Demand in Emerging Markets for Diabetes Management

-

The Glycated Albumin Market has reasonably prospect growth in the emerging market area because of increasing cases of diagnosed diabetes and the increasing focus on diagnosing tools for diabetes. Many developing countries in Asia, Latin America and Africa are experiencing an increase of the disease as a result of increased rate of urbanization, longer life spans and development of unhealthy habits. This has raised the demand for proper diagnosis solutions that would assist in monitoring the state of the affected diabetes’ patients. And even as healthcare in these over regions advances and upgrade in the latest diagnosis equipment and glycated albumin testing solutions. This is particularly so because firms that will develop products to make this test cheaper and more available in such areas stand to benefit from such upbeat macro environment factors making the Glycated Albumin Market’s area of growth emergence markets.

Glycated Albumin Market Segment Analysis:

Glycated Albumin Market is Segmented on the basis of Product Type, Application, End User, and Region

By Product Type, Human glycate segment is expected to dominate the market during the forecast period

-

The human glycated albumin section is anticipated to dominate the Glycated Albumin Market over the forecast period due to rising demand for more effective and individualised methods of glucose testing. Human glycated albumin gives more accurate estimation about the blood glucose position of diabetic patients more especially those patients who have their HbA1c levels influenced more by other diseases or those patients who have fluctuations in the blood glucose concentrations and may require more frequent monitoring. Every year, it is on human glycated albumin, healthcare providers are becoming more interested regarding its application in the management of diabetes patients where short-term blood glucose monitoring is required; thus, increasing adoption of human glycated albumin testing solutions. Better glycemic control and patient specific care as intervention approaches are thus expected to drive the future years’ growth for this segment.

By Application, Diagnostic segment expected to held the largest share

-

The diagnostic segment appears to dominate the glycated albumin market concerning its revenue mainly due to the rising demand for better diagnosing solutions for diabetes in hospitals, diagnostic laboratories, and outpatient centres. Glycated albumin testing can be done in a routine as such as HbA1c testing; however, it is mostly used for patients who have diabetes and needs short term monitoring or inadequate HbA1c test result. Thanks to an increase in knowledge about glycaemic control, as well as due to the integration of a glycated albumin test into the routine diagnosis of diabetes, the diagnostic segment has expanded. Moreover, rising investments in diagnostic technology particularly the automatic system that offer short working time and high accuracy also create demand for glycated albumin tests and tend to be positive for the development of the diagnostic segment.

Glycated Albumin Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America will dominate the Glycated Albumin Market during the upcoming years due to the rising prevalence of the disease, a highly developed healthcare system, and higher expenditures on diagnostics. Diabetes is a debated subject in the United States and other developed countries because specialists shift toward new glycated albumin as a part of an individualized approach for diabetes control. This region also has the real prospect of financial endowment for diabetes more especially on the research and management with both the government and private health care institutions willing to enhance the models currently in the management of diabetes. Secondly, the healthcare across the North America region is fast and quick to adopt any new diagnostic methods as soon as possible. They also understand the limitations of HbA1c for some patient population groups Therefore the need to conduct glycated albumin testing.

- It also increases the overall of the market share of North America because of the concern for the healthcare system and awareness for the disease. As diabetes is always an issue in the United States and Canada, the need for testing solutions for glycated albumin will remain relevant for both countries. As mentioned earlier, there are strong market players present in North America, and regulations are strongly supporting innovations in the diabetes market. This in turn is supported by the rising demand for diagnostic systems, transitioning towards patient centric care model and the strong position in North America.

Active Key Players in the Glycated Albumin Market:

-

Asahi Kasei Corporation (Japan)

- Beijing Strong Biotechnologies, Inc. (China)

- Bio-Rad Laboratories, Inc. (USA)

- Diazyme Laboratories, Inc. (USA)

- EKF Diagnostics (UK)

- FUJIFILM Wako Pure Chemical Corporation (Japan)

- H-U Pharma Co., Ltd. (Japan)

- Korea C-Line Co., Ltd. (South Korea)

- LifeSpan BioSciences, Inc. (USA)

- Metabolic Solutions Development Company (USA)

- Ortho Clinical Diagnostics (USA)

- Quest Diagnostics (USA)

- Randox Laboratories Ltd. (UK)

- Sekisui Medical Co., Ltd. (Japan)

- Zhejiang Orient Gene Biotech Co., Ltd. (China)

- Other Active Players

|

Global Glycated Albumin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 217.30 Million |

|

Forecast Period 2024-32 CAGR: |

7.53 % |

Market Size in 2032: |

USD 417.66 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Glycated Albumin Market by Product Type

4.1 Glycated Albumin Market Snapshot and Growth Engine

4.2 Glycated Albumin Market Overview

4.3 Human

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Human: Geographic Segmentation Analysis

4.4 Animal Glycated

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Animal Glycated: Geographic Segmentation Analysis

Chapter 5: Glycated Albumin Market by Application

5.1 Glycated Albumin Market Snapshot and Growth Engine

5.2 Glycated Albumin Market Overview

5.3 Diagnostics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Diagnostics: Geographic Segmentation Analysis

5.4 Research

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Research: Geographic Segmentation Analysis

5.5 Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others: Geographic Segmentation Analysis

Chapter 6: Glycated Albumin Market by End Use

6.1 Glycated Albumin Market Snapshot and Growth Engine

6.2 Glycated Albumin Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Diagnostic centres

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Diagnostic centres: Geographic Segmentation Analysis

6.5 Research centres

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Research centres: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Glycated Albumin Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ASAHI KASEI CORPORATION (JAPAN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BEIJING STRONG BIOTECHNOLOGIES INC. (CHINA)

7.4 BIO-RAD LABORATORIES INC. (USA)

7.5 DIAZYME LABORATORIES INC. (USA)

7.6 EKF DIAGNOSTICS (UK)

7.7 FUJIFILM WAKO PURE CHEMICAL CORPORATION (JAPAN)

7.8 H-U PHARMA CO. LTD. (JAPAN)

7.9 KOREA C-LINE CO. LTD. (SOUTH KOREA)

7.10 LIFESPAN BIOSCIENCES INC. (USA)

7.11 METABOLIC SOLUTIONS DEVELOPMENT COMPANY (USA)

7.12 ORTHO CLINICAL DIAGNOSTICS (USA)

7.13 QUEST DIAGNOSTICS (USA)

7.14 RANDOX LABORATORIES LTD. (UK)

7.15 SEKISUI MEDICAL CO. LTD. (JAPAN)

7.16 ZHEJIANG ORIENT GENE BIOTECH CO. LTD. (CHINA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Glycated Albumin Market By Region

8.1 Overview

8.2. North America Glycated Albumin Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Human

8.2.4.2 Animal Glycated

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Diagnostics

8.2.5.2 Research

8.2.5.3 Others

8.2.6 Historic and Forecasted Market Size By End Use

8.2.6.1 Hospitals

8.2.6.2 Diagnostic centres

8.2.6.3 Research centres

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Glycated Albumin Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Human

8.3.4.2 Animal Glycated

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Diagnostics

8.3.5.2 Research

8.3.5.3 Others

8.3.6 Historic and Forecasted Market Size By End Use

8.3.6.1 Hospitals

8.3.6.2 Diagnostic centres

8.3.6.3 Research centres

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Glycated Albumin Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Human

8.4.4.2 Animal Glycated

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Diagnostics

8.4.5.2 Research

8.4.5.3 Others

8.4.6 Historic and Forecasted Market Size By End Use

8.4.6.1 Hospitals

8.4.6.2 Diagnostic centres

8.4.6.3 Research centres

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Glycated Albumin Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Human

8.5.4.2 Animal Glycated

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Diagnostics

8.5.5.2 Research

8.5.5.3 Others

8.5.6 Historic and Forecasted Market Size By End Use

8.5.6.1 Hospitals

8.5.6.2 Diagnostic centres

8.5.6.3 Research centres

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Glycated Albumin Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Human

8.6.4.2 Animal Glycated

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Diagnostics

8.6.5.2 Research

8.6.5.3 Others

8.6.6 Historic and Forecasted Market Size By End Use

8.6.6.1 Hospitals

8.6.6.2 Diagnostic centres

8.6.6.3 Research centres

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Glycated Albumin Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Human

8.7.4.2 Animal Glycated

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Diagnostics

8.7.5.2 Research

8.7.5.3 Others

8.7.6 Historic and Forecasted Market Size By End Use

8.7.6.1 Hospitals

8.7.6.2 Diagnostic centres

8.7.6.3 Research centres

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Glycated Albumin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 217.30 Million |

|

Forecast Period 2024-32 CAGR: |

7.53 % |

Market Size in 2032: |

USD 417.66 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||