GLP-1 Receptor Agonist Market Synopsis:

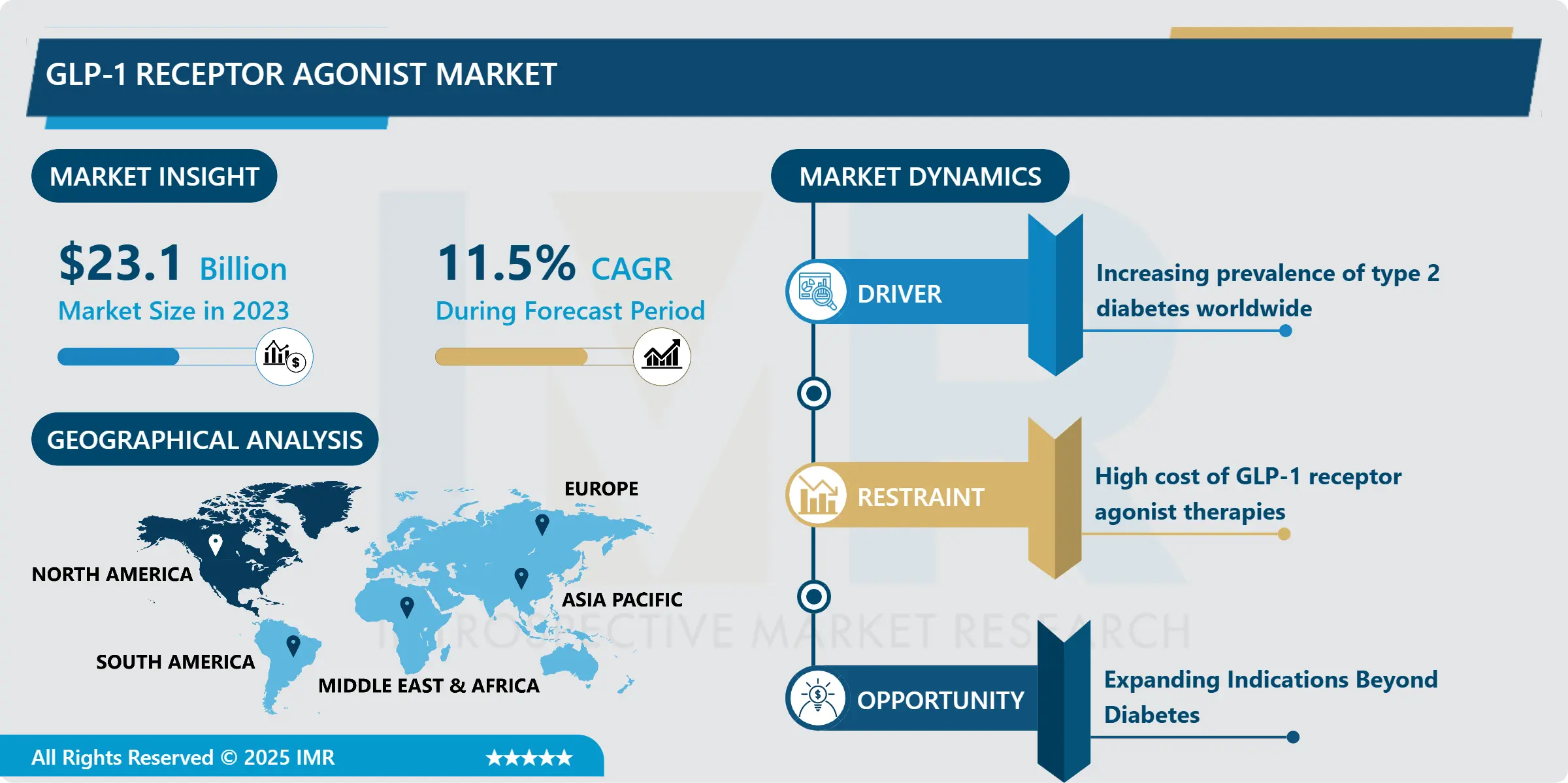

GLP-1 Receptor Agonist Market Size Was Valued at USD 23.1 Billion in 2023, and is Projected to Reach USD 61.5 Billion by 2032, Growing at a CAGR of 11.5% From 2024-2032.

The GLP-1 Receptor Agonist Market is the worldwide market for the GLP-1 Receptor Agonist drugs-the pharmaceuticals which are used to manage type 2 diabetes. These drugs actually are imitations of the GLP-1 which is a naturally taking place hormone in the body responsible for the control of the blood sugar level through the promotion of insulin secretion, decrease of the rate of stomach emptying, and reduction of feeling of hunger. This market encompass a number of drug formulations and delivery systems such as parenteral and oral health products to match the increasing demand for better diabetes treatment.

The GLP-1 receptor agonist has been promising itself for the past ten years given the increasing population of people who are type 2 diabetes and obesity. As chronic diseases associated with the modern/Rayleighyzed lifestyle continue to act, so does the need for tertiary interventions like GLP-1 receptor agonists. These drugs prove very efficient due to their action upon several metabolic processes; besides controlling the levels of sugar in blood they contribute to weight loss which is essential in the course of the treatment of type 2 diabetes. Moreover, owing to the safe and effective utilization of GLP-1 receptor agonist over conventional diabetes therapies including insulin, the adoption has risen substantially in patients and health care professionals.

This market is thought to expand more so owing to a growing knowledge base of the benefits related to these drugs for instance, cardiovascular. Therefore, a few GLP-1 receptor agonists such as liraglutide and semaglutide have clinical trials that attest to their ability to minimize the risk of major cardiovascular episodes in patients with type two diabetes. Further, the market has several ongoing advancements, for instance, the technology advancement regarding drug delivery systems like oral GLP-1 receptor agonists that increase patient compliance due to the availability of better treatment options.

GLP-1 Receptor Agonist Market Trend Analysis:

Oral GLP-1 Agonists Taking Center Stage

-

A significant uptrend identified in the market for GLP-1 receptor agonist is the shift towards orals GLP-1 receptor agonists. Originally most of the GLP-1 receptor agonists have been in a form of injection this was a key challenge because many patients could not strictly adhere to this method. However, with new forms like oral structures such as Rybelsus (semaglutide), the availability in the market is changing much to be patient-friendly than it has been in the past. The non-injectable GLP-1 receptor agonist drugs are as effective as injectable drugs but are more convenient to use, thus preferred by patients. This shift is believed to boost the market rapidly as pharma majors strive to produce more and more oral products for patients convenience and increased customer base.

Expanding Indications Beyond Diabetes

-

Thus one of the potential opportunities for GLP-1 receptor agonist is the increase of the therapeutic scope of application outside of diabetes type 2. Some of these drugs are now being investigated for the management of other metabolic diseases especially obesity and cardiovascular diseases. In the present literature, it has been shown that GLP-1 receptor agonists not only optimise glycaemic control but also lead to weight loss, which makes this class of drugs a promising candidate for obesity treatment. However, with the cardiovascular benefits having been established, their potential applications include treatment of cardiovascular diseases related to metabolic syndrome. In other cases, pharmaceutical firms are funding clinical trials for these drugs as they look to gain new label approvals which are an attractive avenue for growth in new therapeutic segments.

GLP-1 Receptor Agonist Market Segment Analysis:

GLP-1 Receptor Agonist Market is Segmented on the basis of Drug Class, Indication, Route of Administration, and Region

By Drug Class, Exenatide segment is expected to dominate the market during the forecast period

-

Analyzing by drugs class, it is expected that the Exenatide segment will initiate a number one role in the GLP-1 receptor agonist market throughout the forecast period. Byetta and other related brands such as Bydureon constitute a verified market leader in exenatide thanks to the product’s efficacy and widespread recognition of the medication’s safety. This one is Bydureon – it aims at once weekly administration so patients need less injection, comparing to other preparations of the same group. This has been coupled with the fact that use of Exenatide has been shown to bring about impressive enhancement of glycemia with attendant weight loss, and this has placed Exenatide as the first option in recourse by both doctors and patients. Significant market share with predictable clinical efficacy and increasing consumer acceptance make the segment dominate the GLP-1 receptor agonist market.

By Indication, Diabetes segment expected to held the largest share

-

By indication, the diabetes segment shall be the largest share of the GLP-1 receptor agonist market. This dominance is as a result of high worldwide incidence of type 2 diabetes that is advancing especially due to inadequate diets and sedentary life. SGlt2 inhibitors have emerged as an essential element of the type 2 diabetes treatment portfolio, demonstrating better glucose control compared with SUs with the added advantage of promoting weight loss and halting/risking cardiovascular disease. The substantial market share of the diabetes segment is further bolstered by a higher number of patients who still have unmet glycemic targets despite traditional therapies – they can take GLP-1 receptor agonists. With enhanced knowledge of the medicinal application of these products, this segment will continue to lead the market and grow at a consistent pace throughout the forecast horizon.

GLP-1 Receptor Agonist Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

It is estimated that in 2023, North America will be the largest consumer of the GLP-1 receptor agonist in the global market, controlling for the largest market share. To this effect, the United States has relatively higher incidence of type 2 diabetes and obesity and increased use of hi-tech health care systems. Largest share of the regional market is attributed to the US, here due to the saturation of healthcare facilities, incurable reimbursement policies, and key pharmaceutical companies.

- North America alone is expected to constitute of more than 40% of the existing global market come 2023. Further dominance of the region is evident from an increased level of research and development activities, which have resulted in the development of newer and better GLP-1 receptor agonists in the form of a tablet. Moreover, growing patient and healthcare professional understanding of the cardiovascular uses of GLP-1 receptor agonists have boosted its popularity as well their region, with North America leading.

Active Key Players in the GLP-1 Receptor Agonist Market:

-

Amgen (USA)

- AstraZeneca (UK)

- Boehringer Ingelheim (Germany)

- Daiichi Sankyo (Japan)

- Eli Lilly (USA)

- GlaxoSmithKline (UK)

- Ipsen (France)

- Johnson & Johnson (USA)

- Merck & Co. (USA)

- Novartis (Switzerland)

- Novo Nordisk (Denmark)

- Pfizer (USA)

- Sanofi (France)

- Takeda Pharmaceutical (Japan)

- Teva Pharmaceuticals (Israel)

- Other Active Players

|

Global GLP-1 Receptor Agonist Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.1 Billion |

|

Forecast Period 2024-32 CAGR: |

11.5% |

Market Size in 2032: |

USD 61.5 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Indication |

|

||

|

By Route of Administration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: GLP-1 Receptor Agonist Market by Drug Class

4.1 GLP-1 Receptor Agonist Market Snapshot and Growth Engine

4.2 GLP-1 Receptor Agonist Market Overview

4.3 Exenatide

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Exenatide: Geographic Segmentation Analysis

4.4 Liraglutide

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Liraglutide: Geographic Segmentation Analysis

4.5 Dulaglutide

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Dulaglutide: Geographic Segmentation Analysis

4.6 Lixisenatide

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Lixisenatide: Geographic Segmentation Analysis

4.7 Others

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Others: Geographic Segmentation Analysis

Chapter 5: GLP-1 Receptor Agonist Market by Indication

5.1 GLP-1 Receptor Agonist Market Snapshot and Growth Engine

5.2 GLP-1 Receptor Agonist Market Overview

5.3 Diabetes

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Diabetes: Geographic Segmentation Analysis

5.4 Cardiovascular Disease

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Cardiovascular Disease: Geographic Segmentation Analysis

5.5 Weight Management Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Weight Management Others: Geographic Segmentation Analysis

Chapter 6: GLP-1 Receptor Agonist Market by Route of Administration

6.1 GLP-1 Receptor Agonist Market Snapshot and Growth Engine

6.2 GLP-1 Receptor Agonist Market Overview

6.3 Parenteral

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Parenteral: Geographic Segmentation Analysis

6.4 Oral

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Oral: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 GLP-1 Receptor Agonist Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMGEN (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ASTRAZENECA (UK)

7.4 BOEHRINGER INGELHEIM (GERMANY)

7.5 DAIICHI SANKYO (JAPAN)

7.6 ELI LILLY (USA)

7.7 GLAXOSMITHKLINE (UK)

7.8 IPSEN (FRANCE)

7.9 JOHNSON & JOHNSON (USA)

7.10 MERCK & CO. (USA)

7.11 NOVARTIS (SWITZERLAND)

7.12 NOVO NORDISK (DENMARK)

7.13 PFIZER (USA)

7.14 SANOFI (FRANCE)

7.15 TAKEDA PHARMACEUTICAL (JAPAN)

7.16 TEVA PHARMACEUTICALS (ISRAEL)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global GLP-1 Receptor Agonist Market By Region

8.1 Overview

8.2. North America GLP-1 Receptor Agonist Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Drug Class

8.2.4.1 Exenatide

8.2.4.2 Liraglutide

8.2.4.3 Dulaglutide

8.2.4.4 Lixisenatide

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By Indication

8.2.5.1 Diabetes

8.2.5.2 Cardiovascular Disease

8.2.5.3 Weight Management Others

8.2.6 Historic and Forecasted Market Size By Route of Administration

8.2.6.1 Parenteral

8.2.6.2 Oral

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe GLP-1 Receptor Agonist Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Drug Class

8.3.4.1 Exenatide

8.3.4.2 Liraglutide

8.3.4.3 Dulaglutide

8.3.4.4 Lixisenatide

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By Indication

8.3.5.1 Diabetes

8.3.5.2 Cardiovascular Disease

8.3.5.3 Weight Management Others

8.3.6 Historic and Forecasted Market Size By Route of Administration

8.3.6.1 Parenteral

8.3.6.2 Oral

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe GLP-1 Receptor Agonist Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Drug Class

8.4.4.1 Exenatide

8.4.4.2 Liraglutide

8.4.4.3 Dulaglutide

8.4.4.4 Lixisenatide

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By Indication

8.4.5.1 Diabetes

8.4.5.2 Cardiovascular Disease

8.4.5.3 Weight Management Others

8.4.6 Historic and Forecasted Market Size By Route of Administration

8.4.6.1 Parenteral

8.4.6.2 Oral

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific GLP-1 Receptor Agonist Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Drug Class

8.5.4.1 Exenatide

8.5.4.2 Liraglutide

8.5.4.3 Dulaglutide

8.5.4.4 Lixisenatide

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By Indication

8.5.5.1 Diabetes

8.5.5.2 Cardiovascular Disease

8.5.5.3 Weight Management Others

8.5.6 Historic and Forecasted Market Size By Route of Administration

8.5.6.1 Parenteral

8.5.6.2 Oral

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa GLP-1 Receptor Agonist Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Drug Class

8.6.4.1 Exenatide

8.6.4.2 Liraglutide

8.6.4.3 Dulaglutide

8.6.4.4 Lixisenatide

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By Indication

8.6.5.1 Diabetes

8.6.5.2 Cardiovascular Disease

8.6.5.3 Weight Management Others

8.6.6 Historic and Forecasted Market Size By Route of Administration

8.6.6.1 Parenteral

8.6.6.2 Oral

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America GLP-1 Receptor Agonist Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Drug Class

8.7.4.1 Exenatide

8.7.4.2 Liraglutide

8.7.4.3 Dulaglutide

8.7.4.4 Lixisenatide

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By Indication

8.7.5.1 Diabetes

8.7.5.2 Cardiovascular Disease

8.7.5.3 Weight Management Others

8.7.6 Historic and Forecasted Market Size By Route of Administration

8.7.6.1 Parenteral

8.7.6.2 Oral

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global GLP-1 Receptor Agonist Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.1 Billion |

|

Forecast Period 2024-32 CAGR: |

11.5% |

Market Size in 2032: |

USD 61.5 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Indication |

|

||

|

By Route of Administration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||