Crohn’s Disease Treatment Market Synopsis:

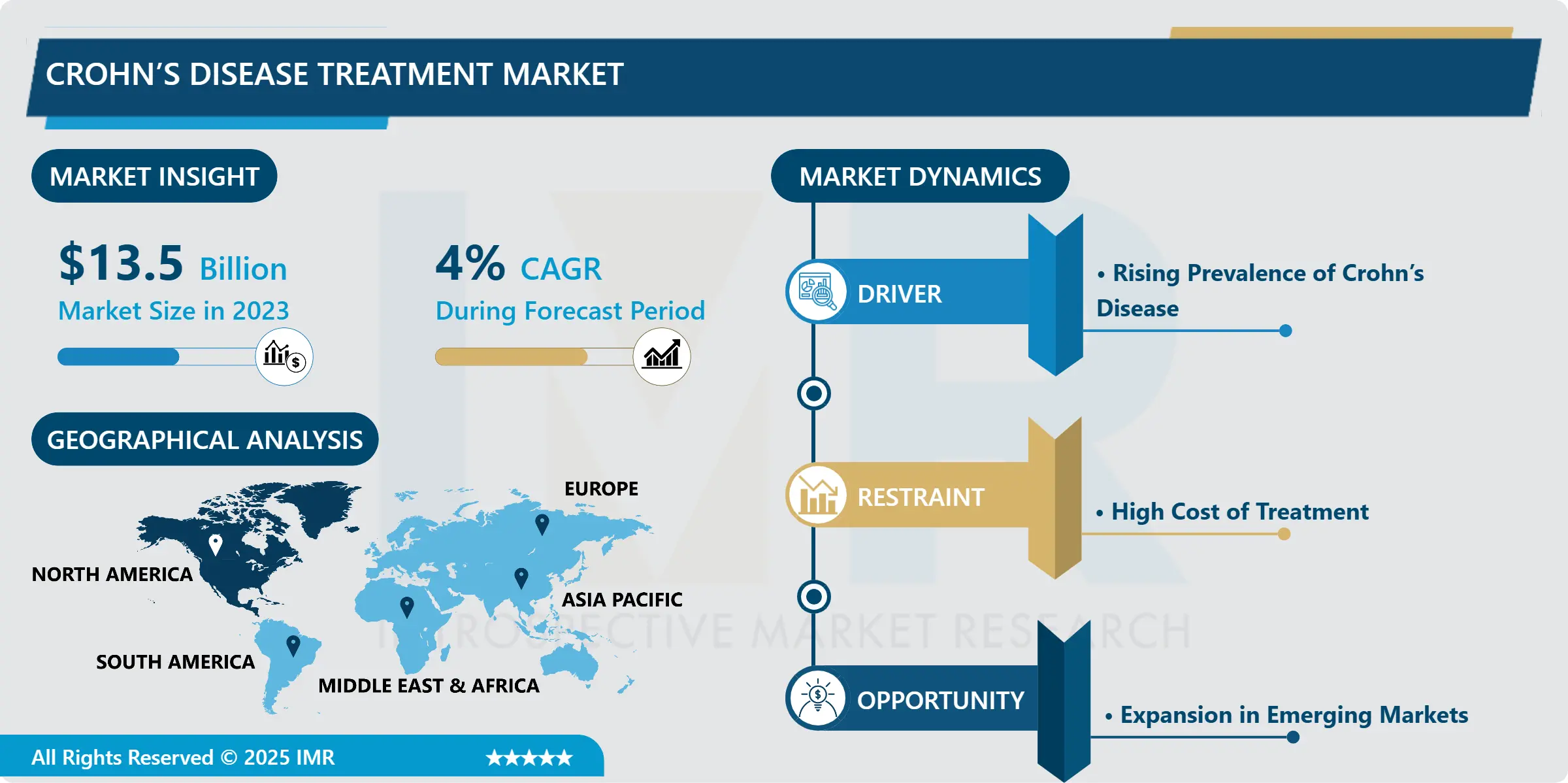

Crohn’s Disease Treatment Market Size Was Valued at USD 13.5 Billion in 2023, and is Projected to Reach USD 19.2 Billion by 2032, Growing at a CAGR of 4% From 2024-2032.

The Crohn's disease treatment market covers all types of therapies, drugs, surgical interventions, and nutritional approaches that will help manage the disease, a type of chronic inflammatory bowel disease that causes inflammation of the digestive tract. It is in reducing symptoms, inducing remission, and preventing the worsening of the disease to achieve a better quality of life for patients.

Millions are affected by Crohn's disease, which exhibits severe abdominal pain, diarrhea, fatigue, and weight loss among symptoms. Its cause is yet to be identified, but some cases are attributed to a predisposed genetic condition, immunity dysfunction, and environmental exposures. The market for treatment for Crohn's disease has been growing rapidly over time, driven by a growth in the prevalence of disease, advances in biologic therapies, and heightened awareness of gastrointestinal disorders.

These strategies include pharmacological therapy with anti-inflammatory drugs, immunosuppressive drugs, antibiotics, and biologic therapies in the severe condition, there are also surgical and nutritional treatments. Given the need for each solution in every patient as the level of disease progression varies with that patient, the market is very dynamic and has high fragmentation. Personalized medicine and advanced biologics have shaped the future of the market growth. Telemedicine and digital health platforms also expand, creating space for innovative solutions in the improvement of disease management.

Crohn’s Disease Treatment Market Trend Analysis:

Growing Adoption of Biologic Therapies

- Biologic therapy is now the cornerstone of Crohn's disease treatment, by targeting specific points within the inflammation process. Advanced drugs, including TNF inhibitor, integrin inhibitor, and interleukin antagonist, demonstrate greater efficacy and improved control over the disease than traditional remedies do.

- This is largely because of induction and maintenance of remission, the decrease in the hospitalization rates, and betterment of the quality of life in patients. Due to the continuous progression in the biotechnology fields, approvals for biosimilars are also increased; this would make access to the market as well as affordability through the better use of biologics. Many companies have invested very highly in next-generation biologics that promote this trend even further.

Expansion in Emerging Markets

- Improving health care infrastructure and disease awareness has created ample scope for the Crohn's Disease Treatment Market in emerging markets. With all these, the countries from Asia-Pacific, Latin America, and the Middle East region are now experiencing an increased rate of prevalence of Crohn's disease due to urbanization, lifestyle changes, and improved diagnostic capabilities.

- The governments and health care systems of these regions have focused on increasing access to biologics and immune-modulating therapies. The adoption of telemedicine and digital health also is growing in these regions, which is a great opportunity for the market players to increase their footprints and cater to this population's unmet medical needs.

Crohn’s Disease Treatment Market Segment Analysis:

Crohn’s Disease Treatment Market Segmented on the basis of Treatment Type, Drug Class, Route of Administration, Distribution Channel, End User, and Region.

By Treatment Type, Anti-inflammatory Drugs segment is expected to dominate the market during the forecast period

- Anti-inflammatory drugs and immune system suppressors remain as the first line of treatment and long-term management, antibiotics treat secondary infections, and nutritional therapy and surgery are used as an adjunct treatment wherein other treatments are not tolerated or complications set in that ensure holistic patient care.

- This diversification of options ensures that treatment can be given to patients as their individual needs suit them best. Biologic therapies are most likely to expand much larger, while surgery continues to have stable demand for complex cases.

By End User, Hospitals segment expected to held the largest share

- Hospitals are preferred in the end-user category since the management of the disease is complex and requires high-level equipment and multidisciplinary teams. Clinics are the preferred outpatient site and follow-up visit center because patients need to have frequent monitoring and medication titration.

- These factors are driven by advancements in telehealth and remote monitoring, and there is indeed a growing preference for convenience and cost-effectiveness; patients are being cared for at home increasingly, primarily for nutritional therapy and also for medication administration.

Crohn’s Disease Treatment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominated the Crohn's Disease Treatment Market, primarily attributed to its advanced healthcare structure, high prevalence of IBD, and strong focus on research and development. Robust pharmaceutical industries in this region have helped in developing as well as commercializing the innovative therapies.

- Positive reimbursement policies and increasing awareness about gastrointestinal disorders are driving the market. The participation of major players and adoption of biologics among the masses has further strengthened the North American position in the global market.

Active Key Players in the Crohn’s Disease Treatment Market:

- AbbVie Inc. (United States)

- Johnson & Johnson (Janssen Biotech) (United States)

- Pfizer Inc. (United States)

- Takeda Pharmaceutical Company Limited (Japan)

- Eli Lilly and Company (United States)

- Bristol-Myers Squibb (United States)

- Amgen Inc. (United States)

- UCB S.A. (Belgium)

- Celltrion Healthcare (South Korea)

- Roche Holding AG (Switzerland)

- Novartis AG (Switzerland)

- Biogen Inc. (United States)

- Other Active Players

|

Global Crohn’s Disease Treatment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.5 Billion |

|

Forecast Period 2024-32 CAGR: |

4% |

Market Size in 2032: |

USD 19.2 Billion |

|

Segments Covered: |

By Treatment Type |

|

|

|

By Drug Class |

|

||

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Crohn’s Disease Treatment Market by Treatment Type

4.1 Crohn’s Disease Treatment Market Snapshot and Growth Engine

4.2 Crohn’s Disease Treatment Market Overview

4.3 Anti-inflammatory Drugs

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Anti-inflammatory Drugs: Geographic Segmentation Analysis

4.4 Immune System Suppressors

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Immune System Suppressors: Geographic Segmentation Analysis

4.5 Antibiotics

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Antibiotics: Geographic Segmentation Analysis

4.6 Biologic Therapies

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Biologic Therapies: Geographic Segmentation Analysis

4.7 Surgery

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Surgery: Geographic Segmentation Analysis

4.8 Nutritional Therapy

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Nutritional Therapy: Geographic Segmentation Analysis

Chapter 5: Crohn’s Disease Treatment Market by Drug Class

5.1 Crohn’s Disease Treatment Market Snapshot and Growth Engine

5.2 Crohn’s Disease Treatment Market Overview

5.3 Aminosalicylates

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Aminosalicylates: Geographic Segmentation Analysis

5.4 Corticosteroids

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Corticosteroids: Geographic Segmentation Analysis

5.5 Immunomodulators

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Immunomodulators: Geographic Segmentation Analysis

5.6 TNF Inhibitors

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 TNF Inhibitors: Geographic Segmentation Analysis

5.7 IL Inhibitors

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 IL Inhibitors: Geographic Segmentation Analysis

Chapter 6: Crohn’s Disease Treatment Market by Route of Administration

6.1 Crohn’s Disease Treatment Market Snapshot and Growth Engine

6.2 Crohn’s Disease Treatment Market Overview

6.3 Oral

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Oral: Geographic Segmentation Analysis

6.4 Injectable

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Injectable: Geographic Segmentation Analysis

Chapter 7: Crohn’s Disease Treatment Market by Distribution Channel

7.1 Crohn’s Disease Treatment Market Snapshot and Growth Engine

7.2 Crohn’s Disease Treatment Market Overview

7.3 Hospital Pharmacies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospital Pharmacies: Geographic Segmentation Analysis

7.4 Retail Pharmacies

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Retail Pharmacies: Geographic Segmentation Analysis

7.5 Online Pharmacies

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Online Pharmacies: Geographic Segmentation Analysis

Chapter 8: Crohn’s Disease Treatment Market by End User

8.1 Crohn’s Disease Treatment Market Snapshot and Growth Engine

8.2 Crohn’s Disease Treatment Market Overview

8.3 Hospitals

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Hospitals: Geographic Segmentation Analysis

8.4 Clinics

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Clinics: Geographic Segmentation Analysis

8.5 Homecare Settings

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Homecare Settings: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Crohn’s Disease Treatment Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ABBVIE INC. (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 JOHNSON & JOHNSON (JANSSEN BIOTECH) (UNITED STATES)

9.4 PFIZER INC. (UNITED STATES)

9.5 TAKEDA PHARMACEUTICAL COMPANY LIMITED (JAPAN)

9.6 ELI LILLY AND COMPANY (UNITED STATES)

9.7 BRISTOL-MYERS SQUIBB (UNITED STATES)

9.8 AMGEN INC. (UNITED STATES)

9.9 UCB S.A. (BELGIUM)

9.10 CELLTRION HEALTHCARE (SOUTH KOREA)

9.11 ROCHE HOLDING AG (SWITZERLAND)

9.12 NOVARTIS AG (SWITZERLAND)

9.13 BIOGEN INC. (UNITED STATES)

9.14 OTHER ACTIVE PLAYERS

Chapter 10: Global Crohn’s Disease Treatment Market By Region

10.1 Overview

10.2. North America Crohn’s Disease Treatment Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Treatment Type

10.2.4.1 Anti-inflammatory Drugs

10.2.4.2 Immune System Suppressors

10.2.4.3 Antibiotics

10.2.4.4 Biologic Therapies

10.2.4.5 Surgery

10.2.4.6 Nutritional Therapy

10.2.5 Historic and Forecasted Market Size By Drug Class

10.2.5.1 Aminosalicylates

10.2.5.2 Corticosteroids

10.2.5.3 Immunomodulators

10.2.5.4 TNF Inhibitors

10.2.5.5 IL Inhibitors

10.2.6 Historic and Forecasted Market Size By Route of Administration

10.2.6.1 Oral

10.2.6.2 Injectable

10.2.7 Historic and Forecasted Market Size By Distribution Channel

10.2.7.1 Hospital Pharmacies

10.2.7.2 Retail Pharmacies

10.2.7.3 Online Pharmacies

10.2.8 Historic and Forecasted Market Size By End User

10.2.8.1 Hospitals

10.2.8.2 Clinics

10.2.8.3 Homecare Settings

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Crohn’s Disease Treatment Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Treatment Type

10.3.4.1 Anti-inflammatory Drugs

10.3.4.2 Immune System Suppressors

10.3.4.3 Antibiotics

10.3.4.4 Biologic Therapies

10.3.4.5 Surgery

10.3.4.6 Nutritional Therapy

10.3.5 Historic and Forecasted Market Size By Drug Class

10.3.5.1 Aminosalicylates

10.3.5.2 Corticosteroids

10.3.5.3 Immunomodulators

10.3.5.4 TNF Inhibitors

10.3.5.5 IL Inhibitors

10.3.6 Historic and Forecasted Market Size By Route of Administration

10.3.6.1 Oral

10.3.6.2 Injectable

10.3.7 Historic and Forecasted Market Size By Distribution Channel

10.3.7.1 Hospital Pharmacies

10.3.7.2 Retail Pharmacies

10.3.7.3 Online Pharmacies

10.3.8 Historic and Forecasted Market Size By End User

10.3.8.1 Hospitals

10.3.8.2 Clinics

10.3.8.3 Homecare Settings

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Crohn’s Disease Treatment Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Treatment Type

10.4.4.1 Anti-inflammatory Drugs

10.4.4.2 Immune System Suppressors

10.4.4.3 Antibiotics

10.4.4.4 Biologic Therapies

10.4.4.5 Surgery

10.4.4.6 Nutritional Therapy

10.4.5 Historic and Forecasted Market Size By Drug Class

10.4.5.1 Aminosalicylates

10.4.5.2 Corticosteroids

10.4.5.3 Immunomodulators

10.4.5.4 TNF Inhibitors

10.4.5.5 IL Inhibitors

10.4.6 Historic and Forecasted Market Size By Route of Administration

10.4.6.1 Oral

10.4.6.2 Injectable

10.4.7 Historic and Forecasted Market Size By Distribution Channel

10.4.7.1 Hospital Pharmacies

10.4.7.2 Retail Pharmacies

10.4.7.3 Online Pharmacies

10.4.8 Historic and Forecasted Market Size By End User

10.4.8.1 Hospitals

10.4.8.2 Clinics

10.4.8.3 Homecare Settings

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Crohn’s Disease Treatment Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Treatment Type

10.5.4.1 Anti-inflammatory Drugs

10.5.4.2 Immune System Suppressors

10.5.4.3 Antibiotics

10.5.4.4 Biologic Therapies

10.5.4.5 Surgery

10.5.4.6 Nutritional Therapy

10.5.5 Historic and Forecasted Market Size By Drug Class

10.5.5.1 Aminosalicylates

10.5.5.2 Corticosteroids

10.5.5.3 Immunomodulators

10.5.5.4 TNF Inhibitors

10.5.5.5 IL Inhibitors

10.5.6 Historic and Forecasted Market Size By Route of Administration

10.5.6.1 Oral

10.5.6.2 Injectable

10.5.7 Historic and Forecasted Market Size By Distribution Channel

10.5.7.1 Hospital Pharmacies

10.5.7.2 Retail Pharmacies

10.5.7.3 Online Pharmacies

10.5.8 Historic and Forecasted Market Size By End User

10.5.8.1 Hospitals

10.5.8.2 Clinics

10.5.8.3 Homecare Settings

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Crohn’s Disease Treatment Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Treatment Type

10.6.4.1 Anti-inflammatory Drugs

10.6.4.2 Immune System Suppressors

10.6.4.3 Antibiotics

10.6.4.4 Biologic Therapies

10.6.4.5 Surgery

10.6.4.6 Nutritional Therapy

10.6.5 Historic and Forecasted Market Size By Drug Class

10.6.5.1 Aminosalicylates

10.6.5.2 Corticosteroids

10.6.5.3 Immunomodulators

10.6.5.4 TNF Inhibitors

10.6.5.5 IL Inhibitors

10.6.6 Historic and Forecasted Market Size By Route of Administration

10.6.6.1 Oral

10.6.6.2 Injectable

10.6.7 Historic and Forecasted Market Size By Distribution Channel

10.6.7.1 Hospital Pharmacies

10.6.7.2 Retail Pharmacies

10.6.7.3 Online Pharmacies

10.6.8 Historic and Forecasted Market Size By End User

10.6.8.1 Hospitals

10.6.8.2 Clinics

10.6.8.3 Homecare Settings

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Crohn’s Disease Treatment Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Treatment Type

10.7.4.1 Anti-inflammatory Drugs

10.7.4.2 Immune System Suppressors

10.7.4.3 Antibiotics

10.7.4.4 Biologic Therapies

10.7.4.5 Surgery

10.7.4.6 Nutritional Therapy

10.7.5 Historic and Forecasted Market Size By Drug Class

10.7.5.1 Aminosalicylates

10.7.5.2 Corticosteroids

10.7.5.3 Immunomodulators

10.7.5.4 TNF Inhibitors

10.7.5.5 IL Inhibitors

10.7.6 Historic and Forecasted Market Size By Route of Administration

10.7.6.1 Oral

10.7.6.2 Injectable

10.7.7 Historic and Forecasted Market Size By Distribution Channel

10.7.7.1 Hospital Pharmacies

10.7.7.2 Retail Pharmacies

10.7.7.3 Online Pharmacies

10.7.8 Historic and Forecasted Market Size By End User

10.7.8.1 Hospitals

10.7.8.2 Clinics

10.7.8.3 Homecare Settings

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Crohn’s Disease Treatment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.5 Billion |

|

Forecast Period 2024-32 CAGR: |

4% |

Market Size in 2032: |

USD 19.2 Billion |

|

Segments Covered: |

By Treatment Type |

|

|

|

By Drug Class |

|

||

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||