Airway Management Devices Market Synopsis

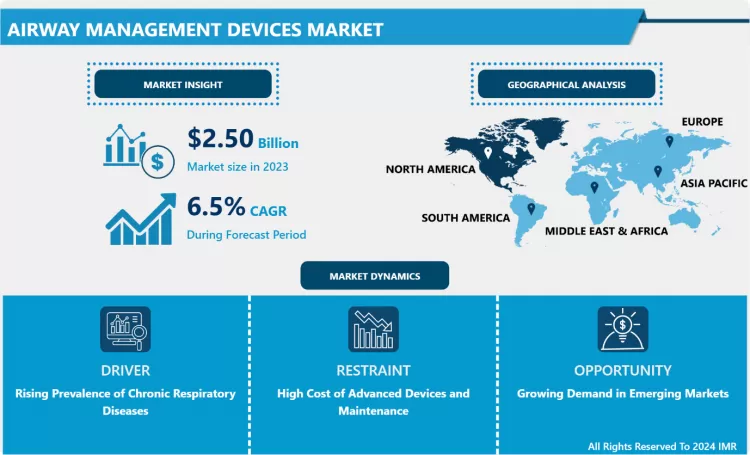

Airway Management Devices Market Size Was Valued at USD 2.50 Billion in 2023, and is Projected to Reach USD 4.41 Billion by 2032, Growing at a CAGR of 6.5% From 2024-2032.

The Airway Management Devices Market includes the devices and tools used to open up or keep open the airway to maintain ventilation and oxygenation during surgeries, anesthesia, and other urgent circumstances. These devices are indispensable in the treatment of a variety of respiratory diseases and are applied in both resuscitation and in elective operations.

- Supplementary airway devices contribute to safeguarding patients’ lives in a number of ways by providing requisites channels of airflow throughout various procedures. They span the basic gadgets comprising of non-invasive resuscitators and laryngoscopes to sophisticated supraglottic I & infraglottic gadgets in airway intervention. Airway management devices market has been burgeoning across the world in the recent past due to the elevating incidences of respiratory diseases, increasing number of surgical operations, and enhanced focus on emergency treatment. Further on, the enhanced technology of various devices has made it safer and easier to perform then as well as integrated to various healthcare institutions.

- It is poised on the growing number of the elderly, increase in prevalence of respiratory illnesses including COPD and asthma, and growth in the number of healthcare facilities mainly in the developing world. In the same respect, the safety of airway management in the intensive care unit during critical situations was evident during the COVID 19 pandemic, resulting in additional demand. However, more competitors can pose some challenges such as long approval from the market and expensive and risky airway devices.

Airway Management Devices Market Trend Analysis

Increased Adoption of Portable Airway Devices

- The use of PAM devices has seen an upward trend in the current years especially when it comes to pre-hospital /emergency care. In today’s model of healthcare delivery where providers are under pressure to deliver quality efficient care, devices that can be easily moved from one location to another are critical. These small, conformable and portable devices allow first responders and paramedics to deliver appropriate airway management within the shortest time possible hence improving the survival rates of critical patients.

- The move to portability can be viewed as concurring with the tendencies for the outpatient and out-of-hospital treatment increases, especially in the field of emergency medicine. Flexible airway devices are convenient and can be used while on the move meaning medical teams can easily provide respiratory support in the field. This has encouraged improvements in light-weight and simple designs of the airway management devices leading to increased flexibility in managing different patients.

Growing Demand in Emerging Markets

- New emerging markets offer remarkable opportunities for the growth of airway management devices market, spurred by the growing healthcare industry and rising spending on healthcare technologies. Currently, Asian-Pacific countries, Latin America and countries of the Middle East are experiencing growth in healthcare expenditure, which makes the introduction of the latest airway control devices promising. In addition, scaling up accessibility to health care in these areas contributes to the development of both scheduled operations and massive critical care.

- This growth is also due to increase in prevalence of respiratory related diseases as well as growth in population of old age people in these areas. They reveal that government programs to improve healthcare services and products have also stimulated demand making emerging markets the most favorable for global manufacturers. These factors can be used by companies which have started their operations in these regions to capture more market share and begin to offer more products into these markets.

Airway Management Devices Market Segment Analysis:

Airway Management Devices Market is segmented on the basis of product type, application and end user.

By Product Type, Supraglottic Devices segment is expected to dominate the market during the forecast period

- Supraglottics, infraglottic, resuscitators, laryngoscopes and other Types of airway management devices are classified based on the product type. Supraglottic devices are highly placed in the airway above the vocal cords and are common in anesthetic and emergency use since they do not require intimate placement. Fragmatic laryngeal devices are not useful in situations such as aftercare and in critical care or operating rooms since a secure airway is paramount in emphatic INTs and during surgeries. Each of the two categories of devices offers its advantages; while infraglottic devices are preferable for a long-term control for airway integrities and supraglottic devices are suitable for short-term or emergency use.

- Laryngoscopes are used particularly when getting an access to the patients airway during intubation and are of great importance in emergency care as well as during surgery. Bag and mask or pre-hospital resuscitators as they are commonly referred are very crucial in ensuring patients receive oxygen they cannot breathe for themselves. These types of products help provide specific treatment methods for airway management, giving the health care givers a wide range to chose from depending on the patient and environment.

By Application, Anesthesia segment expected to held the largest share

- The airway management devices are common in numerous domains such as anesthetic practice, emergency medicine, critical and other areas which need respiratory care. In anesthesia, these devices have become instrumental in holding the airway during surgery, and avoiding hypoxia in the patient. Hospitals and surgical centers require airway management for their patients and the efficient use of the devices makes it a predominant segment in the market.

- Another major application relates to an emergency medicine as airway access is critically important in traumatic surgery, resuscitation, or acute lung disorders. For emergency incidents, devices that are easy to implement in an organization are desirable and should work well under time-sensitive applications. The variability of airway management devices in the context of these applications evidences its criticality in diverse aspects of health care including regular operations and emergencies.

Airway Management Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America holds the largest market share for airway management devices because of higher healthcare standards, an increased number of respiratory diseases, and a higher healthcare expenditure. There are many chronic respiratory patients in the United States and many of them require constant use of these devices in hospitals and emergency departments. Also, the increased concentration on research and development of new and sophisticated technologies and products as well as the adoption of technologically advanced diagnostic tools in North America has shaped the market.

- The high demand for medical devices in hospital and clinics, and the strong base of original equipment manufacturers (OEMs) located in North America also advances the market. A majority of leading companies are located in the region so that advanced airway management devices would not be a problem to procure. Their friendly legal systems, coupled with high health consumption help in sustaining the region strongly on the global market.

Active Key Players in the Airway Management Devices Market

- Medtronic (Ireland)

- Smiths Medical (United Kingdom)

- Teleflex Incorporated (United States)

- Ambu A/S (Denmark)

- GE Healthcare (United States)

- Koninklijke Philips N.V. (Netherlands)

- Karl Storz SE & Co. KG (Germany)

- Vyaire Medical (United States)

- Flexicare Medical Ltd. (United Kingdom)

- Intersurgical Ltd. (United Kingdom)

- SunMed (United States)

- Roper Technologies, Inc. (United States)

- Other key Players

Key Industry Developments in the Airway Management Devices Market:

- In September 2023, Verathon unveiled the GlideScope Go 2, an advanced handheld video laryngoscope designed to enhance airway management in urgent and critical care situations. This next-generation device features QuickConnect technology for seamless operation, allowing clinicians to focus more on patient care. The GlideScope Go 2 is now available in the U.S., reinforcing Verathon's commitment to providing innovative airway management devices that support first-pass success in challenging medical environments.

- In June 2023, Teleflex Incorporated partnered with Shenzhen Insighters Medical Technology Co., Ltd. to become the exclusive U.S. distributor of the Insighters® Video Laryngoscope system. This advanced airway management device facilitates endotracheal intubation and inspects the upper glottic airway. The system features interchangeable components, allowing real-time high-resolution video sharing and enhancing clinical practice. This addition to Teleflex’s portfolio supports the American Society of Anesthesiologists Difficult Airway Algorithm, improving patient safety in challenging intubation scenarios.

|

Global Airway Management Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.50 Billion |

|

Forecast Period 2024-32 CAGR: |

6.5% |

Market Size in 2032: |

USD 4.41 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Airway Management Devices Market by Product Type (2018-2032)

4.1 Airway Management Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Supraglottic Devices

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Infraglottic Devices

4.5 Resuscitators

4.6 Laryngoscopes

4.7 Others

Chapter 5: Airway Management Devices Market by Application (2018-2032)

5.1 Airway Management Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Anesthesia

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Emergency Medicine

5.5 Others

Chapter 6: Airway Management Devices Market by End User (2018-2032)

6.1 Airway Management Devices Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Homecare Settings

6.5 Ambulatory Surgical Centers (ASCs)

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Airway Management Devices Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MEDTRONIC (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SMITHS MEDICAL (UNITED KINGDOM)

7.4 TELEFLEX INCORPORATED (UNITED STATES)

7.5 AMBU A/S (DENMARK)

7.6 GE HEALTHCARE (UNITED STATES)

7.7 KONINKLIJKE PHILIPS N.V. (NETHERLANDS)

7.8 KARL STORZ SE & CO. KG (GERMANY)

7.9 VYAIRE MEDICAL (UNITED STATES)

7.10 FLEXICARE MEDICAL LTD. (UNITED KINGDOM)

7.11 INTERSURGICAL LTD. (UNITED KINGDOM)

7.12 SUNMED (UNITED STATES)

7.13 ROPER TECHNOLOGIES INC. (UNITED STATES)

7.14 OTHER KEY PLAYERS

Chapter 8: Global Airway Management Devices Market By Region

8.1 Overview

8.2. North America Airway Management Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Supraglottic Devices

8.2.4.2 Infraglottic Devices

8.2.4.3 Resuscitators

8.2.4.4 Laryngoscopes

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Anesthesia

8.2.5.2 Emergency Medicine

8.2.5.3 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Hospitals

8.2.6.2 Homecare Settings

8.2.6.3 Ambulatory Surgical Centers (ASCs)

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Airway Management Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Supraglottic Devices

8.3.4.2 Infraglottic Devices

8.3.4.3 Resuscitators

8.3.4.4 Laryngoscopes

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Anesthesia

8.3.5.2 Emergency Medicine

8.3.5.3 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Hospitals

8.3.6.2 Homecare Settings

8.3.6.3 Ambulatory Surgical Centers (ASCs)

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Airway Management Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Supraglottic Devices

8.4.4.2 Infraglottic Devices

8.4.4.3 Resuscitators

8.4.4.4 Laryngoscopes

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Anesthesia

8.4.5.2 Emergency Medicine

8.4.5.3 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Hospitals

8.4.6.2 Homecare Settings

8.4.6.3 Ambulatory Surgical Centers (ASCs)

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Airway Management Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Supraglottic Devices

8.5.4.2 Infraglottic Devices

8.5.4.3 Resuscitators

8.5.4.4 Laryngoscopes

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Anesthesia

8.5.5.2 Emergency Medicine

8.5.5.3 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Hospitals

8.5.6.2 Homecare Settings

8.5.6.3 Ambulatory Surgical Centers (ASCs)

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Airway Management Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Supraglottic Devices

8.6.4.2 Infraglottic Devices

8.6.4.3 Resuscitators

8.6.4.4 Laryngoscopes

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Anesthesia

8.6.5.2 Emergency Medicine

8.6.5.3 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Hospitals

8.6.6.2 Homecare Settings

8.6.6.3 Ambulatory Surgical Centers (ASCs)

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Airway Management Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Supraglottic Devices

8.7.4.2 Infraglottic Devices

8.7.4.3 Resuscitators

8.7.4.4 Laryngoscopes

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Anesthesia

8.7.5.2 Emergency Medicine

8.7.5.3 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Hospitals

8.7.6.2 Homecare Settings

8.7.6.3 Ambulatory Surgical Centers (ASCs)

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Airway Management Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.50 Billion |

|

Forecast Period 2024-32 CAGR: |

6.5% |

Market Size in 2032: |

USD 4.41 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Airway Management Devices Market research report is 2024-2032.

Medtronic (Ireland), Smiths Medical (United Kingdom), Teleflex Incorporated (United States), Ambu A/S (Denmark), GE Healthcare (United States), Koninklijke Philips N.V. (Netherlands), Karl Storz SE & Co. KG (Germany), Vyaire Medical (United States), and Other Major Players.

The Airway Management Devices Market is segmented into Product Type, Application, End User and region. By Product Type, the market is categorized into Supraglottic Devices, Infraglottic Devices, Resuscitators, Laryngoscopes, Others. By Application, the market is categorized into Anaesthesia, Emergency Medicine, Others. By End User, the market is categorized into Hospitals, Homecare Settings, Ambulatory Surgical Centers (ASCs), Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Airway Management Devices Market includes the devices and tools used to open up or keep open the airway to maintain ventilation and oxygenation during surgeries, anaesthesia, and other urgent circumstances. These devices are indispensable in the treatment of a variety of respiratory diseases and are applied in both resuscitation and elective operations.

Airway Management Devices Market Size Was Valued at USD 2.50 Billion in 2023, and is Projected to Reach USD 4.41 Billion by 2032, Growing at a CAGR of 6.5% From 2024-2032.