Global Tokenization Market Overview

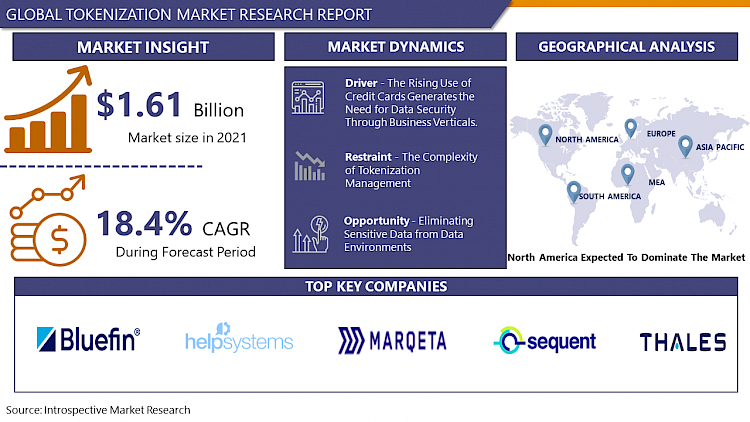

Global Tokenization Market was valued at USD 1.61 billion in 2021 and is expected to reach USD 5.25 billion by the year 2028, at a CAGR of 18.4%.

Tokenization is the conversion of sensitive data into non-sensitive tokens that may be used in a database or internal system without being exposed to the public. By replacing sensitive data with an irrelevant value of the same length and format as the original, tokenization may be used to protect it. After then, the tokens are sent to an organization's internal systems for usage, while the original data is stored in a token vault. Unlike encrypted data, tokenized data is impenetrable and irreversible. This distinction is crucial: tokens cannot be restored to their original form since the token and its original number have no mathematical relationship. To put it another way, a token is a piece of data that acts as a stand-in for a more valuable piece of data. The need for payment security grew in tandem with the amount of credit card fraud events. Contactless payments and tokenization-as-a-service approaches are two examples of payment security components. During the projected period, such factors are likely to fuel market growth.

Market Dynamics and Factors For Tokenization:

Drivers

The rising use of credit cards generates the need for data security through business verticals.

Tokenization protects companies from the financial consequences of data theft. Even if there is a breach, there is no user personal data to grab. Credit card tokenization assists online businesses in improving data security from the moment of data capture through storage by removing credit card details from POS devices and internal systems. Tokenization of data protects credit card and bank account details in a virtual vault, allowing businesses to safely send data across wireless networks. Organizations must employ a payment gateway to safely store sensitive data for tokenization to be effective. A payment gateway is a merchant service that allows direct payments or credit card processing and is provided by an e-commerce application service provider. This gateway securely saves credit card information and creates a random token.

Growing need for data security against cyber breaches

The rising number of data breaches has fueled the need for secure payment gateways, which is one of the key factors driving demand for tokenization solutions. According to the Identity Theft Resource Center (ITRC), data breaches surged by 44.7 percent in the United States. In 2018, there were 367 data breaches reported in the medical and healthcare industries. Credit and debit card information was found in nearly 20% of breaches, up nearly 6% from the previous year. Counterfeit cards account for around 37% of all credit card fraud in the United States. As the number of data breaches rises, so does the amount of money lost as a result of them. Since the last 4 years, demand for data security in the banking and insurance sector has increased. The need for a robust platform and secured transaction system call for tokenization to ensure the safe handling of customer data. As a result, the need for tokenization has increased largely which is expected to propel the market in coming years.

Restraints

Tokenization works by creating tokens and storing the real values of credit and debit cards in token vaults. The complexity of tokenization management is growing as storage space becomes more limited. The usage of online payments has increased dramatically since the emergence of COVID-19. Because of the rising reliance on internet payment methods, these channels have become a favored target for cybercriminals. To perform successful real-time screening after tokenization, it is necessary to understand and evaluate numerous parameters surrounding each transaction as part of an optimized fraud rule set. This involves the preservation of the Bank Identification Number (BIN), which specifies the issuer, card type, and country of issuance.

Opportunities

The process of exchanging sensitive data for an irreversible, non-sensitive placeholder called a token and safely retaining the original, sensitive data outside of the organization's internal systems is known as cloud-based tokenization. Traditional on-premises tokenization might be more expensive and difficult to incorporate. It also decreases the risk and compliance scope of a company by eliminating sensitive data from its data environments. Additionally, by employing format- and/or length-preserving tokens as placeholders for the original, sensitive data, enterprises may safeguard that data without losing its value or the agility of current business operations.

Challenge

Technology is only as useful as the people who utilize it. The technology will not deliver actual value if employees do not submit data or pull the appropriate reports. Simplifying what have become exceedingly complex organizational cultures throughout the sector will aid in the adoption of dependability and digitalization. Leadership supports the beliefs and behaviors required for organizational reliability by developing a training program for all workers, which aids talent retention and corporate success. Training should include the principles of dependability, the link between reliability and maintenance and operations, and how to utilize tokenization technologies to assure data security and compliance standards.

Market Segmentation

By Type, Solution is dominating segment in the Tokenization Market. The solution segment is growing swiftly in all verticals as online payments have risen in the last 3 years from large enterprises to small and medium scale businesses. To ensure a safe payment gateway and full-proof system, tokenization has been adopted by many new and existing firms. Cardholder data, including magnetic swipe data, key account numbers, and cardholder information can be protected using tokenization technologies. Companies can more easily comply with industry regulations and secure customer information. For HIPAA-covered instances, enterprises can employ tokenization solutions. Healthcare businesses can better comply with HIPAA laws by replacing a tokenized value for electronically protected health information (ePHI) and non-public personal information (NPPI). Therefore, Tokenization solutions are expected to propel the market growth during the forecasted period.

By Deployment, on cloud is dominating in the Tokenization Market. Cloud deployment is developing rapidly in the tokenization industry. SMEs are increasingly turning to cloud deployment options because they allow them to focus on their core skills rather than on payment infrastructure. Using cloud-based solutions, businesses can dramatically reduce their software, hardware, storage, and technical staffing costs. Tokenization and encryption are often employed to safeguard data stored in cloud services or apps. To safeguard various types of data and fulfill different legal standards, an organization may utilize tokenization, or a mix of both, depending on the use case. For example, McAfee CASB uses an irreversible one-way mechanism to tokenize user identifying information and obscure company identification on-premises. Tokenization is being used to safeguard data stored in cloud services as more data flows to the cloud. Most importantly, if a government agency issues a subpoena for cloud data, the service provider can only disclose encrypted or tokenized information, with no method to decrypt the original data. When a cybercriminal acquires access to data saved on a computer, the same thing happens.

By End-User Industry, the BFSI industry vertical is expected to hold the largest share of the global market. Tokenization solutions have gained immense popularity and a higher rate of adoption in the BFSI vertical, as it deals with money. The vertical displays a large number of financial transactions, which become an attractive target for cybercriminals. Increasing fraudulent activities emerging in the BFSI vertical is another major factor driving the demand for tokenization. Tokenization is extremely important in the banking business. For example, the PAN (Primary Account Number) should never be stored on a database. As a result, a token or surrogate PAN is commonly used to represent the PAN. The current EMV tokenization trend is for ALL transaction data to become tokens! Not simply the PAN or card information. The use of credit card data for fraudulent online web purchases is known as card-not-present (CNP) fraud. The PAN, expiration date, cardholder name, and CVV / CVC are examples of such information. These details are frequently obtained through breaking into merchant databases that are unencrypted and unsecured. Tokenization prohibits businesses from retaining card data while allowing them to save the token, which is worthless to hackers. Hence, Tokenization is expected to strengthen the BFSI sector during the forecasted period.

Players Covered in Tokenization market are :

- American Express Company

- AsiaPay Limited

- Bluefin Payment Systems LLC

- Card link

- Fiserv Inc.

- Futurex LP

- HelpSystems LLC

- HST Campinas SP

- IntegraPay

- Marqeta Inc.

- Mastercard Inc.

- MeaWallet AS

- Micro Focus International plc

- Paragon Payment Solutions

- Sequent Software Inc.

- Shift4 Payments LLC

- Sygnum Bank AG

- Thales TCT

- TokenEx LLC

- VeriFone Inc.

- Visa Inc. and other major players.

Regional Analysis of Tokenization Market

North America is the dominating region in the tokenization solution market, owing to the earliest adoption of advanced technology in the payment gateway industry. Most of the tokenization solution vendors are American-based, hence accounting for the major portion of the revenue of the tokenization solution market. The adoption of cloud technology is the highest in the region, a vital reason for the growing adoption of tokenization solutions. The region is also the home of all the major e-commerce major companies, where the adoption of tokenization solutions is highest. The significant growth of the retail and e-commerce industry in the region is further estimated to grow the tokenization solution market. BFSI sector has also shown healthy growth in the region. The highest adoption of blockchain technology in the region is estimated to further expand the tokenization solution market significantly.

The Asia Pacific is the second-fastest-growing region in the Tokenization Market. In the Asia Pacific, China is forecast to reach an estimated market size of US$476.3 Million in the year 2026 trailing a CAGR of 23.7% through the analysis period. The regional market is also benefiting from the rapid growth of e-commerce, as well as the widespread usage of smartphones to make online payments and access a variety of services such as government services, online gaming, and digital information. Government efforts to combat financial fraud, as well as the introduction of tough legislation to increase cyber-security, are credited with driving growth in the Asia-Pacific area.

Contactless payments are assisting end-users and businesses in moving away from wire transfer services, which is one of the most abused media by cybercriminals. Across general, contactless payments are gaining increasing momentum in Europe. According to research released by Gemalto, 90 percent of Europe's corporate leaders have already invested in contactless payment systems. One of the key issues driving the need for tokenization in Europe is the increasing number of data breaches and financial scams.

Key Developments of Tokenization Market

- October 2021, American Express and Goldman Sachs teamed up to provide major business clients with cloud-based payment options. American Express would use Goldman Sachs' Transaction Banking (TxB) infrastructure to provide a variety of payment solutions for major businesses, making B2B payments simpler and more efficient.

- September 2021, Mastercard purchased CipherTrace, a renowned cryptocurrency analytics firm. The combination of Mastercard's cybersecurity solutions with CipherTrace's digital assets would provide organizations more transparency and assist them to spot dangers.

- April 2020, TDC and Futurex have released the Post-Quantum Hybrid certificate authority system, which combines certificate lifecycle management with a FIPS 140-2 Level 3-validated hardware security module (HSM). This module is a safe option for companies. The company's KMES puts full-spectrum key management into a single device, whether it's public key infrastructure or faultless tokenization.

Covid19 Impact on Tokenization Market

The COVID-19 outbreak is affecting corporate operations all around the world. In the face of the pandemic, the global payments ecosystem has shown to be resilient. The general public continues to trust payment systems and providers, and there have been no significant disruptions to basic infrastructure recorded. Nonetheless, the payment sector is far from immune to the crisis's effects. The pandemic has resulted in a spike in non-performing loans, a drop in revenues, and a greater strain on client care teams for payments providers. Because of the drop in consumption and commerce, total payment amounts have decreased. In the short term, this development is expected to force payment providers to adapt their operational models, with increased flexibility and new short-term aims likely to be prioritized. However, the epidemic's long-term effects on global payments are projected to be considerably more severe. A strong push towards a cashless society, the necessity for creative fraud prevention tools and solutions, a tighter environment for payments fintech, digital innovation, and the expansion of tokenized mobile wallets are all expected to occur.

|

Global Tokenization Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.61 Bn. |

|

Forecast Period 2022-28 CAGR: |

18.4% |

Market Size in 2028: |

USD 5.25Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Deployment

3.3 By End User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Tokenization Market by Type

5.1 Tokenization Market Overview Snapshot and Growth Engine

5.2 Tokenization Market Overview

5.3 Solution

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Solution: Grographic Segmentation

5.4 Services

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Services: Grographic Segmentation

Chapter 6: Tokenization Market by Deployment

6.1 Tokenization Market Overview Snapshot and Growth Engine

6.2 Tokenization Market Overview

6.3 On-premise

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 On-premise: Grographic Segmentation

6.4 Cloud

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Cloud: Grographic Segmentation

Chapter 7: Tokenization Market by End User

7.1 Tokenization Market Overview Snapshot and Growth Engine

7.2 Tokenization Market Overview

7.3 Retail & E-commerce

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Retail & E-commerce: Grographic Segmentation

7.4 Transportation & Logistics

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Transportation & Logistics: Grographic Segmentation

7.5 BFSI

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 BFSI: Grographic Segmentation

7.6 IT & Telecommunications

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 IT & Telecommunications: Grographic Segmentation

7.7 Others

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2016-2028F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Tokenization Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Tokenization Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Tokenization Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 AMERICAN EXPRESS COMPANY

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 ASIAPAY LIMITED

8.4 BLUEFIN PAYMENT SYSTEMS LLC

8.5 CARD LINK

8.6 FISERV INC.

8.7 FUTUREX LP

8.8 HELPSYSTEMS LLC

8.9 HST CAMPINAS SP

8.10 INTEGRAPAY

8.11 MARQETA INC.

8.12 MASTERCARD INC.

8.13 MEAWALLET AS

8.14 MICRO FOCUS INTERNATIONAL PLC

8.15 PARAGON PAYMENT SOLUTIONS

8.16 SEQUENT SOFTWARE INC.

8.17 SHIFT4 PAYMENTS LLC

8.18 SYGNUM BANK AG

8.19 THALES TCT

8.20 TOKENEX LLC

8.21 VERIFONE INC.

8.22 VISA INC.

8.23 OTHER MAJOR PLAYERS

Chapter 9: Global Tokenization Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Solution

9.2.2 Services

9.3 Historic and Forecasted Market Size By Deployment

9.3.1 On-premise

9.3.2 Cloud

9.4 Historic and Forecasted Market Size By End User

9.4.1 Retail & E-commerce

9.4.2 Transportation & Logistics

9.4.3 BFSI

9.4.4 IT & Telecommunications

9.4.5 Others

Chapter 10: North America Tokenization Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Solution

10.4.2 Services

10.5 Historic and Forecasted Market Size By Deployment

10.5.1 On-premise

10.5.2 Cloud

10.6 Historic and Forecasted Market Size By End User

10.6.1 Retail & E-commerce

10.6.2 Transportation & Logistics

10.6.3 BFSI

10.6.4 IT & Telecommunications

10.6.5 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Tokenization Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Solution

11.4.2 Services

11.5 Historic and Forecasted Market Size By Deployment

11.5.1 On-premise

11.5.2 Cloud

11.6 Historic and Forecasted Market Size By End User

11.6.1 Retail & E-commerce

11.6.2 Transportation & Logistics

11.6.3 BFSI

11.6.4 IT & Telecommunications

11.6.5 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Tokenization Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Solution

12.4.2 Services

12.5 Historic and Forecasted Market Size By Deployment

12.5.1 On-premise

12.5.2 Cloud

12.6 Historic and Forecasted Market Size By End User

12.6.1 Retail & E-commerce

12.6.2 Transportation & Logistics

12.6.3 BFSI

12.6.4 IT & Telecommunications

12.6.5 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Tokenization Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Solution

13.4.2 Services

13.5 Historic and Forecasted Market Size By Deployment

13.5.1 On-premise

13.5.2 Cloud

13.6 Historic and Forecasted Market Size By End User

13.6.1 Retail & E-commerce

13.6.2 Transportation & Logistics

13.6.3 BFSI

13.6.4 IT & Telecommunications

13.6.5 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Tokenization Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Solution

14.4.2 Services

14.5 Historic and Forecasted Market Size By Deployment

14.5.1 On-premise

14.5.2 Cloud

14.6 Historic and Forecasted Market Size By End User

14.6.1 Retail & E-commerce

14.6.2 Transportation & Logistics

14.6.3 BFSI

14.6.4 IT & Telecommunications

14.6.5 Others

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Tokenization Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.61 Bn. |

|

Forecast Period 2022-28 CAGR: |

18.4% |

Market Size in 2028: |

USD 5.25Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. TOKENIZATION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. TOKENIZATION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. TOKENIZATION MARKET COMPETITIVE RIVALRY

TABLE 005. TOKENIZATION MARKET THREAT OF NEW ENTRANTS

TABLE 006. TOKENIZATION MARKET THREAT OF SUBSTITUTES

TABLE 007. TOKENIZATION MARKET BY TYPE

TABLE 008. SOLUTION MARKET OVERVIEW (2016-2028)

TABLE 009. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 010. TOKENIZATION MARKET BY DEPLOYMENT

TABLE 011. ON-PREMISE MARKET OVERVIEW (2016-2028)

TABLE 012. CLOUD MARKET OVERVIEW (2016-2028)

TABLE 013. TOKENIZATION MARKET BY END USER

TABLE 014. RETAIL & E-COMMERCE MARKET OVERVIEW (2016-2028)

TABLE 015. TRANSPORTATION & LOGISTICS MARKET OVERVIEW (2016-2028)

TABLE 016. BFSI MARKET OVERVIEW (2016-2028)

TABLE 017. IT & TELECOMMUNICATIONS MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA TOKENIZATION MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA TOKENIZATION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 021. NORTH AMERICA TOKENIZATION MARKET, BY END USER (2016-2028)

TABLE 022. N TOKENIZATION MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE TOKENIZATION MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE TOKENIZATION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 025. EUROPE TOKENIZATION MARKET, BY END USER (2016-2028)

TABLE 026. TOKENIZATION MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC TOKENIZATION MARKET, BY TYPE (2016-2028)

TABLE 028. ASIA PACIFIC TOKENIZATION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 029. ASIA PACIFIC TOKENIZATION MARKET, BY END USER (2016-2028)

TABLE 030. TOKENIZATION MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA TOKENIZATION MARKET, BY TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA TOKENIZATION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA TOKENIZATION MARKET, BY END USER (2016-2028)

TABLE 034. TOKENIZATION MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA TOKENIZATION MARKET, BY TYPE (2016-2028)

TABLE 036. SOUTH AMERICA TOKENIZATION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 037. SOUTH AMERICA TOKENIZATION MARKET, BY END USER (2016-2028)

TABLE 038. TOKENIZATION MARKET, BY COUNTRY (2016-2028)

TABLE 039. AMERICAN EXPRESS COMPANY: SNAPSHOT

TABLE 040. AMERICAN EXPRESS COMPANY: BUSINESS PERFORMANCE

TABLE 041. AMERICAN EXPRESS COMPANY: PRODUCT PORTFOLIO

TABLE 042. AMERICAN EXPRESS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ASIAPAY LIMITED: SNAPSHOT

TABLE 043. ASIAPAY LIMITED: BUSINESS PERFORMANCE

TABLE 044. ASIAPAY LIMITED: PRODUCT PORTFOLIO

TABLE 045. ASIAPAY LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. BLUEFIN PAYMENT SYSTEMS LLC: SNAPSHOT

TABLE 046. BLUEFIN PAYMENT SYSTEMS LLC: BUSINESS PERFORMANCE

TABLE 047. BLUEFIN PAYMENT SYSTEMS LLC: PRODUCT PORTFOLIO

TABLE 048. BLUEFIN PAYMENT SYSTEMS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. CARD LINK: SNAPSHOT

TABLE 049. CARD LINK: BUSINESS PERFORMANCE

TABLE 050. CARD LINK: PRODUCT PORTFOLIO

TABLE 051. CARD LINK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. FISERV INC.: SNAPSHOT

TABLE 052. FISERV INC.: BUSINESS PERFORMANCE

TABLE 053. FISERV INC.: PRODUCT PORTFOLIO

TABLE 054. FISERV INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. FUTUREX LP: SNAPSHOT

TABLE 055. FUTUREX LP: BUSINESS PERFORMANCE

TABLE 056. FUTUREX LP: PRODUCT PORTFOLIO

TABLE 057. FUTUREX LP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. HELPSYSTEMS LLC: SNAPSHOT

TABLE 058. HELPSYSTEMS LLC: BUSINESS PERFORMANCE

TABLE 059. HELPSYSTEMS LLC: PRODUCT PORTFOLIO

TABLE 060. HELPSYSTEMS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. HST CAMPINAS SP: SNAPSHOT

TABLE 061. HST CAMPINAS SP: BUSINESS PERFORMANCE

TABLE 062. HST CAMPINAS SP: PRODUCT PORTFOLIO

TABLE 063. HST CAMPINAS SP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. INTEGRAPAY: SNAPSHOT

TABLE 064. INTEGRAPAY: BUSINESS PERFORMANCE

TABLE 065. INTEGRAPAY: PRODUCT PORTFOLIO

TABLE 066. INTEGRAPAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. MARQETA INC.: SNAPSHOT

TABLE 067. MARQETA INC.: BUSINESS PERFORMANCE

TABLE 068. MARQETA INC.: PRODUCT PORTFOLIO

TABLE 069. MARQETA INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. MASTERCARD INC.: SNAPSHOT

TABLE 070. MASTERCARD INC.: BUSINESS PERFORMANCE

TABLE 071. MASTERCARD INC.: PRODUCT PORTFOLIO

TABLE 072. MASTERCARD INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. MEAWALLET AS: SNAPSHOT

TABLE 073. MEAWALLET AS: BUSINESS PERFORMANCE

TABLE 074. MEAWALLET AS: PRODUCT PORTFOLIO

TABLE 075. MEAWALLET AS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. MICRO FOCUS INTERNATIONAL PLC: SNAPSHOT

TABLE 076. MICRO FOCUS INTERNATIONAL PLC: BUSINESS PERFORMANCE

TABLE 077. MICRO FOCUS INTERNATIONAL PLC: PRODUCT PORTFOLIO

TABLE 078. MICRO FOCUS INTERNATIONAL PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. PARAGON PAYMENT SOLUTIONS: SNAPSHOT

TABLE 079. PARAGON PAYMENT SOLUTIONS: BUSINESS PERFORMANCE

TABLE 080. PARAGON PAYMENT SOLUTIONS: PRODUCT PORTFOLIO

TABLE 081. PARAGON PAYMENT SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. SEQUENT SOFTWARE INC.: SNAPSHOT

TABLE 082. SEQUENT SOFTWARE INC.: BUSINESS PERFORMANCE

TABLE 083. SEQUENT SOFTWARE INC.: PRODUCT PORTFOLIO

TABLE 084. SEQUENT SOFTWARE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. SHIFT4 PAYMENTS LLC: SNAPSHOT

TABLE 085. SHIFT4 PAYMENTS LLC: BUSINESS PERFORMANCE

TABLE 086. SHIFT4 PAYMENTS LLC: PRODUCT PORTFOLIO

TABLE 087. SHIFT4 PAYMENTS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. SYGNUM BANK AG: SNAPSHOT

TABLE 088. SYGNUM BANK AG: BUSINESS PERFORMANCE

TABLE 089. SYGNUM BANK AG: PRODUCT PORTFOLIO

TABLE 090. SYGNUM BANK AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. THALES TCT: SNAPSHOT

TABLE 091. THALES TCT: BUSINESS PERFORMANCE

TABLE 092. THALES TCT: PRODUCT PORTFOLIO

TABLE 093. THALES TCT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. TOKENEX LLC: SNAPSHOT

TABLE 094. TOKENEX LLC: BUSINESS PERFORMANCE

TABLE 095. TOKENEX LLC: PRODUCT PORTFOLIO

TABLE 096. TOKENEX LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. VERIFONE INC.: SNAPSHOT

TABLE 097. VERIFONE INC.: BUSINESS PERFORMANCE

TABLE 098. VERIFONE INC.: PRODUCT PORTFOLIO

TABLE 099. VERIFONE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. VISA INC.: SNAPSHOT

TABLE 100. VISA INC.: BUSINESS PERFORMANCE

TABLE 101. VISA INC.: PRODUCT PORTFOLIO

TABLE 102. VISA INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 103. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 104. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 105. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. TOKENIZATION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. TOKENIZATION MARKET OVERVIEW BY TYPE

FIGURE 012. SOLUTION MARKET OVERVIEW (2016-2028)

FIGURE 013. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 014. TOKENIZATION MARKET OVERVIEW BY DEPLOYMENT

FIGURE 015. ON-PREMISE MARKET OVERVIEW (2016-2028)

FIGURE 016. CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 017. TOKENIZATION MARKET OVERVIEW BY END USER

FIGURE 018. RETAIL & E-COMMERCE MARKET OVERVIEW (2016-2028)

FIGURE 019. TRANSPORTATION & LOGISTICS MARKET OVERVIEW (2016-2028)

FIGURE 020. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 021. IT & TELECOMMUNICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA TOKENIZATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE TOKENIZATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC TOKENIZATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA TOKENIZATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA TOKENIZATION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Tokenization Market research report is 2022-2028.

American Express Company, AsiaPay Limited, Bluefin Payment Systems LLC, Card link, Fiserv Inc., Futurex LP, HelpSystems LLC, HST Campinas SP, IntegraPay, Marqeta Inc., Mastercard Inc., MeaWallet AS, Micro Focus International plc, Paragon Payment Solutions, Sequent Software Inc., Shift4 Payments LLC, Sygnum Bank AG, Thales TCT, TokenEx LLC, VeriFone Inc., Visa Inc, and other major players.

The Tokenization Market is segmented into Type, Deployment, End User and region. By Type, the market is categorized into Solution, Services. By Deployment, the market is categorized into On-premise, Cloud. By End User, the market is categorized into Retail & E-commerce, Transportation & Logistics, BFSI, IT & Telecommunications, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Tokenization is the conversion of sensitive data into non-sensitive tokens that may be used in a database or internal system without being exposed to the public.

The Tokenization Market was valued at USD 1.61 Billion in 2021 and is projected to reach USD 5.25 Billion by 2028, growing at a CAGR of 18.4% from 2022 to 2028.