Global Smart Transportation Market Overview

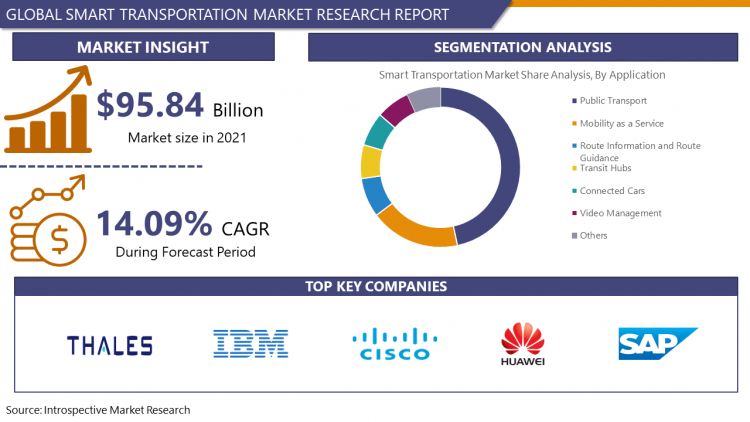

Global Smart Transportation Market was estimated at USD 95.84 billion in 2021 and is anticipated to reach USD 241.15 billion by 2028, growing at a CAGR of 14.09% globally.

Smart Transportation Systems uses a wide range of technologies such as traffic signal control systems, automatic number plate recognition, container management systems, or speed cameras such as security CCTV systems to evaluate, manage, and monitor transportation systems to improve efficiency and safety in transportation services. Smart transportation aims at using Artificial Intelligence to shift the burden of transportation infrastructure and managing vehicles from humans to automated technologies, to decrease the human costs of crashes involved. Smart transportation technologies provide innovative services to several transport modes and enable consumers to plan their routes more safely and smartly. Moreover, the development of smart cities will propel the growth of the smart transportation market in the period of forecast.

Furthermore, the rollout of 5G and technological advancements in artificial intelligence and embedded systems, can significantly enhance the networking and performance processing of smart vehicles. Additionally, 5G advancements such as side link transmission can crucially enhance peer-to-peer communication among mobile devices and vehicles. This quality to communicate directly without cell tower facilitation provides proximity services such as parking, lighting, maps, wayfinding, and centimeter positioning accuracy. All these factors are promoting the smart transportation market expansion throughout the forecast. Furthermore, travel delays exhaust around three billion gallons of fuel and near about seven billion hours of citizens. In 2015, it was estimated that Americans waste about 75 billion hours in traffic and that smart transportation could save US$507 billion in productivity, US$488 billion in accident reduction, and US$138 billion in productivity savings owing to reduced congestion of vehicles.

COVID-19 Impact on Smart Transportation Market

The outbreak of COVID-19 has affected various industries worldwide. Moreover, to constrain the spread of coronavirus restrictions have been imposed by governments on gatherings of people and transportation, as a result, there will be fewer humans in vehicles and transportation. Additionally, even though people are getting vaccinated against COVID-19, a significant percentage of the population will still be afraid to travel in crowded buses. Furthermore, the COVID-19 pandemic has paused many ongoing smart city and transportation projects. The financial stress attributed to the COVID-19 pandemic has forced the global economy into recession and has negatively impacted the adoption of technology in transportation. The recession has resulted in a delay in Autonomous Driving and Advanced Driver Assistance Systems integration in cars. Research and development projects are being scaled down and predicted timelines have been adjusted. Furthermore, the automotive industry was already in recession even before the COVID-19 pandemic, and the aftermath has created a more dip to this recession and thus has hampered Smart transportation market growth.

Market Dynamics and Key Factors in Smart Transportation Market

Drivers:

By combining machine learning with IoT and 5G, smart transportation has proven to decrease the human component in accidents attributed to the fact, computers don't get distracted or fatigued, or emotional. Moreover, the collection of data is the vital key, responsible for public management of infrastructure further, smart transportation provides detailed data points for every aspect of the transportation system, but allows administrators to better monitor operations, track maintenance needs, and identify key sources of problems that need to be fixed thus, supporting the growth of smart transportation market in the period of forecast.

Furthermore, smart transportation allows traffic management systems to quickly analyze congestion on city roads and accordingly divert traffic. Smart transportation has proven to be more efficient owing to factors such as, an adjustment in timing of train schedules can aid in increasing the fill rates and bus facilities can efficiently serve the consumers if stops are allocated according to the area-wise density of population. Moreover, smart transportation offers a navigation system to the user to find the best suitable route based on real-time conditions.

Users can ride public transport buses which turns red traffic light into green upon arrival. Additionally, it offers travelers with information about road conditions, weather emergencies, and manage fuel consumption. All these factors are strengthening the growth of the smart transportation market throughout the forecast. Moreover, smart transportation provides information about parking areas in the vicinity with the help of GPS. Smart transportation alerts drivers about hazardous situations in time to avoid crashes.

Restraints:

Artificial intelligence is the latest innovative technology that provides solutions to every aspect of transportation mode. The difficulty in the utilization of Artificial intelligence in a congested area or a mixed traffic region is hampering the growth of the Smart Transportation Market in the forecast period. Moreover, the complexity involved in understanding the use of smart transportation services is further restricting the Smart Transportation Market growth. The major factor hindering the Smart Transportation Market growth is the cost of the equipment involved in the smart transportation services and high maintenance costs. Furthermore, the software system that controls the transportation system can be hacked by hackers. In certain instances, such as an emergency or congestion due to an accident, the smart transportation system can't make a quick and accurate response. Additionally, the limited availability of data collection systems is further hampering the Smart Transportation Market growth throughout the forecast period.

Opportunities:

The growing trend of autonomous vehicles for public, private, and freight transportation has witnessed a rapid evolution owing to technological advancements in artificial intelligence and the Internet of things. These automatic vehicles require minimal or no human intervention. The curiosity of driverless vehicles among the general population is instigating market players to launch vehicles that can be operated with the help of AI and IoT (Internet on Things). The increase in the number of road accidents and the time required for medical services to reach accident spots through the congested traffic areas is providing opportunities for market players of Smart Transportation such as to build road maps for medical services to reach accident spots in time. The growing inconvenience of parking due to rising vehicle numbers and the irritation of freight transportation to the local population are generating ample opportunities for market players of smart transportation.

Challenges:

Providing accurate road data for roadway transportation and the correct time of arrival and departure of airlines and railways are the major challenges for market players of smart transportation. Moreover, developing public-private partnerships and collaborating with institutions to resolve air quality, traffic congestion, and sustainability issues are some major challenges. Furthermore, to minimize the cost involved in the developments of smart transportation and the open nature of smart transportation as wireless communication which can cause many securities and privacy challenges are some challenges that are posing threats to the implementation of smart transportation.

Market Segmentation

Segmentation Analysis of Smart Transportation Market:

Depending on Transportation Mode, Smart Transportation Market is segmented into roadways, railways, airways, and maritime. The roadways segment is anticipated to dominate the market in the period of forecast attributed to factors such as enhancement in road safety for the driver, pedestrians, and passengers, to reduce the accident rates in high-density populated regions. Moreover, the majority of the population uses roadways to carry out their day-to-day activities. The railway segment is estimated to have the second-highest share in Smart Transportation Market owing to the huge number of individuals using railways for long-distance routes.

Depending on the Technology Used, Smart Transportation Market is segmented into cloud computing, artificial intelligence, and the Internet of Things. The artificial intelligence segment is expected to dominate the market attributed the factors such as it helps in making transportation modes safer and comfortable. Moreover, Artificial intelligence can also analyze a large amount of data and help the service provider to plan, design, and control road transport networks. Internet of things is estimated to have the highest growth rate in the market owing to the advancement and development in this segment. Moreover, the connection of automobiles to the internet of things is expected to reduce accident rates thus boosting the segment growth. The combination of AI and cloud computing is a segment to watch out for but as this innovative technology is only in talks, nothing can be predicted on this.

Depending upon the Solution, the traffic management sector is anticipated to have the highest market share in the period of forecast. The growing number of vehicles has resulted in congestion, air pollution, and an increase in road accidents. Moreover, to provide medical services more efficiently and on time, traffic management is very important. Furthermore, to reduce the emission of greenhouse gases in urban areas traffic management has proven effective thus promoting the growth of traffic management solutions in the period of forecast. The ticket management system is estimated to have the second-highest share in the market owing to the convenience it provides by generating electronic tickets instead of conventional ticketing systems.

Depending upon the Application, public transport is expected to dominate the Smart Transportation Market. The growing awareness about global warming among individuals and the inconvenience caused due to a large number of private vehicles is encouraging consumers to use public transport. Moreover, to provide efficient service in public transport many governments have invested in the development of public transport thus promoting the growth of this segment.

Regional Analysis of Smart Transportation Market:

Europe region is anticipated to dominate the Smart Transportation Market in the period of forecast owing to the growing number of deployments of smart transportation systems. Moreover, the governments and private sector in this region are turning to information and communication technologies to resolve transportation issues. Greece and United Kingdom are the major countries in this region promoting the growth of the smart transportation market in this region. Furthermore, under the current EU funding scheme, the governments have announced to invest US$17.5 billion in railway infrastructure and US$36.6 billion for the development of road infrastructure for smart transportation.

Followed by Europe, the North American region is expected to dominate the Smart Transportation Market in the period of forecast. With the growing adoption of innovative technologies and to make transportation systems reliable, safe, and comfortable countries such as the United States and Canada are investing to develop road, railway, and airway infrastructure.

Asia-Pacific is expected to have the highest growth rate owing to robust growing economies like Japan, China, India, Singapore, and Australia. The technology advancements in Japan and ease at which smart transportation is accommodated is promoting Smart Transportation Market growth. China is the world's second-largest economy and the most populated country is investing in smart transportation to resolve the countries congestion problem hence all these factors are promoting the growth of the Smart Transportation Market in this region.

Players Covered in Smart Transportation Market are:

- Thales Group (France)

- Huawei Technologies Co. Ltd. (China)

- Siemens AG (Germany)

- IBM Corporation (US)

- Cisco Systems Inc. (US)

- SAP (Germany)

- Cubic Corporation (US)

- Alstom (France)

- Bombardier Inc. (Canada)

- Toshiba (Japan)

- Harris Corporation (US)

- Saab AB (Sweden)

- Veson Nautical (Massachusetts)

- BASS Software (Norway)

- Bentley Systems (US)

- Indra Sistemas (Spain)

- Trimble (US)

- TomTom International BV. (Netherlands)

- Amadeus IT Group SA (Spain)

- Conduent (US)

- Kapsch (Austria)

- Hitachi Ltd. (Japan)

- Descartes (Canada)

- Accenture (Ireland)

- DNV GL (Norway) and other major players

Key Industry Development in Smart Transportation Market

- In March 2021, Thales announced new digital services for railway transportation. With the help of the test metro signaling system SelTra G8, operators can observe a reduction in maintenance and installation costs while upgrading system functionalities to meet the demands of passengers such as safety and service reliability. It will also help operators to provide real-time passenger density with the help of CCTV cameras deployed on railway stations with an accuracy rate above 90%.

- In October 2021, Siemens Mobility announced that it has completed the acquisition of Sqills, a Netherlands-based company. With this acquisition, Sqills will function as a separate legal organization and a wholly-owned division of Siemens Mobility, an agreement that will allow Sqills to consolidate its leading position in providing innovative, smart, and comprehensive mobility solutions. Sqills is a global leading provider of cloud-based inventory management, ticketing software, and reservation to public transport operators across the globe.

|

Global Smart Transportation Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2021: |

USD 95.84 Bn. |

|

Forecast Period 2022-28 CAGR: |

14.09% |

Market Size in 2028: |

USD 241.15 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology Used |

|

||

|

By Solutions |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Thales Group (France), Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), IBM Corporation (US), Cisco Systems, Inc. (US), SAP (Germany), Cubic Corporation (US), Alstom (France), Bombardier Inc. (Canada), Toshiba (Japan) and other major players |

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Transportation Mode

3.2 By Technology Used

3.3 By Solutions

3.4 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Smart Transportation Market by Transportation Mode

4.1 Smart Transportation Market Overview Snapshot and Growth Engine

4.2 Smart Transportation Market Overview

4.3 Roadways

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Roadways: Grographic Segmentation

4.4 Railways

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Railways: Grographic Segmentation

4.5 Airways

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Airways: Grographic Segmentation

4.6 Maritime

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2016-2028F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Maritime: Grographic Segmentation

Chapter 5: Smart Transportation Market by Technology Used

5.1 Smart Transportation Market Overview Snapshot and Growth Engine

5.2 Smart Transportation Market Overview

5.3 Cloud Computing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cloud Computing: Grographic Segmentation

5.4 Artificial Intelligence

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Artificial Intelligence: Grographic Segmentation

5.5 Internet Of Things

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Internet Of Things: Grographic Segmentation

Chapter 6: Smart Transportation Market by Solutions

6.1 Smart Transportation Market Overview Snapshot and Growth Engine

6.2 Smart Transportation Market Overview

6.3 Ticket Management System

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Ticket Management System: Grographic Segmentation

6.4 Parking Management And Guidance System

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Parking Management And Guidance System: Grographic Segmentation

6.5 Traffic Management System

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Traffic Management System: Grographic Segmentation

6.6 Freight Management

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Freight Management: Grographic Segmentation

6.7 Road Safety And Security

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Road Safety And Security: Grographic Segmentation

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size (2016-2028F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Grographic Segmentation

Chapter 7: Smart Transportation Market by Application

7.1 Smart Transportation Market Overview Snapshot and Growth Engine

7.2 Smart Transportation Market Overview

7.3 Mobility as a Service

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Mobility as a Service: Grographic Segmentation

7.4 Route Information and Route Guidance

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Route Information and Route Guidance: Grographic Segmentation

7.5 Public Transport

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Public Transport: Grographic Segmentation

7.6 Transit Hubs

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Transit Hubs: Grographic Segmentation

7.7 Connected Cars

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2016-2028F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Connected Cars: Grographic Segmentation

7.8 Video Management

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size (2016-2028F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Video Management: Grographic Segmentation

7.9 Others

7.9.1 Introduction and Market Overview

7.9.2 Historic and Forecasted Market Size (2016-2028F)

7.9.3 Key Market Trends, Growth Factors and Opportunities

7.9.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Smart Transportation Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Smart Transportation Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Smart Transportation Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 THALES GROUP (FRANCE)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 HUAWEI TECHNOLOGIES CO. LTD. (CHINA)

8.4 SIEMENS AG (GERMANY)

8.5 IBM CORPORATION (US)

8.6 CISCO SYSTEMS INC. (US)

8.7 SAP (GERMANY)

8.8 CUBIC CORPORATION (US)

8.9 ALSTOM (FRANCE)

8.10 BOMBARDIER INC. (CANADA)

8.11 TOSHIBA (JAPAN)

8.12 HARRIS CORPORATION (US)

8.13 SAAB AB (SWEDEN)

8.14 VESON NAUTICAL (MASSACHUSETTS)

8.15 BASS SOFTWARE (NORWAY)

8.16 BENTLEY SYSTEMS (US)

8.17 INDRA SISTEMAS (SPAIN)

8.18 TRIMBLE (US)

8.19 TOMTOM INTERNATIONAL BV. (NETHERLANDS)

8.20 AMADEUS IT GROUP SA (SPAIN)

8.21 CONDUENT (US)

8.22 KAPSCH (AUSTRIA)

8.23 HITACHI LTD. (JAPAN)

8.24 DESCARTES (CANADA)

8.25 ACCENTURE (IRELAND)

8.26 DNV GL (NORWAY)

Chapter 9: Global Smart Transportation Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Transportation Mode

9.2.1 Roadways

9.2.2 Railways

9.2.3 Airways

9.2.4 Maritime

9.3 Historic and Forecasted Market Size By Technology Used

9.3.1 Cloud Computing

9.3.2 Artificial Intelligence

9.3.3 Internet Of Things

9.4 Historic and Forecasted Market Size By Solutions

9.4.1 Ticket Management System

9.4.2 Parking Management And Guidance System

9.4.3 Traffic Management System

9.4.4 Freight Management

9.4.5 Road Safety And Security

9.4.6 Others

9.5 Historic and Forecasted Market Size By Application

9.5.1 Mobility as a Service

9.5.2 Route Information and Route Guidance

9.5.3 Public Transport

9.5.4 Transit Hubs

9.5.5 Connected Cars

9.5.6 Video Management

9.5.7 Others

Chapter 10: North America Smart Transportation Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Transportation Mode

10.4.1 Roadways

10.4.2 Railways

10.4.3 Airways

10.4.4 Maritime

10.5 Historic and Forecasted Market Size By Technology Used

10.5.1 Cloud Computing

10.5.2 Artificial Intelligence

10.5.3 Internet Of Things

10.6 Historic and Forecasted Market Size By Solutions

10.6.1 Ticket Management System

10.6.2 Parking Management And Guidance System

10.6.3 Traffic Management System

10.6.4 Freight Management

10.6.5 Road Safety And Security

10.6.6 Others

10.7 Historic and Forecasted Market Size By Application

10.7.1 Mobility as a Service

10.7.2 Route Information and Route Guidance

10.7.3 Public Transport

10.7.4 Transit Hubs

10.7.5 Connected Cars

10.7.6 Video Management

10.7.7 Others

10.8 Historic and Forecast Market Size by Country

10.8.1 U.S.

10.8.2 Canada

10.8.3 Mexico

Chapter 11: Europe Smart Transportation Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Transportation Mode

11.4.1 Roadways

11.4.2 Railways

11.4.3 Airways

11.4.4 Maritime

11.5 Historic and Forecasted Market Size By Technology Used

11.5.1 Cloud Computing

11.5.2 Artificial Intelligence

11.5.3 Internet Of Things

11.6 Historic and Forecasted Market Size By Solutions

11.6.1 Ticket Management System

11.6.2 Parking Management And Guidance System

11.6.3 Traffic Management System

11.6.4 Freight Management

11.6.5 Road Safety And Security

11.6.6 Others

11.7 Historic and Forecasted Market Size By Application

11.7.1 Mobility as a Service

11.7.2 Route Information and Route Guidance

11.7.3 Public Transport

11.7.4 Transit Hubs

11.7.5 Connected Cars

11.7.6 Video Management

11.7.7 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 Germany

11.8.2 U.K.

11.8.3 France

11.8.4 Italy

11.8.5 Russia

11.8.6 Spain

Chapter 12: Asia-Pacific Smart Transportation Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Transportation Mode

12.4.1 Roadways

12.4.2 Railways

12.4.3 Airways

12.4.4 Maritime

12.5 Historic and Forecasted Market Size By Technology Used

12.5.1 Cloud Computing

12.5.2 Artificial Intelligence

12.5.3 Internet Of Things

12.6 Historic and Forecasted Market Size By Solutions

12.6.1 Ticket Management System

12.6.2 Parking Management And Guidance System

12.6.3 Traffic Management System

12.6.4 Freight Management

12.6.5 Road Safety And Security

12.6.6 Others

12.7 Historic and Forecasted Market Size By Application

12.7.1 Mobility as a Service

12.7.2 Route Information and Route Guidance

12.7.3 Public Transport

12.7.4 Transit Hubs

12.7.5 Connected Cars

12.7.6 Video Management

12.7.7 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 China

12.8.2 India

12.8.3 Japan

12.8.4 Southeast Asia

Chapter 13: South America Smart Transportation Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Transportation Mode

13.4.1 Roadways

13.4.2 Railways

13.4.3 Airways

13.4.4 Maritime

13.5 Historic and Forecasted Market Size By Technology Used

13.5.1 Cloud Computing

13.5.2 Artificial Intelligence

13.5.3 Internet Of Things

13.6 Historic and Forecasted Market Size By Solutions

13.6.1 Ticket Management System

13.6.2 Parking Management And Guidance System

13.6.3 Traffic Management System

13.6.4 Freight Management

13.6.5 Road Safety And Security

13.6.6 Others

13.7 Historic and Forecasted Market Size By Application

13.7.1 Mobility as a Service

13.7.2 Route Information and Route Guidance

13.7.3 Public Transport

13.7.4 Transit Hubs

13.7.5 Connected Cars

13.7.6 Video Management

13.7.7 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 Brazil

13.8.2 Argentina

Chapter 14: Middle East & Africa Smart Transportation Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Transportation Mode

14.4.1 Roadways

14.4.2 Railways

14.4.3 Airways

14.4.4 Maritime

14.5 Historic and Forecasted Market Size By Technology Used

14.5.1 Cloud Computing

14.5.2 Artificial Intelligence

14.5.3 Internet Of Things

14.6 Historic and Forecasted Market Size By Solutions

14.6.1 Ticket Management System

14.6.2 Parking Management And Guidance System

14.6.3 Traffic Management System

14.6.4 Freight Management

14.6.5 Road Safety And Security

14.6.6 Others

14.7 Historic and Forecasted Market Size By Application

14.7.1 Mobility as a Service

14.7.2 Route Information and Route Guidance

14.7.3 Public Transport

14.7.4 Transit Hubs

14.7.5 Connected Cars

14.7.6 Video Management

14.7.7 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 Saudi Arabia

14.8.2 South Africa

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Smart Transportation Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2021: |

USD 95.84 Bn. |

|

Forecast Period 2022-28 CAGR: |

14.09% |

Market Size in 2028: |

USD 241.15 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology Used |

|

||

|

By Solutions |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Thales Group (France), Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), IBM Corporation (US), Cisco Systems, Inc. (US), SAP (Germany), Cubic Corporation (US), Alstom (France), Bombardier Inc. (Canada), Toshiba (Japan) and other major players |

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SMART TRANSPORTATION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SMART TRANSPORTATION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SMART TRANSPORTATION MARKET COMPETITIVE RIVALRY

TABLE 005. SMART TRANSPORTATION MARKET THREAT OF NEW ENTRANTS

TABLE 006. SMART TRANSPORTATION MARKET THREAT OF SUBSTITUTES

TABLE 007. SMART TRANSPORTATION MARKET BY TRANSPORTATION MODE

TABLE 008. ROADWAYS MARKET OVERVIEW (2016-2028)

TABLE 009. RAILWAYS MARKET OVERVIEW (2016-2028)

TABLE 010. AIRWAYS MARKET OVERVIEW (2016-2028)

TABLE 011. MARITIME MARKET OVERVIEW (2016-2028)

TABLE 012. SMART TRANSPORTATION MARKET BY TECHNOLOGY USED

TABLE 013. CLOUD COMPUTING MARKET OVERVIEW (2016-2028)

TABLE 014. ARTIFICIAL INTELLIGENCE MARKET OVERVIEW (2016-2028)

TABLE 015. INTERNET OF THINGS MARKET OVERVIEW (2016-2028)

TABLE 016. SMART TRANSPORTATION MARKET BY SOLUTIONS

TABLE 017. TICKET MANAGEMENT SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 018. PARKING MANAGEMENT AND GUIDANCE SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 019. TRAFFIC MANAGEMENT SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 020. FREIGHT MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 021. ROAD SAFETY AND SECURITY MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. SMART TRANSPORTATION MARKET BY APPLICATION

TABLE 024. MOBILITY AS A SERVICE MARKET OVERVIEW (2016-2028)

TABLE 025. ROUTE INFORMATION AND ROUTE GUIDANCE MARKET OVERVIEW (2016-2028)

TABLE 026. PUBLIC TRANSPORT MARKET OVERVIEW (2016-2028)

TABLE 027. TRANSIT HUBS MARKET OVERVIEW (2016-2028)

TABLE 028. CONNECTED CARS MARKET OVERVIEW (2016-2028)

TABLE 029. VIDEO MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 030. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 031. NORTH AMERICA SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE (2016-2028)

TABLE 032. NORTH AMERICA SMART TRANSPORTATION MARKET, BY TECHNOLOGY USED (2016-2028)

TABLE 033. NORTH AMERICA SMART TRANSPORTATION MARKET, BY SOLUTIONS (2016-2028)

TABLE 034. NORTH AMERICA SMART TRANSPORTATION MARKET, BY APPLICATION (2016-2028)

TABLE 035. N SMART TRANSPORTATION MARKET, BY COUNTRY (2016-2028)

TABLE 036. EUROPE SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE (2016-2028)

TABLE 037. EUROPE SMART TRANSPORTATION MARKET, BY TECHNOLOGY USED (2016-2028)

TABLE 038. EUROPE SMART TRANSPORTATION MARKET, BY SOLUTIONS (2016-2028)

TABLE 039. EUROPE SMART TRANSPORTATION MARKET, BY APPLICATION (2016-2028)

TABLE 040. SMART TRANSPORTATION MARKET, BY COUNTRY (2016-2028)

TABLE 041. ASIA PACIFIC SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE (2016-2028)

TABLE 042. ASIA PACIFIC SMART TRANSPORTATION MARKET, BY TECHNOLOGY USED (2016-2028)

TABLE 043. ASIA PACIFIC SMART TRANSPORTATION MARKET, BY SOLUTIONS (2016-2028)

TABLE 044. ASIA PACIFIC SMART TRANSPORTATION MARKET, BY APPLICATION (2016-2028)

TABLE 045. SMART TRANSPORTATION MARKET, BY COUNTRY (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE (2016-2028)

TABLE 047. MIDDLE EAST & AFRICA SMART TRANSPORTATION MARKET, BY TECHNOLOGY USED (2016-2028)

TABLE 048. MIDDLE EAST & AFRICA SMART TRANSPORTATION MARKET, BY SOLUTIONS (2016-2028)

TABLE 049. MIDDLE EAST & AFRICA SMART TRANSPORTATION MARKET, BY APPLICATION (2016-2028)

TABLE 050. SMART TRANSPORTATION MARKET, BY COUNTRY (2016-2028)

TABLE 051. SOUTH AMERICA SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE (2016-2028)

TABLE 052. SOUTH AMERICA SMART TRANSPORTATION MARKET, BY TECHNOLOGY USED (2016-2028)

TABLE 053. SOUTH AMERICA SMART TRANSPORTATION MARKET, BY SOLUTIONS (2016-2028)

TABLE 054. SOUTH AMERICA SMART TRANSPORTATION MARKET, BY APPLICATION (2016-2028)

TABLE 055. SMART TRANSPORTATION MARKET, BY COUNTRY (2016-2028)

TABLE 056. THALES GROUP (FRANCE): SNAPSHOT

TABLE 057. THALES GROUP (FRANCE): BUSINESS PERFORMANCE

TABLE 058. THALES GROUP (FRANCE): PRODUCT PORTFOLIO

TABLE 059. THALES GROUP (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. HUAWEI TECHNOLOGIES CO. LTD. (CHINA): SNAPSHOT

TABLE 060. HUAWEI TECHNOLOGIES CO. LTD. (CHINA): BUSINESS PERFORMANCE

TABLE 061. HUAWEI TECHNOLOGIES CO. LTD. (CHINA): PRODUCT PORTFOLIO

TABLE 062. HUAWEI TECHNOLOGIES CO. LTD. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. SIEMENS AG (GERMANY): SNAPSHOT

TABLE 063. SIEMENS AG (GERMANY): BUSINESS PERFORMANCE

TABLE 064. SIEMENS AG (GERMANY): PRODUCT PORTFOLIO

TABLE 065. SIEMENS AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. IBM CORPORATION (US): SNAPSHOT

TABLE 066. IBM CORPORATION (US): BUSINESS PERFORMANCE

TABLE 067. IBM CORPORATION (US): PRODUCT PORTFOLIO

TABLE 068. IBM CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. CISCO SYSTEMS INC. (US): SNAPSHOT

TABLE 069. CISCO SYSTEMS INC. (US): BUSINESS PERFORMANCE

TABLE 070. CISCO SYSTEMS INC. (US): PRODUCT PORTFOLIO

TABLE 071. CISCO SYSTEMS INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. SAP (GERMANY): SNAPSHOT

TABLE 072. SAP (GERMANY): BUSINESS PERFORMANCE

TABLE 073. SAP (GERMANY): PRODUCT PORTFOLIO

TABLE 074. SAP (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. CUBIC CORPORATION (US): SNAPSHOT

TABLE 075. CUBIC CORPORATION (US): BUSINESS PERFORMANCE

TABLE 076. CUBIC CORPORATION (US): PRODUCT PORTFOLIO

TABLE 077. CUBIC CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. ALSTOM (FRANCE): SNAPSHOT

TABLE 078. ALSTOM (FRANCE): BUSINESS PERFORMANCE

TABLE 079. ALSTOM (FRANCE): PRODUCT PORTFOLIO

TABLE 080. ALSTOM (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. BOMBARDIER INC. (CANADA): SNAPSHOT

TABLE 081. BOMBARDIER INC. (CANADA): BUSINESS PERFORMANCE

TABLE 082. BOMBARDIER INC. (CANADA): PRODUCT PORTFOLIO

TABLE 083. BOMBARDIER INC. (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. TOSHIBA (JAPAN): SNAPSHOT

TABLE 084. TOSHIBA (JAPAN): BUSINESS PERFORMANCE

TABLE 085. TOSHIBA (JAPAN): PRODUCT PORTFOLIO

TABLE 086. TOSHIBA (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. HARRIS CORPORATION (US): SNAPSHOT

TABLE 087. HARRIS CORPORATION (US): BUSINESS PERFORMANCE

TABLE 088. HARRIS CORPORATION (US): PRODUCT PORTFOLIO

TABLE 089. HARRIS CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. SAAB AB (SWEDEN): SNAPSHOT

TABLE 090. SAAB AB (SWEDEN): BUSINESS PERFORMANCE

TABLE 091. SAAB AB (SWEDEN): PRODUCT PORTFOLIO

TABLE 092. SAAB AB (SWEDEN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. VESON NAUTICAL (MASSACHUSETTS): SNAPSHOT

TABLE 093. VESON NAUTICAL (MASSACHUSETTS): BUSINESS PERFORMANCE

TABLE 094. VESON NAUTICAL (MASSACHUSETTS): PRODUCT PORTFOLIO

TABLE 095. VESON NAUTICAL (MASSACHUSETTS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. BASS SOFTWARE (NORWAY): SNAPSHOT

TABLE 096. BASS SOFTWARE (NORWAY): BUSINESS PERFORMANCE

TABLE 097. BASS SOFTWARE (NORWAY): PRODUCT PORTFOLIO

TABLE 098. BASS SOFTWARE (NORWAY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. BENTLEY SYSTEMS (US): SNAPSHOT

TABLE 099. BENTLEY SYSTEMS (US): BUSINESS PERFORMANCE

TABLE 100. BENTLEY SYSTEMS (US): PRODUCT PORTFOLIO

TABLE 101. BENTLEY SYSTEMS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. INDRA SISTEMAS (SPAIN): SNAPSHOT

TABLE 102. INDRA SISTEMAS (SPAIN): BUSINESS PERFORMANCE

TABLE 103. INDRA SISTEMAS (SPAIN): PRODUCT PORTFOLIO

TABLE 104. INDRA SISTEMAS (SPAIN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. TRIMBLE (US): SNAPSHOT

TABLE 105. TRIMBLE (US): BUSINESS PERFORMANCE

TABLE 106. TRIMBLE (US): PRODUCT PORTFOLIO

TABLE 107. TRIMBLE (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. TOMTOM INTERNATIONAL BV. (NETHERLANDS): SNAPSHOT

TABLE 108. TOMTOM INTERNATIONAL BV. (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 109. TOMTOM INTERNATIONAL BV. (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 110. TOMTOM INTERNATIONAL BV. (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. AMADEUS IT GROUP SA (SPAIN): SNAPSHOT

TABLE 111. AMADEUS IT GROUP SA (SPAIN): BUSINESS PERFORMANCE

TABLE 112. AMADEUS IT GROUP SA (SPAIN): PRODUCT PORTFOLIO

TABLE 113. AMADEUS IT GROUP SA (SPAIN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 113. CONDUENT (US): SNAPSHOT

TABLE 114. CONDUENT (US): BUSINESS PERFORMANCE

TABLE 115. CONDUENT (US): PRODUCT PORTFOLIO

TABLE 116. CONDUENT (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 116. KAPSCH (AUSTRIA): SNAPSHOT

TABLE 117. KAPSCH (AUSTRIA): BUSINESS PERFORMANCE

TABLE 118. KAPSCH (AUSTRIA): PRODUCT PORTFOLIO

TABLE 119. KAPSCH (AUSTRIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 119. HITACHI LTD. (JAPAN): SNAPSHOT

TABLE 120. HITACHI LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 121. HITACHI LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 122. HITACHI LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 122. DESCARTES (CANADA): SNAPSHOT

TABLE 123. DESCARTES (CANADA): BUSINESS PERFORMANCE

TABLE 124. DESCARTES (CANADA): PRODUCT PORTFOLIO

TABLE 125. DESCARTES (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 125. ACCENTURE (IRELAND): SNAPSHOT

TABLE 126. ACCENTURE (IRELAND): BUSINESS PERFORMANCE

TABLE 127. ACCENTURE (IRELAND): PRODUCT PORTFOLIO

TABLE 128. ACCENTURE (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 128. DNV GL (NORWAY): SNAPSHOT

TABLE 129. DNV GL (NORWAY): BUSINESS PERFORMANCE

TABLE 130. DNV GL (NORWAY): PRODUCT PORTFOLIO

TABLE 131. DNV GL (NORWAY): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SMART TRANSPORTATION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SMART TRANSPORTATION MARKET OVERVIEW BY TRANSPORTATION MODE

FIGURE 012. ROADWAYS MARKET OVERVIEW (2016-2028)

FIGURE 013. RAILWAYS MARKET OVERVIEW (2016-2028)

FIGURE 014. AIRWAYS MARKET OVERVIEW (2016-2028)

FIGURE 015. MARITIME MARKET OVERVIEW (2016-2028)

FIGURE 016. SMART TRANSPORTATION MARKET OVERVIEW BY TECHNOLOGY USED

FIGURE 017. CLOUD COMPUTING MARKET OVERVIEW (2016-2028)

FIGURE 018. ARTIFICIAL INTELLIGENCE MARKET OVERVIEW (2016-2028)

FIGURE 019. INTERNET OF THINGS MARKET OVERVIEW (2016-2028)

FIGURE 020. SMART TRANSPORTATION MARKET OVERVIEW BY SOLUTIONS

FIGURE 021. TICKET MANAGEMENT SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 022. PARKING MANAGEMENT AND GUIDANCE SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 023. TRAFFIC MANAGEMENT SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 024. FREIGHT MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 025. ROAD SAFETY AND SECURITY MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. SMART TRANSPORTATION MARKET OVERVIEW BY APPLICATION

FIGURE 028. MOBILITY AS A SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 029. ROUTE INFORMATION AND ROUTE GUIDANCE MARKET OVERVIEW (2016-2028)

FIGURE 030. PUBLIC TRANSPORT MARKET OVERVIEW (2016-2028)

FIGURE 031. TRANSIT HUBS MARKET OVERVIEW (2016-2028)

FIGURE 032. CONNECTED CARS MARKET OVERVIEW (2016-2028)

FIGURE 033. VIDEO MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 034. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 035. NORTH AMERICA SMART TRANSPORTATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. EUROPE SMART TRANSPORTATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 037. ASIA PACIFIC SMART TRANSPORTATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 038. MIDDLE EAST & AFRICA SMART TRANSPORTATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 039. SOUTH AMERICA SMART TRANSPORTATION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Smart Transportation Market research report is 2022-2028.

The key players mentioned are Thales Group (France), Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), IBM Corporation (US), Cisco Systems, Inc. (US), SAP (Germany), Cubic Corporation (US), Alstom (France), Bombardier Inc. (Canada), Toshiba (Japan), Harris Corporation (US), Saab AB (Sweden), Veson Nautical (Massachusetts), BASS Software (Norway), Bentley Systems (US), Indra Sistemas (Spain), Trimble (US), TomTom International BV. (Netherlands), Amadeus IT Group SA (Spain), Conduent (US), Kapsch (Austria), Hitachi Ltd. (Japan), Descartes (Canada), Accenture (Ireland), and DNV GL (Norway).

The Smart Transportation market is segmented into Transportation Mode, Technology Used, Solutions and Region. By Application, the market is categorized into Mobility as a Service, Route Information and Route Guidance, Public Transport, Transit Hubs, Connected Cars, Video Management, Others. By Transportation Mode, it is classified into Roadways, Railways, Airways, and Maritime and others. By Solution, it is classified into Ticket Management System, Parking Management And Guidance System, Traffic Management System, Freight Management, Road Safety And Security, And Others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

Smart Transportation Systems uses a wide range of technologies such as traffic signal control systems, automatic number plate recognition, container management systems, or speed cameras such as security CCTV systems to evaluate, manage, and monitor transportation systems to improve efficiency and safety in transportation services.

The Smart Transportation Market was estimated at USD 95.84 billion in 2021 and is anticipated to reach USD 241.15 billion by 2028, growing at a CAGR of 14.09% globally.