Ready Mix Concrete Market Synopsis

The Global Market for Ready Mix Concrete Estimated at USD 421400 Million In the Year 2022, Is Projected To Reach A Revised Size Of USD 774500 Million By 2030, Growing At A CAGR Of 7.90% Over The Forecast Period 2022-2030.

Ready-mix Concrete is a specified proportion of cement, water, aggregates, and extra elements. To achieve the appropriate strength and durability, all of the elements are blended in proportion according to established specifications.

- Ready-mix concrete refers to a material used in construction. It is made of cement (cement paste), fine and coarse aggregates, including sand, combined with water, which dries over time. A concrete mix that comprises crushed rocks or coarse gravel, such as granite or limestone, along with finer material, such as sand, is called an aggregate. When creating concrete, different types of cement are utilized, such as Portland cement or hydraulic cement. The market demand is being supported by the increased consumption of goods for quicker and simpler construction processes.

- Additives like superplasticizers and pozzolans are often used to enhance the functionality of the final product. Usually, concrete is poured with reinforcing components like rebar anchored in the mix to increase the material's tensile strength and yield strength. The need for RMC is boosted by the widespread use of concrete in construction; its global use surpasses that of wood, steel, polymers, and aluminum combined.

- Admixtures are also added to concrete to improve its qualities in addition to additives. Concrete components for recycled products use mineral-based admixtures. Fly ash, a result of coal-fired power stations, and silica fume, a consequence of commercial electric arc furnaces, are two notable substances. Market growth is anticipated to be supported by the expanding construction sector.

The Ready-Mix Concrete Market Trend Analysis

Increased Construction and Infrastructural Projects

- As infrastructure projects like bridges, roads, dams, and airport expansions proliferate, particularly in developing nations, the need for ready-mix concrete is rising. As a result, it is anticipated that over the projected period, the global ready-mix concrete business will expand quickly. More government spending on manufacturing, power plants and construction is also helping the market.

- Rapid population expansion and increasing urbanization are two factors that will help the ready-mix concrete market grow at a faster rate. The simple pouring techniques used in ready-mix building will also contribute to an increase in market value. Other market growth drivers that are anticipated to support the market's growth include the expansion of the automotive sector and the development of various parts of the global infrastructure.

- Additionally, as ready-mix concrete can be made from recycled materials and its use can result in lower waste, energy use, and greenhouse gas emissions, the drive towards sustainable construction methods has also raised demand for it.

- As a result, the global ready-mix concrete market is expected to continue to grow in the coming years, driven by the increasing demand for new construction and infrastructure projects, as well as the trend toward sustainable construction practices.

Increased Government Investments

- The ready-mix concrete industry may benefit from an increase in government spending. Highways, bridges, airports, seaports, trains, and buildings are all examples of government-funded infrastructure projects that necessitate enormous amounts of high-quality concrete that must fulfill strict performance standards and timeframes.

- By investing in infrastructure, governments can create jobs, stimulate economic growth, improve public safety and mobility, and enhance the quality of life for their citizens. The use of ready-mix concrete can help accelerate construction timelines and reduce the risk of project delays or quality issues, as it allows for efficient and reliable delivery of concrete to the job site.

- Furthermore, the growing emphasis on green building materials and sustainable construction might benefit the ready-mix concrete market by providing chances to produce eco-friendly concrete mixes that employ recycled resources or reduce the carbon footprint of concrete manufacturing and transportation.

- However, the success of the ready-mix concrete market depends on several factors, such as the level of government investment, the competitiveness of the market, the availability of raw materials and skilled labor, the regulatory environment, and the ability of the industry to innovate and adapt to changing customer needs and trends.

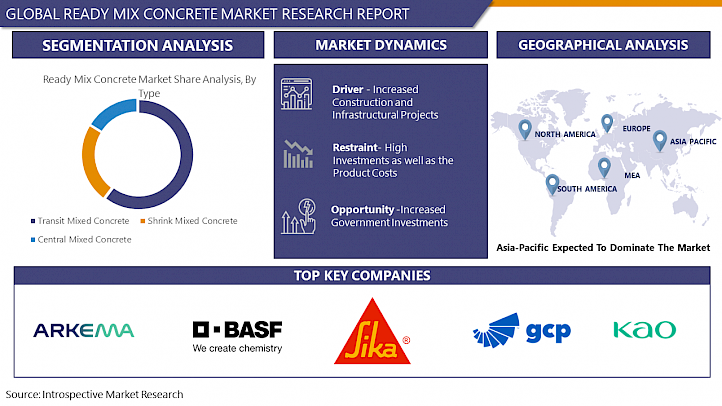

Segmentation Analysis Of The Ready Mix Concrete Market

Ready Mix Concrete market segments cover the Type and application. By Application, Commercial Building is Anticipated to Dominate the Market Over the Forecast period.

- The commercial building segment is one of the key segments dominating the global ready-mix concrete market. This is because commercial buildings require large volumes of high-quality concrete, which can be efficiently and reliably supplied by ready-mix concrete manufacturers and suppliers.

- The commercial building segment includes a wide range of building types, such as office buildings, shopping malls, hotels, hospitals, schools, and other public buildings. These buildings require concrete for various applications, such as foundations, floors, walls, columns, beams, and roofs.

- The benefits of adopting ready-mix concrete for commercial building projects include less material waste, increased safety, and lower labor expenses. Furthermore, ready-mix concrete can be adjusted to each project's individual needs and requirements, such as strength, durability, workability, and aesthetic appeal.

Regional Analysis of The Ready-Mix Concrete Market

Asia Pacific is Expected to Dominate the Market Over the Forecast period.

- The Asia Pacific ready-mix concrete market is the largest and is predicted to increase significantly because of high demand from rising economies like China, India, and South Korea. Furthermore, due to the availability of raw materials and the expanding population, China is the leading producer of concrete. Increased infrastructure development and the installation of new manufacturing plants in developing countries will boost market expansion even further.

- The construction industry in the Asia Pacific region has been growing at a rapid pace, driven by the increasing demand for residential and commercial buildings, as well as infrastructure projects such as highways, airports, seaports, and railroads. Ready-mix concrete is a crucial component in these construction projects, as it offers several advantages, such as improved quality, consistency, efficiency, and safety.

- The above figure shows that there is an increase in china’s building construction in 2021 as compared to 2020. The increasing building construction in China is expected to drive the demand for ready-mix concrete in the country.

Covid-19 Impact Analysis On Ready Mix Concrete Market

The current coronavirus outbreak had a negative impact on the ready-mix concrete market. The market was affected by major interruptions in various production and supply-chain operations as a result of numerous precautionary lockdowns. The numerous end consumers of the ready-mix concrete business were impacted during the COVID-19 outbreak's lockdown. Building activity had slowed globally, resulting in a significant decrease in demand for ready-mix concrete. The aforementioned determinants will affect the market's revenue trajectory during the forecast period.

On the other hand, the government has taken additional steps to support the construction industry, such as the introduction of many awards for employees and manufacturers, which will increase demand for construction materials. The government has also begun construction projects in all regions, which will result in the creation of more jobs. Future market growth will be aided by more government initiatives and a growing workforce in the industry.

Top Key Players Covered in The Ready-Mix Concrete Market

- Arkema(France)

- Sika AG (Switzerland)

- BASF SE (Germany)

- GCP Applied Technologies Inc. (U.S.)

- MAPEI S.p.A. (Italy)

- Kao Corporation (Japan)

- M&I Materials Limited (U.K)

- Dupont (U.S.)

- SOLVAY(Belgium)

- W. R. Grace & Co.-Conn. (U.S.)

- Setral Chemie GmbH (Germany)

- Enaspol a.s (Czech Republic)

- CAC Admixtures (India)

- CHRYSO GROUP (France)

- Ashland Inc (U.S.)

- Rhein-Chemotechnik GMBH (Germany) and Other Major Players

Key Industry Developments in the Ready-Mix Concrete Market

In February 2023, LafargeHolcim announced a new investment of $100 million in its ready-mix concrete business in North America. The investment will be used to expand capacity and improve efficiency at LafargeHolcim's ready mix concrete plants across the region.

In February 2023, CEMEX announced a new partnership with Microsoft to use artificial intelligence (AI) to optimize its ready-mix concrete operations. The partnership will use Microsoft's Azure cloud platform to develop AI models that can help CEMEX predict demand, optimize routes, and reduce waste.

In February 2023, Holcim announced a new sustainability commitment to make all of its ready-mix concrete products carbon neutral by 2050. The company will use a variety of measures to achieve this goal, including using low-carbon cement, reducing energy consumption, and capturing and storing carbon dioxide emissions.

|

Global Ready-Mix Concrete Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2030 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2022: |

USD 421400 Mn. |

|

Forecast Period 2022-30 CAGR: |

7.90% |

Market Size in 2030: |

USD 774500 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Ready Mix Concrete Market by Type

5.1 Ready Mix Concrete Market Overview Snapshot and Growth Engine

5.2 Ready Mix Concrete Market Overview

5.3 Transit Mixed Concrete

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2030F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Transit Mixed Concrete: Geographic Segmentation

5.4 Shrink Mixed Concrete

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2030F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Shrink Mixed Concrete: Geographic Segmentation

5.5 Central Mixed Concrete

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2030F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Central Mixed Concrete: Geographic Segmentation

Chapter 6: Ready Mix Concrete Market by Application

6.1 Ready Mix Concrete Market Overview Snapshot and Growth Engine

6.2 Ready Mix Concrete Market Overview

6.3 Commercial Building

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2030F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Commercial Building: Geographic Segmentation

6.4 Industrial Utilities

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2030F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Industrial Utilities: Geographic Segmentation

6.5 Residential Buildings

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2030F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Residential Buildings: Geographic Segmentation

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2030F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Ready Mix Concrete Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Ready Mix Concrete Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Ready Mix Concrete Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 ARKEMA (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 SIKA AG (SWITZERLAND)

7.4 BASF SE (GERMANY)

7.5 GCP APPLIED TECHNOLOGIES INC. (U.S.)

7.6 MAPEI S.P.A. (ITALY)

7.7 KAO CORPORATION (JAPAN)

7.8 M&I MATERIALS LIMITED (U.K)

7.9 DUPONT (U.S.)

7.10 SOLVAY (BELGIUM)

7.11 W. R. GRACE & CO.-CONN. (U.S.)

7.12 SETRAL CHEMIE GMBH (GERMANY)

7.13 ENASPOL A.S (CZECH REPUBLIC)

7.14 CAC ADMIXTURES (INDIA)

7.15 CHRYSO GROUP (FRANCE)

7.16 ASHLAND INC (U.S.)

7.17 RHEIN-CHEMOTECHNIK GMBH (GERMANY)

7.18 OTHER MAJOR PLAYERS

Chapter 8: Global Ready Mix Concrete Market Analysis, Insights and Forecast, 2016-2030

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Transit Mixed Concrete

8.2.2 Shrink Mixed Concrete

8.2.3 Central Mixed Concrete

8.3 Historic and Forecasted Market Size By Application

8.3.1 Commercial Building

8.3.2 Industrial Utilities

8.3.3 Residential Buildings

8.3.4 Others

Chapter 9: North America Ready Mix Concrete Market Analysis, Insights and Forecast, 2016-2030

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Transit Mixed Concrete

9.4.2 Shrink Mixed Concrete

9.4.3 Central Mixed Concrete

9.5 Historic and Forecasted Market Size By Application

9.5.1 Commercial Building

9.5.2 Industrial Utilities

9.5.3 Residential Buildings

9.5.4 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 US

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Eastern Europe Ready Mix Concrete Market Analysis, Insights and Forecast, 2016-2030

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Transit Mixed Concrete

10.4.2 Shrink Mixed Concrete

10.4.3 Central Mixed Concrete

10.5 Historic and Forecasted Market Size By Application

10.5.1 Commercial Building

10.5.2 Industrial Utilities

10.5.3 Residential Buildings

10.5.4 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Bulgaria

10.6.2 The Czech Republic

10.6.3 Hungary

10.6.4 Poland

10.6.5 Romania

10.6.6 Rest of Eastern Europe

Chapter 11: Western Europe Ready Mix Concrete Market Analysis, Insights and Forecast, 2016-2030

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Transit Mixed Concrete

11.4.2 Shrink Mixed Concrete

11.4.3 Central Mixed Concrete

11.5 Historic and Forecasted Market Size By Application

11.5.1 Commercial Building

11.5.2 Industrial Utilities

11.5.3 Residential Buildings

11.5.4 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 Germany

11.6.2 UK

11.6.3 France

11.6.4 Netherlands

11.6.5 Italy

11.6.6 Russia

11.6.7 Spain

11.6.8 Rest of Western Europe

Chapter 12: Asia Pacific Ready Mix Concrete Market Analysis, Insights and Forecast, 2016-2030

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Transit Mixed Concrete

12.4.2 Shrink Mixed Concrete

12.4.3 Central Mixed Concrete

12.5 Historic and Forecasted Market Size By Application

12.5.1 Commercial Building

12.5.2 Industrial Utilities

12.5.3 Residential Buildings

12.5.4 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 China

12.6.2 India

12.6.3 Japan

12.6.4 South Korea

12.6.5 Malaysia

12.6.6 Thailand

12.6.7 Vietnam

12.6.8 The Philippines

12.6.9 Australia

12.6.10 New Zealand

12.6.11 Rest of APAC

Chapter 13: Middle East & Africa Ready Mix Concrete Market Analysis, Insights and Forecast, 2016-2030

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Transit Mixed Concrete

13.4.2 Shrink Mixed Concrete

13.4.3 Central Mixed Concrete

13.5 Historic and Forecasted Market Size By Application

13.5.1 Commercial Building

13.5.2 Industrial Utilities

13.5.3 Residential Buildings

13.5.4 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Turkey

13.6.2 Bahrain

13.6.3 Kuwait

13.6.4 Saudi Arabia

13.6.5 Qatar

13.6.6 UAE

13.6.7 Israel

13.6.8 South Africa

Chapter 14: South America Ready Mix Concrete Market Analysis, Insights and Forecast, 2016-2030

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Transit Mixed Concrete

14.4.2 Shrink Mixed Concrete

14.4.3 Central Mixed Concrete

14.5 Historic and Forecasted Market Size By Application

14.5.1 Commercial Building

14.5.2 Industrial Utilities

14.5.3 Residential Buildings

14.5.4 Others

14.6 Historic and Forecast Market Size by Country

14.6.1 Brazil

14.6.2 Argentina

14.6.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Ready-Mix Concrete Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2030 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2022: |

USD 421400 Mn. |

|

Forecast Period 2022-30 CAGR: |

7.90% |

Market Size in 2030: |

USD 774500 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. READY MIX CONCRETE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. READY MIX CONCRETE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. READY MIX CONCRETE MARKET COMPETITIVE RIVALRY

TABLE 005. READY MIX CONCRETE MARKET THREAT OF NEW ENTRANTS

TABLE 006. READY MIX CONCRETE MARKET THREAT OF SUBSTITUTES

TABLE 007. READY MIX CONCRETE MARKET BY TYPE

TABLE 008. TRANSIT MIXED CONCRETE MARKET OVERVIEW (2016-2030)

TABLE 009. SHRINK MIXED CONCRETE MARKET OVERVIEW (2016-2030)

TABLE 010. CENTRAL MIXED CONCRETE MARKET OVERVIEW (2016-2030)

TABLE 011. READY MIX CONCRETE MARKET BY APPLICATION

TABLE 012. COMMERCIAL BUILDING MARKET OVERVIEW (2016-2030)

TABLE 013. INDUSTRIAL UTILITIES MARKET OVERVIEW (2016-2030)

TABLE 014. RESIDENTIAL BUILDINGS MARKET OVERVIEW (2016-2030)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 016. NORTH AMERICA READY MIX CONCRETE MARKET, BY TYPE (2016-2030)

TABLE 017. NORTH AMERICA READY MIX CONCRETE MARKET, BY APPLICATION (2016-2030)

TABLE 018. N READY MIX CONCRETE MARKET, BY COUNTRY (2016-2030)

TABLE 019. EASTERN EUROPE READY MIX CONCRETE MARKET, BY TYPE (2016-2030)

TABLE 020. EASTERN EUROPE READY MIX CONCRETE MARKET, BY APPLICATION (2016-2030)

TABLE 021. READY MIX CONCRETE MARKET, BY COUNTRY (2016-2030)

TABLE 022. WESTERN EUROPE READY MIX CONCRETE MARKET, BY TYPE (2016-2030)

TABLE 023. WESTERN EUROPE READY MIX CONCRETE MARKET, BY APPLICATION (2016-2030)

TABLE 024. READY MIX CONCRETE MARKET, BY COUNTRY (2016-2030)

TABLE 025. ASIA PACIFIC READY MIX CONCRETE MARKET, BY TYPE (2016-2030)

TABLE 026. ASIA PACIFIC READY MIX CONCRETE MARKET, BY APPLICATION (2016-2030)

TABLE 027. READY MIX CONCRETE MARKET, BY COUNTRY (2016-2030)

TABLE 028. MIDDLE EAST & AFRICA READY MIX CONCRETE MARKET, BY TYPE (2016-2030)

TABLE 029. MIDDLE EAST & AFRICA READY MIX CONCRETE MARKET, BY APPLICATION (2016-2030)

TABLE 030. READY MIX CONCRETE MARKET, BY COUNTRY (2016-2030)

TABLE 031. SOUTH AMERICA READY MIX CONCRETE MARKET, BY TYPE (2016-2030)

TABLE 032. SOUTH AMERICA READY MIX CONCRETE MARKET, BY APPLICATION (2016-2030)

TABLE 033. READY MIX CONCRETE MARKET, BY COUNTRY (2016-2030)

TABLE 034. ARKEMA (FRANCE): SNAPSHOT

TABLE 035. ARKEMA (FRANCE): BUSINESS PERFORMANCE

TABLE 036. ARKEMA (FRANCE): PRODUCT PORTFOLIO

TABLE 037. ARKEMA (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. SIKA AG (SWITZERLAND): SNAPSHOT

TABLE 038. SIKA AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 039. SIKA AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 040. SIKA AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. BASF SE (GERMANY): SNAPSHOT

TABLE 041. BASF SE (GERMANY): BUSINESS PERFORMANCE

TABLE 042. BASF SE (GERMANY): PRODUCT PORTFOLIO

TABLE 043. BASF SE (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. GCP APPLIED TECHNOLOGIES INC. (U.S.): SNAPSHOT

TABLE 044. GCP APPLIED TECHNOLOGIES INC. (U.S.): BUSINESS PERFORMANCE

TABLE 045. GCP APPLIED TECHNOLOGIES INC. (U.S.): PRODUCT PORTFOLIO

TABLE 046. GCP APPLIED TECHNOLOGIES INC. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. MAPEI S.P.A. (ITALY): SNAPSHOT

TABLE 047. MAPEI S.P.A. (ITALY): BUSINESS PERFORMANCE

TABLE 048. MAPEI S.P.A. (ITALY): PRODUCT PORTFOLIO

TABLE 049. MAPEI S.P.A. (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. KAO CORPORATION (JAPAN): SNAPSHOT

TABLE 050. KAO CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 051. KAO CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 052. KAO CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. M&I MATERIALS LIMITED (U.K): SNAPSHOT

TABLE 053. M&I MATERIALS LIMITED (U.K): BUSINESS PERFORMANCE

TABLE 054. M&I MATERIALS LIMITED (U.K): PRODUCT PORTFOLIO

TABLE 055. M&I MATERIALS LIMITED (U.K): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. DUPONT (U.S.): SNAPSHOT

TABLE 056. DUPONT (U.S.): BUSINESS PERFORMANCE

TABLE 057. DUPONT (U.S.): PRODUCT PORTFOLIO

TABLE 058. DUPONT (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. SOLVAY (BELGIUM): SNAPSHOT

TABLE 059. SOLVAY (BELGIUM): BUSINESS PERFORMANCE

TABLE 060. SOLVAY (BELGIUM): PRODUCT PORTFOLIO

TABLE 061. SOLVAY (BELGIUM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. W. R. GRACE & CO.-CONN. (U.S.): SNAPSHOT

TABLE 062. W. R. GRACE & CO.-CONN. (U.S.): BUSINESS PERFORMANCE

TABLE 063. W. R. GRACE & CO.-CONN. (U.S.): PRODUCT PORTFOLIO

TABLE 064. W. R. GRACE & CO.-CONN. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. SETRAL CHEMIE GMBH (GERMANY): SNAPSHOT

TABLE 065. SETRAL CHEMIE GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 066. SETRAL CHEMIE GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 067. SETRAL CHEMIE GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. ENASPOL A.S (CZECH REPUBLIC): SNAPSHOT

TABLE 068. ENASPOL A.S (CZECH REPUBLIC): BUSINESS PERFORMANCE

TABLE 069. ENASPOL A.S (CZECH REPUBLIC): PRODUCT PORTFOLIO

TABLE 070. ENASPOL A.S (CZECH REPUBLIC): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. CAC ADMIXTURES (INDIA): SNAPSHOT

TABLE 071. CAC ADMIXTURES (INDIA): BUSINESS PERFORMANCE

TABLE 072. CAC ADMIXTURES (INDIA): PRODUCT PORTFOLIO

TABLE 073. CAC ADMIXTURES (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. CHRYSO GROUP (FRANCE): SNAPSHOT

TABLE 074. CHRYSO GROUP (FRANCE): BUSINESS PERFORMANCE

TABLE 075. CHRYSO GROUP (FRANCE): PRODUCT PORTFOLIO

TABLE 076. CHRYSO GROUP (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. ASHLAND INC (U.S.): SNAPSHOT

TABLE 077. ASHLAND INC (U.S.): BUSINESS PERFORMANCE

TABLE 078. ASHLAND INC (U.S.): PRODUCT PORTFOLIO

TABLE 079. ASHLAND INC (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. RHEIN-CHEMOTECHNIK GMBH (GERMANY): SNAPSHOT

TABLE 080. RHEIN-CHEMOTECHNIK GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 081. RHEIN-CHEMOTECHNIK GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 082. RHEIN-CHEMOTECHNIK GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 083. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 084. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 085. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. READY MIX CONCRETE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. READY MIX CONCRETE MARKET OVERVIEW BY TYPE

FIGURE 012. TRANSIT MIXED CONCRETE MARKET OVERVIEW (2016-2030)

FIGURE 013. SHRINK MIXED CONCRETE MARKET OVERVIEW (2016-2030)

FIGURE 014. CENTRAL MIXED CONCRETE MARKET OVERVIEW (2016-2030)

FIGURE 015. READY MIX CONCRETE MARKET OVERVIEW BY APPLICATION

FIGURE 016. COMMERCIAL BUILDING MARKET OVERVIEW (2016-2030)

FIGURE 017. INDUSTRIAL UTILITIES MARKET OVERVIEW (2016-2030)

FIGURE 018. RESIDENTIAL BUILDINGS MARKET OVERVIEW (2016-2030)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 020. NORTH AMERICA READY MIX CONCRETE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 021. EASTERN EUROPE READY MIX CONCRETE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 022. WESTERN EUROPE READY MIX CONCRETE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 023. ASIA PACIFIC READY MIX CONCRETE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. MIDDLE EAST & AFRICA READY MIX CONCRETE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. SOUTH AMERICA READY MIX CONCRETE MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Ready-Mix Concrete Market research report is 2022-2028.

Arkema (France), Sika AG (Switzerland), BASF SE (Germany), GCP Applied Technologies Inc. (U.S.), MAPEI S.p.A. (Italy), Kao Corporation (Japan), M&I Materials Limited (U.K), Dupont (U.S.), SOLVAY (Belgium), W. R. Grace & Co.-Conn. (U.S.), Setral Chemie GmbH (Germany), Enaspol a.s (Czech Republic), CAC Admixtures (India), CHRYSO GROUP (France), Ashland Inc (U.S.), Rhein-Chemotechnik GMBH (Germany) and Other Major Players.

The Ready-Mix Concrete Market has been segmented into Type, Application, and region. By Type, the market is categorized into Transit Mixed Concrete, Shrink Mixed Concrete, and Central Mixed Concrete. By Application, the market is categorized into Commercial buildings, Industrial Utilities, Residential Buildings, and Others. By region, it is analyzed across North America (US, Canada, Mexico), Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Ready-mix concrete refers to a material used in construction. It is made of cement (cement paste), fine and coarse aggregates, including sand, combined with water, which dries over time. A concrete mix that comprises crushed rocks or coarse gravel, such as granite or limestone, along with finer material, such as sand, is called an aggregate. When creating concrete, different types of cement are utilized, such as Portland cement or hydraulic cement. The market demand is being supported by the increased consumption of goods for quicker and simpler construction processes.

The Global Market for Ready Mix Concrete Estimated at USD 421400 Million In the Year 2022, Is Projected To Reach A Revised Size Of USD 774500 Million By 2030, Growing At A CAGR Of 7.90% Over The Forecast Period 2022-2030.