Polyester Plasticizers Market Synopsis

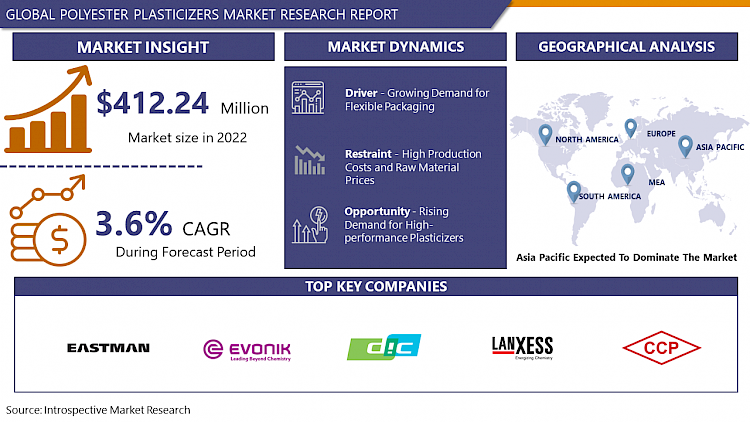

Polyester Plasticizers Market Size Was Valued at USD 412.24 Million in 2022 and is Projected to Reach USD 547.05 Million by 2030, Growing at a CAGR of 3.6 % From 2023-2030.

- Polyester plasticizers are additives used to enhance the flexibility and durability of polyester-based materials. These substances, often phthalate-based, are incorporated during the polymerization process or added post-production to modify the physical properties of polyester polymers. By lowering the glass transition temperature, polyester plasticizers increase material flexibility, making it more pliable and resistant to cracking. This improves the overall performance and versatility of polyester products, particularly in applications where flexibility is crucial, such as in the production of films, coatings, and flexible packaging materials. Despite their benefits, there is growing interest in eco-friendly alternatives to traditional polyester plasticizers due to environmental concerns. Polyester plasticizers enhance the flexibility and durability of polyester-based materials, making them ideal for applications like films, coatings, and flexible packaging. These plasticizers, often phthalate-based, play a crucial role in improving the overall performance of polyester products by lowering the glass transition temperature, which increases material flexibility and resistance to cracking.

- The polyester plasticizers industry is the growing importance of eco-friendly alternatives. Environmental concerns have led to increased research and development in finding sustainable substitutes for traditional phthalate-based plasticizers. Bio-based or non-phthalate polyester plasticizers are gaining power as manufacturers and consumers pursue more environmentally friendly options. The demand for polyester plasticizers continues to rise in the expanding applications of polyester-based materials in diverse sectors such as packaging, textiles, and construction. As industries increasingly recognize the importance of material flexibility and durability, the polyester plasticizers market is expected to witness sustained growth, with a simultaneous push towards innovation and sustainability to meet evolving market demands.

Polyester Plasticizers Market Trend Analysis

Growing Demand for Flexible Packaging

- Flexible packaging has gained prominence due to its numerous advantages, such as its lightweight nature, cost-effectiveness, and superior product protection. Polyester-based materials, when treated with plasticizers, become more flexible and stronger, making them well-suited for flexible packaging applications. The ability to enhance the flexibility and durability of polyester films ensures that the packaging material can easily conform to various shapes, providing manufacturers with versatile options for packaging designs.

- As consumer preferences and industry requirements continue to favor flexible packaging over traditional rigid formats, the demand for polyester plasticizers rises Collaboratively. This trend is particularly noticeable in industries like food and beverage, pharmaceuticals, and cosmetics, where flexible packaging offers improved shelf life, convenience, and reduced environmental impact. Consequently, the polyester plasticizer market experiences significant growth as it plays a crucial role in meeting the evolving needs of industries seeking innovative and adaptable solutions for packaging.

Rising Demand for High-Performance Plasticizers

- Polyester plasticizer materials offer enhanced properties like flexibility, durability, and resistance to extreme temperatures, making them crucial in industries like automotive, aerospace, and electronics. These industries are seeking advanced materials that can withstand challenging conditions and stringent performance requirements.

- The potential is in creating and providing cutting-edge, high-performance polyester plasticizers to meet these specific demands. Manufacturers can capitalize on the trend by investing in research and development to create unique demands for emerging applications. As industries continue to seek materials with superior properties, the demand for high-performance plasticizers positions the polyester plasticizer market as a key player in providing innovative solutions to meet growing performance expectations across various sectors.

Polyester Plasticizers Market Segment Analysis:

Polyester Plasticizers Market Segmented based on Product, Application, End-User.

By Product, Petroleum-based Polyester Plasticizers segment is expected to dominate the market during the forecast period

- Petroleum-based polyester plasticizers offer a cost-effective solution for enhancing the flexibility and performance of polyester materials. The plenty and relatively lower cost of raw materials derived from petroleum make these plasticizers economically attractive for manufacturers and end-users alike. Petroleum-based polyester plasticizers exhibit excellent compatibility with polyester resins, ensuring efficient processing and consistent product quality. The well-established infrastructure for the production and distribution of petroleum-based plasticizers contributes to their prevalent adoption. The established supply chain and manufacturing processes make these plasticizers readily available materials for packaging, textiles, and construction industries.

By Application, the PVC Products segment held the largest share of 51.6% in 2022

- PVC Products are widely used polymers in various industries, including construction, automotive, and packaging, owing to their versatility and cost-effectiveness. Polyester plasticizers play a crucial role in enhancing the flexibility, resilience, and overall performance of PVC materials. They are incorporated into PVC formulations to impart desirable properties like improved workability, durability, and resistance to environmental factors.

- The dominance of the PVC Products segment increasing demand for PVC-based products in construction applications, such as pipes, cables, and flooring. The automotive sector extensively utilizes PVC materials for various components contributing to the significant market share of the polyester plasticizers segment. The demand for high-performance materials, particularly PVC, and polyester plasticizers is expected to remain high due to the growth of industries and the dominance of the segment.

Polyester Plasticizers Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is expected to dominate the polyester plasticizers market in the future due to factors like rapid industrialization and urbanization in countries like China, India, and Southeast Asia. The economic factor is growing the demand for materials characterized by flexibility and durability, particularly in sectors like construction, automotive, and packaging, where polyester plasticizers play a pivotal role. The expanding construction industry in the Asia Pacific, in particular, is contributing significantly to the increased adoption of materials like PVC, incorporating polyester plasticizers for improved properties.

- The manufacturing sector in the Asia Pacific region stands out as a key factor for the polyester plasticizers market. The Asia Pacific region, a global manufacturing hub for textiles, electronics, and consumer goods, heavily depends on polyester plasticizers for their flexibility and resilience. The region's growing population and increased consumer demand for polyester plasticizers fuelled by government policies, economic development initiatives, and significant infrastructure investments, will dominate the global market.

Polyester Plasticizers Market Top Key Players:

- Eastman (US)

- Hallstar (US)

- ExxonMobil Corporation (US)

- Lanxess AG (Germany)

- BASF(Germany)

- Evonik Industries AG (Germany)

- Corda (United Kingdom)

- Polynt Group (Italy)

- Perstorp Group (Sweden)

- China National Petroleum Corporation (China)

- Shandong Hongxin Chemicals Co., Ltd. (China)

- J-PLUS (Japan)

- DIC Corporation (Japan)

- Mitsubishi Chemical Corporation (Japan)

- Adeka Corporation (Japan)

- UPC Group (Taiwan)

- Chang Chun Group (Taiwan)

- Formosa Plastics Corporation (Taiwan)

- LG Chem (South Korea)

- Lotte Chemical Corporation (South Korea), and Other Major Players.

Key Industry Developments in the Polyester Plasticizers Market:

- In October 2023, Evonik, a leading specialty chemicals company, revealed the development of a novel bio-based plasticizer named VESTAMID® Terra EH 4610. This ground-breaking product is sourced from renewable materials, presenting an eco-friendly substitute for conventional petroleum-based plasticizers commonly employed in polyvinyl chloride (PVC) applications.

- In October 2023, BASF launched Ultraplast™ Biobased 5750, a non-phthalate plasticizer specifically crafted for use in medical devices and pharmaceutical applications. This biocompatible plasticizer is free from phthalate esters, addressing concerns related to their potential health impacts

|

Global Polyester Plasticizers Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 412.24 Mn. |

|

Forecast Period 2023-30 CAGR: |

3.6 % |

Market Size in 2030: |

USD 547.05 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- POLYESTER PLASTICIZERS MARKET BY PRODUCT (2016-2030)

- POLYESTER PLASTICIZERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PETROLEUM-BASED POLYESTER PLASTICIZERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BIO-BASED POLYESTER PLASTICIZERS

- POLYESTER PLASTICIZERS MARKET BY APPLICATION (2016-2030)

- POLYESTER PLASTICIZERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PVC PRODUCTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RUBBER PRODUCTS

- POLYESTER PLASTICIZERS MARKET BY END-USER (2016-2030)

- POLYESTER PLASTICIZERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PACKAGING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONSTRUCTION

- AUTOMOTIVE

- TEXTILE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Polyester Plasticizers Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- EASTMAN (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- HALLSTAR (US)

- EXXONMOBIL CORPORATION (US)

- LANXESS AG (GERMANY)

- BASF (GERMANY)

- EVONIK INDUSTRIES AG (GERMANY)

- CORDA (UNITED KINGDOM)

- POLYNT GROUP (ITALY)

- PERSTORP GROUP (SWEDEN)

- CHINA NATIONAL PETROLEUM CORPORATION (CHINA)

- SHANDONG HONGXIN CHEMICALS CO., LTD. (CHINA)

- J-PLUS (JAPAN)

- DIC CORPORATION (JAPAN)

- MITSUBISHI CHEMICAL CORPORATION (JAPAN)

- ADEKA CORPORATION (JAPAN)

- UPC GROUP (TAIWAN)

- CHANG CHUN GROUP (TAIWAN)

- FORMOSA PLASTICS CORPORATION (TAIWAN)

- LG CHEM (SOUTH KOREA)

- LOTTE CHEMICAL CORPORATION (SOUTH KOREA)

- COMPETITIVE LANDSCAPE

- GLOBAL POLYESTER PLASTICIZERS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- US

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Polyester Plasticizers Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 412.24 Mn. |

|

Forecast Period 2023-30 CAGR: |

3.6 % |

Market Size in 2030: |

USD 547.05 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. POLYESTER PLASTICIZERS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. POLYESTER PLASTICIZERS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. POLYESTER PLASTICIZERS MARKET COMPETITIVE RIVALRY

TABLE 005. POLYESTER PLASTICIZERS MARKET THREAT OF NEW ENTRANTS

TABLE 006. POLYESTER PLASTICIZERS MARKET THREAT OF SUBSTITUTES

TABLE 007. POLYESTER PLASTICIZERS MARKET BY TYPE

TABLE 008. LIQUID MARKET OVERVIEW (2016-2028)

TABLE 009. POWDER MARKET OVERVIEW (2016-2028)

TABLE 010. GEL MARKET OVERVIEW (2016-2028)

TABLE 011. GRANULE MARKET OVERVIEW (2016-2028)

TABLE 012. POLYESTER PLASTICIZERS MARKET BY APPLICATION

TABLE 013. PVC PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 014. RUBBER PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA POLYESTER PLASTICIZERS MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA POLYESTER PLASTICIZERS MARKET, BY APPLICATION (2016-2028)

TABLE 018. N POLYESTER PLASTICIZERS MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE POLYESTER PLASTICIZERS MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE POLYESTER PLASTICIZERS MARKET, BY APPLICATION (2016-2028)

TABLE 021. POLYESTER PLASTICIZERS MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC POLYESTER PLASTICIZERS MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC POLYESTER PLASTICIZERS MARKET, BY APPLICATION (2016-2028)

TABLE 024. POLYESTER PLASTICIZERS MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA POLYESTER PLASTICIZERS MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA POLYESTER PLASTICIZERS MARKET, BY APPLICATION (2016-2028)

TABLE 027. POLYESTER PLASTICIZERS MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA POLYESTER PLASTICIZERS MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA POLYESTER PLASTICIZERS MARKET, BY APPLICATION (2016-2028)

TABLE 030. POLYESTER PLASTICIZERS MARKET, BY COUNTRY (2016-2028)

TABLE 031. CHANG CHUN GROUP: SNAPSHOT

TABLE 032. CHANG CHUN GROUP: BUSINESS PERFORMANCE

TABLE 033. CHANG CHUN GROUP: PRODUCT PORTFOLIO

TABLE 034. CHANG CHUN GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. DIC CORPORATION: SNAPSHOT

TABLE 035. DIC CORPORATION: BUSINESS PERFORMANCE

TABLE 036. DIC CORPORATION: PRODUCT PORTFOLIO

TABLE 037. DIC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. UPC GROUP: SNAPSHOT

TABLE 038. UPC GROUP: BUSINESS PERFORMANCE

TABLE 039. UPC GROUP: PRODUCT PORTFOLIO

TABLE 040. UPC GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. MITSUBISHI CHEMICAL: SNAPSHOT

TABLE 041. MITSUBISHI CHEMICAL: BUSINESS PERFORMANCE

TABLE 042. MITSUBISHI CHEMICAL: PRODUCT PORTFOLIO

TABLE 043. MITSUBISHI CHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. SUN CHEMICAL: SNAPSHOT

TABLE 044. SUN CHEMICAL: BUSINESS PERFORMANCE

TABLE 045. SUN CHEMICAL: PRODUCT PORTFOLIO

TABLE 046. SUN CHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. HALLSTAR: SNAPSHOT

TABLE 047. HALLSTAR: BUSINESS PERFORMANCE

TABLE 048. HALLSTAR: PRODUCT PORTFOLIO

TABLE 049. HALLSTAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. POLYNT: SNAPSHOT

TABLE 050. POLYNT: BUSINESS PERFORMANCE

TABLE 051. POLYNT: PRODUCT PORTFOLIO

TABLE 052. POLYNT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. IMCD US: SNAPSHOT

TABLE 053. IMCD US: BUSINESS PERFORMANCE

TABLE 054. IMCD US: PRODUCT PORTFOLIO

TABLE 055. IMCD US: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. TONGXIANG LONGCHENG PLASTIC: SNAPSHOT

TABLE 056. TONGXIANG LONGCHENG PLASTIC: BUSINESS PERFORMANCE

TABLE 057. TONGXIANG LONGCHENG PLASTIC: PRODUCT PORTFOLIO

TABLE 058. TONGXIANG LONGCHENG PLASTIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. POLYONE: SNAPSHOT

TABLE 059. POLYONE: BUSINESS PERFORMANCE

TABLE 060. POLYONE: PRODUCT PORTFOLIO

TABLE 061. POLYONE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ADEKA: SNAPSHOT

TABLE 062. ADEKA: BUSINESS PERFORMANCE

TABLE 063. ADEKA: PRODUCT PORTFOLIO

TABLE 064. ADEKA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. HALLSTAR: SNAPSHOT

TABLE 065. HALLSTAR: BUSINESS PERFORMANCE

TABLE 066. HALLSTAR: PRODUCT PORTFOLIO

TABLE 067. HALLSTAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. POLYESTER PLASTICIZERS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. POLYESTER PLASTICIZERS MARKET OVERVIEW BY TYPE

FIGURE 012. LIQUID MARKET OVERVIEW (2016-2028)

FIGURE 013. POWDER MARKET OVERVIEW (2016-2028)

FIGURE 014. GEL MARKET OVERVIEW (2016-2028)

FIGURE 015. GRANULE MARKET OVERVIEW (2016-2028)

FIGURE 016. POLYESTER PLASTICIZERS MARKET OVERVIEW BY APPLICATION

FIGURE 017. PVC PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 018. RUBBER PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA POLYESTER PLASTICIZERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE POLYESTER PLASTICIZERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC POLYESTER PLASTICIZERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA POLYESTER PLASTICIZERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA POLYESTER PLASTICIZERS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Polyester Plasticizers Market research report is 2023-2030.

Eastman (US), Hallstar (US), ExxonMobil Corporation (US), Lanxess AG (Germany), BASF (Germany), Evonik Industries AG (Germany), Corda (United Kingdom), Polynt Group (Italy), Perstorp Group (Sweden), China National Petroleum Corporation (China), Shandong Hongxin Chemicals Co., Ltd. (China), J-PLUS (Japan), DIC Corporation (Japan), Mitsubishi Chemical Corporation (Japan), Adeka Corporation (Japan), UPC Group (Taiwan), Chang Chun Group (Taiwan), Formosa Plastics Corporation (Taiwan), LG Chem (South Korea), Lotte Chemical Corporation (South Korea), and Other Major Players.

The Polyester Plasticizers Market is segmented into Product, Application, End-User, and Region. By Product, the market is categorized into Petroleum-based Polyester Plasticizers and Bio-based Polyester Plasticizers. By Application, the market is categorized into PVC Products and Rubber Products. By End-User, the market is categorized into Packaging, Construction, Automotive, and Textile. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Polyester plasticizers are additives used to enhance the flexibility and durability of polyester-based materials. These substances, often phthalate-based, are incorporated during the polymerization process or added post-production to modify the physical properties of polyester polymers. By lowering the glass transition temperature, polyester plasticizers increase material flexibility, making it more pliable and resistant to cracking. This improves the overall performance and versatility of polyester products, particularly in applications where flexibility is crucial, such as in the production of films, coatings, and flexible packaging materials. Despite their benefits, there is growing interest in eco-friendly alternatives to traditional polyester plasticizers due to environmental concerns. Polyester plasticizers enhance the flexibility and durability of polyester-based materials, making them ideal for applications like films, coatings, and flexible packaging.

Polyester Plasticizers Market Size Was Valued at USD 412.24 Million in 2022 and is Projected to Reach USD 547.05 Million by 2030, Growing at a CAGR of 3.6 % From 2023-2030.