Global Gummy Market Overview

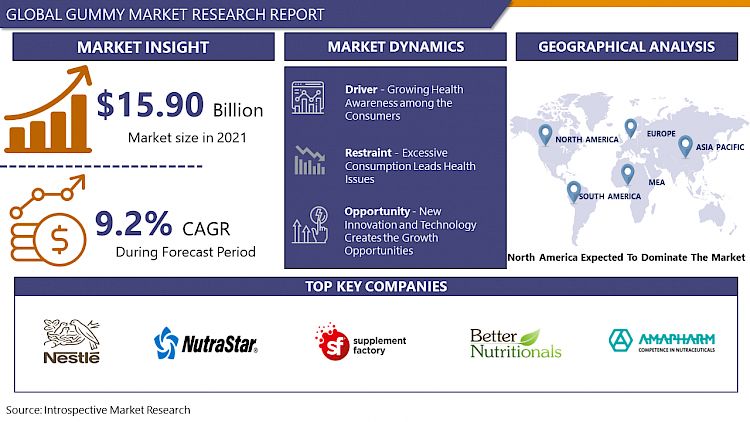

Global Gummy Market was valued at USD 15.90 billion in 2021 and is expected to reach USD 29.44 billion by the year 2028, at a CAGR of 9.2%.

The term "gummy" comes from Germany, but "jelly sweets" is more commonly used in British English. Gummies, also known as gummy candies, gummy candies, or jelly sweets, are gelatin-based chewable treats. Gummy bears, Sour Patch Kids, and Jelly Babies are all well-known in the candy industry. Gummies come in a variety of shapes, but the most prevalent are colorful images of living things like bears, newborns, and worms. Gummy snacks are made by a variety of companies, including Bassett's, Haribo, Betty Crocker, Disney, and Kellogg's, and are commonly marketed to children. Gummies are a popular choice among people of all ages. They are easy to eat and palatable for most of us since they are colorful, have a variety of flavors, and are chewable. It's largely made of gelatin, maize starch, water, sugar, and artificial colorings, which gives it its vibrant appearance. Lemon, raspberry, cherry, and orange are among the most prevalent flavors. Gummies have been a popular source of multivitamin supplements in recent years. As many vitamin tablets and syrups are not pleasant for both children and adults, they have become an alternative source of multivitamins.

In comparison to other non-pill formats, gummy supplements have gained the highest market share, more than doubling in size over the last five years. Immune system support, bone health, antioxidants, vitality, and attractiveness are the top five claims made by new gummy product introductions in recent years to address consumers' preventive concerns.

Market Dynamics and Factors for the Gummy Market:

Drivers:

Growing Health Awareness among the Consumers

Gummies are the most recent wellness supplement trend. The majority of scientists believe that eating a healthy, balanced diet will help to lessen the need for multivitamin pills. Multivitamin pills are a wonderful alternative for persons who have trouble keeping a balanced diet. It's especially common in persons who have trouble swallowing tablets or who don't like the flavor of syrups. Gummies have grown in popularity in the beauty and wellness business with the release of Covid-19 last year. Gummies are currently being used as a source of multivitamins, with hair and skin regeneration advantages. As the adage goes, anything in excess is bad, thus excessive vitamin consumption could lead to a variety of health issues. The market is booming, because of a growing number of health-conscious consumers who want supplements in easy-to-consume dose forms. The quick rate of social and technological change has resulted in unhealthy and stressful lives, leading to an increase in the prevalence of CVDs and heart issues. The desire to live longer and healthier lives, as well as the apparent ability to do so, is a major motivator for preventive health interventions. Gummies have become a more appealing alternative to delivering VMS due to innovation and taste, and as a result, people are switching from traditional pills to gummies. In this case, consumers are overcoming pill tiredness and swallowing difficulties.

Restraints:

Excessive Consumption leads Health Issues

The additional sugars in gummy vitamins give them a sweet taste. It's important to remember that too much added sugar can lead to tooth decay, heart disease, and obesity. Although the sugar in gummy vitamins is not in enormous quantities, taking more than one gummy vitamin per day and eating other meals with added sugars might contribute to excessive sugar consumption. Gummy vitamins have lower vitamin content than traditional multivitamins, making them ineffective and adding sugar to your diet. The delightful taste of gummy vitamins can lead to overdosing and vitamin and mineral toxicity, which can be harmful to your body. Thus, these factors have affected the growth of the gummy market during the forecast period.

Opportunities:

New Innovation and Technology Creates the Growth Opportunities

The transition from gelatin and sugar gummies to vegan, sugar-free, and organic fruit-based gummies is projected to open up new business prospects. Solely, for example, debuted Organic Whole Fruit Gummies exclusively at Whole Foods Market stores nationally in January 2021. Only two or three components make up Solely Organic Whole Fruit Gummies: real whole fruit, Vitamin C, and nothing else. Each pouch contains 0.7 oz. of fruit and has a calorie count of 60-70.

Market Segmentation

By application, the vitamins segment is expected to dominate the gummy market during the forecast period. Gummy vitamins are chewable vitamins that resemble gummy sweets in taste, flavor, color, shape, and size. These gummies, on the other hand, are fortified with vitamins to provide end-users with a variety of health benefits. Gummy vitamins have recently gained a lot of popularity around the world. It was created to increase the number of customers in the children's section. Adults and consumers in older age groups, on the other hand, have shown interest in ingesting gummy vitamins, leading to an increase in global consumption. According to a study published in the European Journal of Clinical Pharmacology, over 30% of customers have trouble swallowing tablets, with the majority of them being women and older persons, which supports the rise in demand for vitamin-infused candies.

By end-use, the adults' segment is expected to capture the maximum market share over the forecast period. Over the forecast period, the growing demand for convenient dietary supplements from working professionals, sports enthusiasts, and the elderly and pregnant women is likely to boost the adult end-user segment's growth. Consumer preferences have evolved toward botanicals as a result of the clean label and organic product trends. Because of its anti-inflammatory and anti-cancer capabilities, consumers are willing to pay more for supplements with such health claims.

By distribution channel, the offline segment is anticipated to hold a significant market share over the assessment year. Hypermarkets and supermarkets, drugstores, pharmacies, specialized stores, and others, such as convenience stores, general stores, and grocery stores, make up the offline category. Gummy manufacturers prefer to sell through these channels because they have a wider reach across regions and nations, allowing them to meet the needs of a bigger client base. Additionally, as the number of store-based channels expands, sales and demand for these gummies are expected to rise. As a result, the offline category is expected to develop at a healthy rate and has a huge opportunity to attract new customers during the forecast period.

Players Covered in Gummy market are :

- Nestle S.A.

- NutraStar Manufacturing Ltd.

- Supplement Factory Ltd.

- Procaps Group

- Santa Cruz Nutritionals

- Better Nutritionals

- Amapharm

- Herbaland Canada

- Vitux AS

- Boscogen Inc.

- Lexicare Pharma Pvt. Ltd.

- Bettera Brands LLC

- Vitakem Nutraceutical Inc.

- Nature's Truth

- Prime Health Ltd.

- AJES Pharmaceuticals LLC

- Lactonova

- Well Aliments

- SMPNutra

- Superior Supplement Manufacturing

- Allseps Pty. Ltd.

- Bayer AG and other major players.

Regional Analysis for the Gummy Market:

The global gummy supplements market is likely to be driven by the North American region, which has been witnessing a significant year-on-year growth rate. A significant driver driving the growth of the gummy supplement market is the rising demand for vitamin C and vitamin D supplements, as well as goods for heart health, stamina, and bone health. Furthermore, goods designed exclusively for children are spurring innovation, particularly those that address immunological and gastrointestinal health, which are projected to gain popularity in the coming years. The North American market may also see a surge in demand for vegan/plant-based products in a variety of fruit tastes, which might help the region's industry, grow.

Growing public knowledge of the benefits of dietary supplements is one of the primary factors driving demand for vitamin-enriched gummies in Europe. Furthermore, a large portion of this region receives less sunlight and experiences long winters and autumns, resulting in vitamin D insufficiency in both adults and children. As a result, demand for vitamin D-enriched supplements is increasing, and so demand for gummy vitamins is expected to increase in this region. The existence of certain major gummy manufacturers, as well as strict government controls, is expected to help the regional gummy market flourish. Moreover, the switching preference of consumers towards the incorporation of healthy food alternatives is a crucial factor in fastening the demand for gummies in this region.

A growing health-conscious consumer base in the Asia Pacific, as well as an increase in dietary supplement usage, will drive regional market expansion. Product demand is being driven by countries such as India, China, and Indonesia. Consumer spending power is increasing, and different brands are becoming more accessible, generating a stronger market scenario for industry growth in these countries.

Key Industry Developments in the Gummy Market:

- In 2021, In Canada, Bayer AG introduced its new RestoraFIBRE® Daily Gummies. Fiber is easily accessible in these gummies. Inulin, soluble fiber and prebiotic that aids in the growth of healthy bacteria in the gut, is found in RestoraFIBREDaily Gummies.

- In 2021, Nature's Truth has announced the addition of three new vitamin gummy products aimed at children's requirements to its vitamin gummy portfolio. Children's multivitamin gummies, Vitamin C gummies, and elderberry gummies are among the products available. The new gummies are vegetarian, non-GMO, gluten-free, dairy-free, and flavorless.

COVID-19 Impact on the Gummy Market:

Due to the obvious concentration of several significant players operating here, the North American region, followed by Europe and the Asia Pacific, plays a critical role in the gummy industry. Because of the COVID-19 lockout and restrictions, the supply from these locations is hampered, limiting the movement of commodities. The COVID-19 situation has had an effect on the gummy industry as a whole, with many outlets closing or limiting their hours of operation. In reaction to the pandemic, Walmart said that it will change its store hours, while other retailers prepared to temporarily close their stores. Many businesses shortened their working hours to allow personnel to refill goods and clean stores overnight. However, it is projected that regional consumption would increase, particularly as sales in supermarkets and hypermarkets increase. Furthermore, vitamin consumption, such as vitamin C and vitamin D, is linked to improved immunity, which will drive up demand for gummy vitamins. Furthermore, as people become more concerned about their health and become more aware of the benefits of immune boosters and other critical vitamins, demand for vitamin-induced goods in gummy formats is expected to skyrocket. The convenience given by gummy products, as well as the growing number of consumers suffering from pill-swallowing challenges, have all contributed to the expansion of the gummy format. Because of the aforementioned considerations, online distributors are seeing a spike in interest as consumers look for retail options they can access from the comfort of their own homes.

|

Global Gummy Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 15.90 Bn. |

|

Forecast Period 2022-28 CAGR: |

9.2% |

Market Size in 2028: |

USD 29.44 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By End Users |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Application

3.2 By End Users

3.3 By Distribution Channels

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Gummy Market by Application

5.1 Gummy Market Overview Snapshot and Growth Engine

5.2 Gummy Market Overview

5.3 Vitamins

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Vitamins: Grographic Segmentation

5.4 Omega Fatty Acids

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Omega Fatty Acids: Grographic Segmentation

5.5 Minerals

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Minerals: Grographic Segmentation

5.6 Proteins

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Proteins: Grographic Segmentation

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Grographic Segmentation

Chapter 6: Gummy Market by End Users

6.1 Gummy Market Overview Snapshot and Growth Engine

6.2 Gummy Market Overview

6.3 Adults

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Adults: Grographic Segmentation

6.4 Kids

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Kids: Grographic Segmentation

Chapter 7: Gummy Market by Distribution Channels

7.1 Gummy Market Overview Snapshot and Growth Engine

7.2 Gummy Market Overview

7.3 Online

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Online: Grographic Segmentation

7.4 Offline

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Offline: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Gummy Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Gummy Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Gummy Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 NESTLE S.A.

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 NUTRASTAR MANUFACTURING LTD.

8.4 SUPPLEMENT FACTORY LTD.

8.5 PROCAPS GROUP

8.6 SANTA CRUZ NUTRITIONALS

8.7 BETTER NUTRITIONALS

8.8 AMAPHARM

8.9 HERBALAND CANADA

8.10 VITUX AS

8.11 BOSCOGEN INC.

8.12 LEXICARE PHARMA PVT. LTD.

8.13 BETTERA BRANDS LLC

8.14 VITAKEM NUTRACEUTICAL INC.

8.15 NATURE'S TRUTH

8.16 PRIME HEALTH LTD.

8.17 AJES PHARMACEUTICALS LLC

8.18 LACTONOVA

8.19 WELL ALIMENTS

8.20 SMPNUTRA

8.21 SUPERIOR SUPPLEMENT MANUFACTURING

8.22 ALLSEPS PTY. LTD.

8.23 BAYER AG

8.24 OTHER MAJOR PLAYERS

Chapter 9: Global Gummy Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Application

9.2.1 Vitamins

9.2.2 Omega Fatty Acids

9.2.3 Minerals

9.2.4 Proteins

9.2.5 Others

9.3 Historic and Forecasted Market Size By End Users

9.3.1 Adults

9.3.2 Kids

9.4 Historic and Forecasted Market Size By Distribution Channels

9.4.1 Online

9.4.2 Offline

Chapter 10: North America Gummy Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Application

10.4.1 Vitamins

10.4.2 Omega Fatty Acids

10.4.3 Minerals

10.4.4 Proteins

10.4.5 Others

10.5 Historic and Forecasted Market Size By End Users

10.5.1 Adults

10.5.2 Kids

10.6 Historic and Forecasted Market Size By Distribution Channels

10.6.1 Online

10.6.2 Offline

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Gummy Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Application

11.4.1 Vitamins

11.4.2 Omega Fatty Acids

11.4.3 Minerals

11.4.4 Proteins

11.4.5 Others

11.5 Historic and Forecasted Market Size By End Users

11.5.1 Adults

11.5.2 Kids

11.6 Historic and Forecasted Market Size By Distribution Channels

11.6.1 Online

11.6.2 Offline

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Gummy Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Application

12.4.1 Vitamins

12.4.2 Omega Fatty Acids

12.4.3 Minerals

12.4.4 Proteins

12.4.5 Others

12.5 Historic and Forecasted Market Size By End Users

12.5.1 Adults

12.5.2 Kids

12.6 Historic and Forecasted Market Size By Distribution Channels

12.6.1 Online

12.6.2 Offline

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Gummy Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Application

13.4.1 Vitamins

13.4.2 Omega Fatty Acids

13.4.3 Minerals

13.4.4 Proteins

13.4.5 Others

13.5 Historic and Forecasted Market Size By End Users

13.5.1 Adults

13.5.2 Kids

13.6 Historic and Forecasted Market Size By Distribution Channels

13.6.1 Online

13.6.2 Offline

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Gummy Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Application

14.4.1 Vitamins

14.4.2 Omega Fatty Acids

14.4.3 Minerals

14.4.4 Proteins

14.4.5 Others

14.5 Historic and Forecasted Market Size By End Users

14.5.1 Adults

14.5.2 Kids

14.6 Historic and Forecasted Market Size By Distribution Channels

14.6.1 Online

14.6.2 Offline

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Gummy Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 15.90 Bn. |

|

Forecast Period 2022-28 CAGR: |

9.2% |

Market Size in 2028: |

USD 29.44 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By End Users |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. GUMMY MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. GUMMY MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. GUMMY MARKET COMPETITIVE RIVALRY

TABLE 005. GUMMY MARKET THREAT OF NEW ENTRANTS

TABLE 006. GUMMY MARKET THREAT OF SUBSTITUTES

TABLE 007. GUMMY MARKET BY APPLICATION

TABLE 008. VITAMINS MARKET OVERVIEW (2016-2028)

TABLE 009. OMEGA FATTY ACIDS MARKET OVERVIEW (2016-2028)

TABLE 010. MINERALS MARKET OVERVIEW (2016-2028)

TABLE 011. PROTEINS MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. GUMMY MARKET BY END USERS

TABLE 014. ADULTS MARKET OVERVIEW (2016-2028)

TABLE 015. KIDS MARKET OVERVIEW (2016-2028)

TABLE 016. GUMMY MARKET BY DISTRIBUTION CHANNELS

TABLE 017. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 018. OFFLINE MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA GUMMY MARKET, BY APPLICATION (2016-2028)

TABLE 020. NORTH AMERICA GUMMY MARKET, BY END USERS (2016-2028)

TABLE 021. NORTH AMERICA GUMMY MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 022. N GUMMY MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE GUMMY MARKET, BY APPLICATION (2016-2028)

TABLE 024. EUROPE GUMMY MARKET, BY END USERS (2016-2028)

TABLE 025. EUROPE GUMMY MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 026. GUMMY MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC GUMMY MARKET, BY APPLICATION (2016-2028)

TABLE 028. ASIA PACIFIC GUMMY MARKET, BY END USERS (2016-2028)

TABLE 029. ASIA PACIFIC GUMMY MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 030. GUMMY MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA GUMMY MARKET, BY APPLICATION (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA GUMMY MARKET, BY END USERS (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA GUMMY MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 034. GUMMY MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA GUMMY MARKET, BY APPLICATION (2016-2028)

TABLE 036. SOUTH AMERICA GUMMY MARKET, BY END USERS (2016-2028)

TABLE 037. SOUTH AMERICA GUMMY MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 038. GUMMY MARKET, BY COUNTRY (2016-2028)

TABLE 039. NESTLE S.A.: SNAPSHOT

TABLE 040. NESTLE S.A.: BUSINESS PERFORMANCE

TABLE 041. NESTLE S.A.: PRODUCT PORTFOLIO

TABLE 042. NESTLE S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. NUTRASTAR MANUFACTURING LTD.: SNAPSHOT

TABLE 043. NUTRASTAR MANUFACTURING LTD.: BUSINESS PERFORMANCE

TABLE 044. NUTRASTAR MANUFACTURING LTD.: PRODUCT PORTFOLIO

TABLE 045. NUTRASTAR MANUFACTURING LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. SUPPLEMENT FACTORY LTD.: SNAPSHOT

TABLE 046. SUPPLEMENT FACTORY LTD.: BUSINESS PERFORMANCE

TABLE 047. SUPPLEMENT FACTORY LTD.: PRODUCT PORTFOLIO

TABLE 048. SUPPLEMENT FACTORY LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. PROCAPS GROUP: SNAPSHOT

TABLE 049. PROCAPS GROUP: BUSINESS PERFORMANCE

TABLE 050. PROCAPS GROUP: PRODUCT PORTFOLIO

TABLE 051. PROCAPS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. SANTA CRUZ NUTRITIONALS: SNAPSHOT

TABLE 052. SANTA CRUZ NUTRITIONALS: BUSINESS PERFORMANCE

TABLE 053. SANTA CRUZ NUTRITIONALS: PRODUCT PORTFOLIO

TABLE 054. SANTA CRUZ NUTRITIONALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. BETTER NUTRITIONALS: SNAPSHOT

TABLE 055. BETTER NUTRITIONALS: BUSINESS PERFORMANCE

TABLE 056. BETTER NUTRITIONALS: PRODUCT PORTFOLIO

TABLE 057. BETTER NUTRITIONALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. AMAPHARM: SNAPSHOT

TABLE 058. AMAPHARM: BUSINESS PERFORMANCE

TABLE 059. AMAPHARM: PRODUCT PORTFOLIO

TABLE 060. AMAPHARM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. HERBALAND CANADA: SNAPSHOT

TABLE 061. HERBALAND CANADA: BUSINESS PERFORMANCE

TABLE 062. HERBALAND CANADA: PRODUCT PORTFOLIO

TABLE 063. HERBALAND CANADA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. VITUX AS: SNAPSHOT

TABLE 064. VITUX AS: BUSINESS PERFORMANCE

TABLE 065. VITUX AS: PRODUCT PORTFOLIO

TABLE 066. VITUX AS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. BOSCOGEN INC.: SNAPSHOT

TABLE 067. BOSCOGEN INC.: BUSINESS PERFORMANCE

TABLE 068. BOSCOGEN INC.: PRODUCT PORTFOLIO

TABLE 069. BOSCOGEN INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. LEXICARE PHARMA PVT. LTD.: SNAPSHOT

TABLE 070. LEXICARE PHARMA PVT. LTD.: BUSINESS PERFORMANCE

TABLE 071. LEXICARE PHARMA PVT. LTD.: PRODUCT PORTFOLIO

TABLE 072. LEXICARE PHARMA PVT. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. BETTERA BRANDS LLC: SNAPSHOT

TABLE 073. BETTERA BRANDS LLC: BUSINESS PERFORMANCE

TABLE 074. BETTERA BRANDS LLC: PRODUCT PORTFOLIO

TABLE 075. BETTERA BRANDS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. VITAKEM NUTRACEUTICAL INC.: SNAPSHOT

TABLE 076. VITAKEM NUTRACEUTICAL INC.: BUSINESS PERFORMANCE

TABLE 077. VITAKEM NUTRACEUTICAL INC.: PRODUCT PORTFOLIO

TABLE 078. VITAKEM NUTRACEUTICAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. NATURE'S TRUTH: SNAPSHOT

TABLE 079. NATURE'S TRUTH: BUSINESS PERFORMANCE

TABLE 080. NATURE'S TRUTH: PRODUCT PORTFOLIO

TABLE 081. NATURE'S TRUTH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. PRIME HEALTH LTD.: SNAPSHOT

TABLE 082. PRIME HEALTH LTD.: BUSINESS PERFORMANCE

TABLE 083. PRIME HEALTH LTD.: PRODUCT PORTFOLIO

TABLE 084. PRIME HEALTH LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. AJES PHARMACEUTICALS LLC: SNAPSHOT

TABLE 085. AJES PHARMACEUTICALS LLC: BUSINESS PERFORMANCE

TABLE 086. AJES PHARMACEUTICALS LLC: PRODUCT PORTFOLIO

TABLE 087. AJES PHARMACEUTICALS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. LACTONOVA: SNAPSHOT

TABLE 088. LACTONOVA: BUSINESS PERFORMANCE

TABLE 089. LACTONOVA: PRODUCT PORTFOLIO

TABLE 090. LACTONOVA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. WELL ALIMENTS: SNAPSHOT

TABLE 091. WELL ALIMENTS: BUSINESS PERFORMANCE

TABLE 092. WELL ALIMENTS: PRODUCT PORTFOLIO

TABLE 093. WELL ALIMENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. SMPNUTRA: SNAPSHOT

TABLE 094. SMPNUTRA: BUSINESS PERFORMANCE

TABLE 095. SMPNUTRA: PRODUCT PORTFOLIO

TABLE 096. SMPNUTRA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. SUPERIOR SUPPLEMENT MANUFACTURING: SNAPSHOT

TABLE 097. SUPERIOR SUPPLEMENT MANUFACTURING: BUSINESS PERFORMANCE

TABLE 098. SUPERIOR SUPPLEMENT MANUFACTURING: PRODUCT PORTFOLIO

TABLE 099. SUPERIOR SUPPLEMENT MANUFACTURING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. ALLSEPS PTY. LTD.: SNAPSHOT

TABLE 100. ALLSEPS PTY. LTD.: BUSINESS PERFORMANCE

TABLE 101. ALLSEPS PTY. LTD.: PRODUCT PORTFOLIO

TABLE 102. ALLSEPS PTY. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. BAYER AG: SNAPSHOT

TABLE 103. BAYER AG: BUSINESS PERFORMANCE

TABLE 104. BAYER AG: PRODUCT PORTFOLIO

TABLE 105. BAYER AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 106. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 107. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 108. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. GUMMY MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. GUMMY MARKET OVERVIEW BY APPLICATION

FIGURE 012. VITAMINS MARKET OVERVIEW (2016-2028)

FIGURE 013. OMEGA FATTY ACIDS MARKET OVERVIEW (2016-2028)

FIGURE 014. MINERALS MARKET OVERVIEW (2016-2028)

FIGURE 015. PROTEINS MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. GUMMY MARKET OVERVIEW BY END USERS

FIGURE 018. ADULTS MARKET OVERVIEW (2016-2028)

FIGURE 019. KIDS MARKET OVERVIEW (2016-2028)

FIGURE 020. GUMMY MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 021. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 022. OFFLINE MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA GUMMY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE GUMMY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC GUMMY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA GUMMY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA GUMMY MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Gummy Market research report is 2022-2028.

Nestle S.A., NutraStar Manufacturing Ltd., Supplement Factory Ltd., Procaps Group, Santa Cruz Nutritionals, Better Nutritionals, Amapharm, Herbaland Canada, Vitux AS, Boscogen Inc., Lexicare Pharma Pvt. Ltd., Bettera Brands LLC, Vitakem Nutraceutical Inc., Nature's Truth, Prime Health Ltd., AJES Pharmaceuticals LLC, Lactonova, Well Aliments, SMPNutra.com, Superior Supplement Manufacturing, Allseps Pty. Ltd., Bayer AG, and other major players.

The Gummy Market is segmented into Application, End Users, Distribution Channel, and region. By Application, the market is categorized into Vitamins, Omega Fatty Acids, Minerals, Proteins, and Others. By End Users, the market is categorized into Adults and Kids. By Distribution Channel, the market is categorized into Online and Offline. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Gummies, also known as gummy candies, gummy candies, or jelly sweets, are gelatin-based chewable treats.

The Gummy Market was valued at USD 15.90 Billion in 2021 and is projected to reach USD 29.44 Billion by 2028, growing at a CAGR of 9.2% from 2022 to 2028.