Global Electric Vehicle Fast-Charging System Market Overview

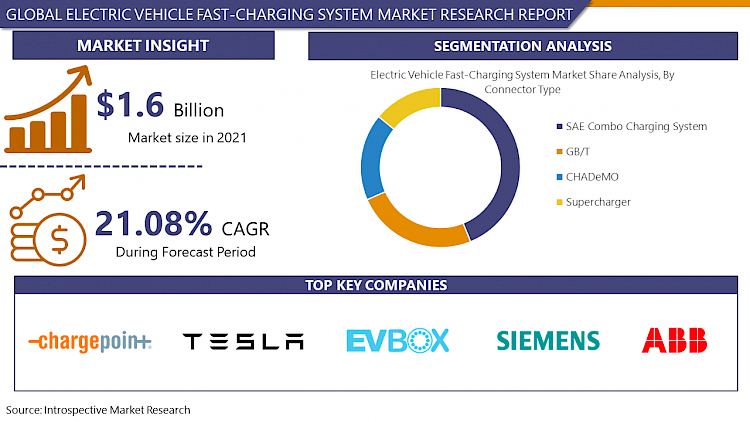

Global Electric Vehicle Fast-Charging System Market Size Was Valued at USD 1.60 Billion in 2021, and is Projected to Reach USD 6.10 Billion by 2028, Growing at A CAGR of 21.08% From 2022 to 2028.

Fast charging systems for electric vehicles are becoming increasingly important to facilitate the transition to zero-emission mobility. The dominant fast charging power for passenger vehicles was 50 kW, while the most recent systems enable charging at speeds of at least 175 kW or even 350 kW. In commercial and logistic fleets, even higher fast charging rates are applied (up to 1 MW)—such as for buses and heavy-duty trucks. Such systems enable much smoother long-distance travel for electric vehicles (EVs) with shorter charging times and more efficient utilization of the stations from a business perspective. DCFC is the fastest of the three levels, making it excellent for long-distance travel with frequent stops for recharging. DCFC could be the key for EV users to take longer road trips and travel further along America's highways in a more practical and time-efficient manner as EV ranges get longer and EV infrastructure becomes more common. Hence, Electric Vehicle Fast-Charging System Market is expected to be booming during the forecasted period.

Market Dynamics And Factors For Electric Vehicle Fast-Charging System Market

Drivers:

Rising Adoption of Evs All Over The Globe

E-mobility has reached a fork in the road. Over 250 new battery-electric automobiles (BEV) and plug-in hybrid electric vehicles (PHEV) will be produced in the next two years, with up to 130 million EVs on the road worldwide by 2030. To maintain these figures, far more price will be required—and it will not be cheap. According to Mckinsey, an estimated $110 billion to $180 billion will be required between 2020 and 2030 to accommodate global demand for EV charging stations in both public and private settings. By the end of 2020, 10 million electric cars would be on the road around the world, following a decade of rapid growth. Despite a global downturn in automotive sales due to the pandemic, which saw global car sales drop by 16 percent in 2020, electric car registrations increased by 41%. Europe overtook the People's Republic of China ("China") as the world's largest electric vehicle (EV) market for the first time, selling about 3 million vehicles (a 4.6 percent market share). In important markets, electric bus and truck registrations also climbed, reaching 600,000 and 31,000 global stocks, respectively. As a result, such a figure shows that the adoption rate of electric vehicles is increasing, which is projected to boost the market for Electric Vehicle Fast-Charging systems.

Restraints:

Excessive Fast Charging Can Reduce The Life of An EV Battery

One major disadvantage of fast charging technology is that it frequently falls to the manufacturer to put up a charging infrastructure. Companies like Ola Electric have the capital to build a large network, but smaller businesses will find it difficult. Furthermore, the charging mechanism must be standardized to allow several manufacturers to use the same charging method. In places with intense heat, fast charging may not be possible, especially if the batteries are passively cooled. This will have a detrimental impact on the battery's entire life cycle. Fast charging tends to shorten the life of a battery faster than slow charging, so frequent use of this technology may be harmful to the battery's health. As a result, those who usually use slow charging may need to replace the battery pack sooner.

Opportunities:

Fast Charging Infrastructure Development Opportunity For Long-Distance Travel

Although fast-charging stations presently play a significant role in meeting long-distance recharging needs, future increases in charging speeds may alter their utility. In China's major cities, such as Beijing, as many fast-charging stations as level 2 charging stations have already been installed. This is an attempt to meet the needs of urban EV drivers who do not have access to a private parking space and consequently a dedicated charging station. Although the limited charging speeds imply that such an alternative is not currently favored by EV drivers, such preferences may change in the future. Most automobiles can only charge at speeds of up to 100 kW, resulting in charging periods of more than 30 minutes to fill the car to 80% capacity. These longer charging durations have led to a preference for charging when parked. With increased battery capacity and improved battery management systems, it is expected that EVs would be able to charge at faster rates. If charging times are reduced dramatically, EV drivers may shift their preferences toward fast charging.

Challenges:

Limited Fast Charging System/Infrastructure

The number of charging sessions required by an electric car is influenced by its battery technology. While some electric vehicles have long ranges, others may only be able to travel a short distance on a single charge. The number of public charging stations required in a given location is determined by this. The capacity of charging stations, on the other hand, determines the charging time for electric vehicles. Regular AC charging outlets can supply Level 1 (equivalent to a US household plug) or Level 2 charging capacity (240 volts). However, it takes longer when compared to a rapid Level 3 DC charging outlet. Integrating several types of chargers into a one-stop solution on a wide scale can be difficult for Electric Vehicle Fast-Charging System providers.

Segmentation Analysis of Electric Vehicle Fast-Charging System Market

By Power, >200 KW segment is expected to be dominating in the Electric Vehicle Fast-Charging System Market. The fast-charging system above 200 KW is also referred to as high-power charging. HPC allows for faster charging with more power, typically up to 100, 150, or 200 kilowatts, depending on the vehicle. Audi e-Tron, Tesla Model 3, and Porsche Taycan have the highest charging power. In ideal conditions, charging time for 100 kilometers of driving distance is about 5-10 minutes. Depending on the vehicle and charging parameters such as battery temperature, HPC reduces charging time by 20%–70%. The charging port is a standard CC. The cables are liquid-cooled, and the connectors are frequently marked "HPC." Because HPC is backward compatible, it may charge any electric vehicle with a CCS plug, including older models. HPC chargers use RFID tags and mobile apps in the same manner that conventional chargers do. HPC is available in two voltages: 400 volts and 800 volts. Only the Porsche Taycan can charge utilizing a new 800-volt system with up to 270 kilowatts, which is compatible with all vehicles. Current HPC installations have a maximum capacity of 350 kilowatts, with considerably higher powers anticipated for future EVs.

By Connector Type, CHADeMO dominates the EV fast-charging system market. The CHAdeMO charging system was developed by Tokyo Electric Power Co. Between 2006 and 2009, TEPCO worked on several EV infrastructure initiatives with Nissan, Mitsubishi, and Subaru (amongst others). CHAdeMO was the first in the world to offer a standardized DC rapid charge solution as the public infrastructure on the roadside that could be shared by EVs of all brands and models. Newer CHAdeMO units have a lower footprint and may be placed with minimal civil engineering work in many existing parking lots. Furthermore, CHAdeMO chargers have grown significantly more inexpensive in recent years. In comparison to other options, the CHAdeMO fast-charging system provides an excellent cost-to-performance ratio.

By Application, the Public segment is likely to dominate the Electric Vehicle Fast-Charging System Market. Governments all over the world are promoting electric vehicles by investing extensively in the expansion of EV charging infrastructure to attract more people to them. By 2020, there will be 1.3 million publicly available slow and rapid chargers. Slow charger (charging power below 22 kW) installations climbed by 65 percent in China in 2020, to around 500 000 publicly accessible slow chargers. In Europe, fast chargers are being adopted at a faster rate than slow chargers. Around 38 000 public fast chargers are now available, up 55% from 2020, with over 7,500 in Germany and 6,200 in the United States. There are 4,000 in the United Kingdom, 4,000 in France, and 2,000 in the Netherlands. In the United States, there are 17 000 fast chargers, with Tesla accounting for roughly 60%, and 9800 fast chargers and superchargers in Korea.

Regional Analysis of Electric Vehicle Fast-Charging System Market

The European region is dominating the Electric Vehicle Fast-Charging System Market. Electric car sales in Europe were much greater as a result of current legislative support programs. Global market conditions were dramatically different in the second half of 2020 when lockdowns were eased for a time and the automobile sector began to recover. Electric vehicle sales in all major markets, including China, India, the European Union, Korea, the United States, and the United Kingdom, exceeded monthly sales every month between July and December 2019. Certain countries, such as Canada, Japan, and others, experienced a loss in income as demand for new autos and manufacturing were badly impacted. During pandemics and lockdowns, the deployment of electric vehicle charging infrastructure has been delayed. Since the prohibition has been lifted, several countries have begun to expand their charging infrastructures in collaboration with corporate and public entities, resulting in a surge in the Electric Vehicle Fast-Charging System market.

The Electric Vehicle Fast-Charging System Market is predicted to develop at the quickest rate in North America. With the rising number of service providers such as Tesla (Superchargers & Destination), ChargePoint, Blink (CarCharging), SemaConnect / SemaCharge, EVgo, GE WattStation, and Electrify America / Electrify Canada, North America, Canada, and the United States have seen tremendous growth in EV charging infrastructure. In terms of cost, charging at home is roughly 30% less expensive than charging at a public charger, and traveling 100 km (62 miles) on electricity is 6 times less expensive than driving on gas in Quebec. Charging at home costs about 65 percent less than charging at a public charger in Ontario, and traveling 100 km (62 miles) on electricity costs 5 times less than driving on gasoline. Everything in the United States is determined by the price of oil and gas. The consumption of an electric vehicle in kWh/100 miles multiplied by the cost of a kWh vs the consumption of a gas automobile in gallons/100 miles multiplied by the price of a gallon of gas. As a result, North America is projected to see a significant increase in Electric Vehicle Fast-Charging System Market.

COVID-19 Impact Analysis on Electric Vehicle Fast-Charging System Market

The widespread outbreak of the novel coronavirus resulted in a sharp drop in non-essential item import-export, and only a small percentage of the workforce was allowed to work in the factories. Global electric car sales in the first half of FY2020 were much lower than in the same period in 2019. Europe was a notable exception, as electric car sales were significantly higher due to existing legislative support programs. In the second half of 2020, global market dynamics were markedly different, as lockdowns were eased for a period and the car sector began to revive. Between July and December 2019, monthly sales of electric automobiles in all major markets, including China, India, the European Union, Korea, the United States, and the United Kingdom, exceeded every month. However, certain nations, such as Canada, Japan, and others, saw a drop in income as both demands for new automobiles and manufacturing were severely hit. The rollout of electric vehicle charging infrastructure has been slow during pandemic and lockdown situations. Since the restriction is being lifted, many countries ramp up the charging infrastructures in association with private and public players which will boost the Electric Vehicle Fast-Charging System Market.

Players Covered in Electric Vehicle Fast-Charging System Market are

- ABB

- Blink Charging Co.

- BP Chargemaster Ltd

- Broadband TelCom Power Inc.

- ChargePoint Inc.

- Delta Electronics Inc.

- Efacec Electric Mobility

- Signet EV Inc.

- EVBox

- ShenZhen SETEC Power Co. Ltd.

- Siemens

- Star Charge

- Tesla Inc.

- Tritium Pty Ltd

- Xi'an TGOOD Intelligent Charging Technology Co Ltd and other major players.

Key Industry Developments In Electric Vehicle Fast-Charging System Market

In September 2021, ABB has unveiled a revolutionary all-in-one electric vehicle (EV) charger that offers the industry's fastest charging experience. The Terra 360 from ABB is a modular charger that can charge up to four vehicles at once with dynamic power distribution.

July 2020, Over the next five years, GM and EVgo plan to increase the size of the nation's largest public fast-charging network by adding more than 2,700 new fast chargers, which will assist drive wider adoption of electric vehicles.

|

Global Electric Vehicle Fast-Charging System Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2021: |

USD 1.60 Bn. |

|

Forecast Period 2022-28 CAGR: |

21.08 % |

Market Size in 2028: |

USD 1.60 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Connector Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Power

3.2 By Connector Type

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Electric Vehicle Fast-Charging System Market by Power

4.1 Electric Vehicle Fast-Charging System Market Overview Snapshot and Growth Engine

4.2 Electric Vehicle Fast-Charging System Market Overview

4.3 <100 KW

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 <100 KW: Grographic Segmentation

4.4 100-200 KW

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 100-200 KW: Grographic Segmentation

4.5 >200 KW

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 >200 KW: Grographic Segmentation

Chapter 5: Electric Vehicle Fast-Charging System Market by Connector Type

5.1 Electric Vehicle Fast-Charging System Market Overview Snapshot and Growth Engine

5.2 Electric Vehicle Fast-Charging System Market Overview

5.3 SAE Combo Charging System

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 SAE Combo Charging System: Grographic Segmentation

5.4 GB/T

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 GB/T: Grographic Segmentation

5.5 CHADeMO

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 CHADeMO: Grographic Segmentation

5.6 Supercharger

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Supercharger: Grographic Segmentation

Chapter 6: Electric Vehicle Fast-Charging System Market by Application

6.1 Electric Vehicle Fast-Charging System Market Overview Snapshot and Growth Engine

6.2 Electric Vehicle Fast-Charging System Market Overview

6.3 Public

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Public: Grographic Segmentation

6.4 Private

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Private: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Electric Vehicle Fast-Charging System Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Electric Vehicle Fast-Charging System Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Electric Vehicle Fast-Charging System Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 ABB

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 BLINK CHARGING CO.

7.4 BP CHARGEMASTER LTD

7.5 BROADBAND TELCOM POWER

7.6 INC.

7.7 CHARGEPOINT INC.

7.8 DELTA ELECTRONICS

7.9 INC.

7.10 EFACEC ELECTRIC MOBILITY

7.11 SIGNET EV INC.

7.12 EVBOX

7.13 SHENZHEN SETEC POWER CO. LTD.

7.14 SIEMENS

7.15 STAR CHARGE

7.16 TESLA INC.

7.17 TRITIUM PTY LTD

7.18 XI'AN TGOOD INTELLIGENT CHARGING TECHNOLOGY CO LTD.

Chapter 8: Global Electric Vehicle Fast-Charging System Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Power

8.2.1 <100 KW

8.2.2 100-200 KW

8.2.3 >200 KW

8.3 Historic and Forecasted Market Size By Connector Type

8.3.1 SAE Combo Charging System

8.3.2 GB/T

8.3.3 CHADeMO

8.3.4 Supercharger

8.4 Historic and Forecasted Market Size By Application

8.4.1 Public

8.4.2 Private

Chapter 9: North America Electric Vehicle Fast-Charging System Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Power

9.4.1 <100 KW

9.4.2 100-200 KW

9.4.3 >200 KW

9.5 Historic and Forecasted Market Size By Connector Type

9.5.1 SAE Combo Charging System

9.5.2 GB/T

9.5.3 CHADeMO

9.5.4 Supercharger

9.6 Historic and Forecasted Market Size By Application

9.6.1 Public

9.6.2 Private

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

Chapter 10: Europe Electric Vehicle Fast-Charging System Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Power

10.4.1 <100 KW

10.4.2 100-200 KW

10.4.3 >200 KW

10.5 Historic and Forecasted Market Size By Connector Type

10.5.1 SAE Combo Charging System

10.5.2 GB/T

10.5.3 CHADeMO

10.5.4 Supercharger

10.6 Historic and Forecasted Market Size By Application

10.6.1 Public

10.6.2 Private

10.7 Historic and Forecast Market Size by Country

10.7.1 Germany

10.7.2 U.K.

10.7.3 France

10.7.4 Italy

10.7.5 Russia

10.7.6 Spain

Chapter 11: Asia-Pacific Electric Vehicle Fast-Charging System Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Power

11.4.1 <100 KW

11.4.2 100-200 KW

11.4.3 >200 KW

11.5 Historic and Forecasted Market Size By Connector Type

11.5.1 SAE Combo Charging System

11.5.2 GB/T

11.5.3 CHADeMO

11.5.4 Supercharger

11.6 Historic and Forecasted Market Size By Application

11.6.1 Public

11.6.2 Private

11.7 Historic and Forecast Market Size by Country

11.7.1 China

11.7.2 India

11.7.3 Japan

11.7.4 Southeast Asia

Chapter 12: South America Electric Vehicle Fast-Charging System Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Power

12.4.1 <100 KW

12.4.2 100-200 KW

12.4.3 >200 KW

12.5 Historic and Forecasted Market Size By Connector Type

12.5.1 SAE Combo Charging System

12.5.2 GB/T

12.5.3 CHADeMO

12.5.4 Supercharger

12.6 Historic and Forecasted Market Size By Application

12.6.1 Public

12.6.2 Private

12.7 Historic and Forecast Market Size by Country

12.7.1 Brazil

12.7.2 Argentina

Chapter 13: Middle East & Africa Electric Vehicle Fast-Charging System Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Power

13.4.1 <100 KW

13.4.2 100-200 KW

13.4.3 >200 KW

13.5 Historic and Forecasted Market Size By Connector Type

13.5.1 SAE Combo Charging System

13.5.2 GB/T

13.5.3 CHADeMO

13.5.4 Supercharger

13.6 Historic and Forecasted Market Size By Application

13.6.1 Public

13.6.2 Private

13.7 Historic and Forecast Market Size by Country

13.7.1 Saudi Arabia

13.7.2 South Africa

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Electric Vehicle Fast-Charging System Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2021: |

USD 1.60 Bn. |

|

Forecast Period 2022-28 CAGR: |

21.08 % |

Market Size in 2028: |

USD 1.60 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Connector Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET BY POWER

TABLE 008. <100 KW MARKET OVERVIEW (2016-2028)

TABLE 009. 100-200 KW MARKET OVERVIEW (2016-2028)

TABLE 010. >200 KW MARKET OVERVIEW (2016-2028)

TABLE 011. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET BY CONNECTOR TYPE

TABLE 012. SAE COMBO CHARGING SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 013. GB/T MARKET OVERVIEW (2016-2028)

TABLE 014. CHADEMO MARKET OVERVIEW (2016-2028)

TABLE 015. SUPERCHARGER MARKET OVERVIEW (2016-2028)

TABLE 016. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET BY APPLICATION

TABLE 017. PUBLIC MARKET OVERVIEW (2016-2028)

TABLE 018. PRIVATE MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY POWER (2016-2028)

TABLE 020. NORTH AMERICA ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY CONNECTOR TYPE (2016-2028)

TABLE 021. NORTH AMERICA ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 022. N ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY POWER (2016-2028)

TABLE 024. EUROPE ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY CONNECTOR TYPE (2016-2028)

TABLE 025. EUROPE ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 026. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY POWER (2016-2028)

TABLE 028. ASIA PACIFIC ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY CONNECTOR TYPE (2016-2028)

TABLE 029. ASIA PACIFIC ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 030. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY POWER (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY CONNECTOR TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 034. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY POWER (2016-2028)

TABLE 036. SOUTH AMERICA ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY CONNECTOR TYPE (2016-2028)

TABLE 037. SOUTH AMERICA ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 038. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 039. ABB: SNAPSHOT

TABLE 040. ABB: BUSINESS PERFORMANCE

TABLE 041. ABB: PRODUCT PORTFOLIO

TABLE 042. ABB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. BLINK CHARGING CO.: SNAPSHOT

TABLE 043. BLINK CHARGING CO.: BUSINESS PERFORMANCE

TABLE 044. BLINK CHARGING CO.: PRODUCT PORTFOLIO

TABLE 045. BLINK CHARGING CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. BP CHARGEMASTER LTD: SNAPSHOT

TABLE 046. BP CHARGEMASTER LTD: BUSINESS PERFORMANCE

TABLE 047. BP CHARGEMASTER LTD: PRODUCT PORTFOLIO

TABLE 048. BP CHARGEMASTER LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. BROADBAND TELCOM POWER: SNAPSHOT

TABLE 049. BROADBAND TELCOM POWER: BUSINESS PERFORMANCE

TABLE 050. BROADBAND TELCOM POWER: PRODUCT PORTFOLIO

TABLE 051. BROADBAND TELCOM POWER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. INC.: SNAPSHOT

TABLE 052. INC.: BUSINESS PERFORMANCE

TABLE 053. INC.: PRODUCT PORTFOLIO

TABLE 054. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. CHARGEPOINT INC.: SNAPSHOT

TABLE 055. CHARGEPOINT INC.: BUSINESS PERFORMANCE

TABLE 056. CHARGEPOINT INC.: PRODUCT PORTFOLIO

TABLE 057. CHARGEPOINT INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. DELTA ELECTRONICS: SNAPSHOT

TABLE 058. DELTA ELECTRONICS: BUSINESS PERFORMANCE

TABLE 059. DELTA ELECTRONICS: PRODUCT PORTFOLIO

TABLE 060. DELTA ELECTRONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. INC.: SNAPSHOT

TABLE 061. INC.: BUSINESS PERFORMANCE

TABLE 062. INC.: PRODUCT PORTFOLIO

TABLE 063. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. EFACEC ELECTRIC MOBILITY: SNAPSHOT

TABLE 064. EFACEC ELECTRIC MOBILITY: BUSINESS PERFORMANCE

TABLE 065. EFACEC ELECTRIC MOBILITY: PRODUCT PORTFOLIO

TABLE 066. EFACEC ELECTRIC MOBILITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. SIGNET EV INC.: SNAPSHOT

TABLE 067. SIGNET EV INC.: BUSINESS PERFORMANCE

TABLE 068. SIGNET EV INC.: PRODUCT PORTFOLIO

TABLE 069. SIGNET EV INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. EVBOX: SNAPSHOT

TABLE 070. EVBOX: BUSINESS PERFORMANCE

TABLE 071. EVBOX: PRODUCT PORTFOLIO

TABLE 072. EVBOX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. SHENZHEN SETEC POWER CO. LTD.: SNAPSHOT

TABLE 073. SHENZHEN SETEC POWER CO. LTD.: BUSINESS PERFORMANCE

TABLE 074. SHENZHEN SETEC POWER CO. LTD.: PRODUCT PORTFOLIO

TABLE 075. SHENZHEN SETEC POWER CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. SIEMENS: SNAPSHOT

TABLE 076. SIEMENS: BUSINESS PERFORMANCE

TABLE 077. SIEMENS: PRODUCT PORTFOLIO

TABLE 078. SIEMENS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. STAR CHARGE: SNAPSHOT

TABLE 079. STAR CHARGE: BUSINESS PERFORMANCE

TABLE 080. STAR CHARGE: PRODUCT PORTFOLIO

TABLE 081. STAR CHARGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. TESLA INC.: SNAPSHOT

TABLE 082. TESLA INC.: BUSINESS PERFORMANCE

TABLE 083. TESLA INC.: PRODUCT PORTFOLIO

TABLE 084. TESLA INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. TRITIUM PTY LTD: SNAPSHOT

TABLE 085. TRITIUM PTY LTD: BUSINESS PERFORMANCE

TABLE 086. TRITIUM PTY LTD: PRODUCT PORTFOLIO

TABLE 087. TRITIUM PTY LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. XI'AN TGOOD INTELLIGENT CHARGING TECHNOLOGY CO LTD.: SNAPSHOT

TABLE 088. XI'AN TGOOD INTELLIGENT CHARGING TECHNOLOGY CO LTD.: BUSINESS PERFORMANCE

TABLE 089. XI'AN TGOOD INTELLIGENT CHARGING TECHNOLOGY CO LTD.: PRODUCT PORTFOLIO

TABLE 090. XI'AN TGOOD INTELLIGENT CHARGING TECHNOLOGY CO LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET OVERVIEW BY POWER

FIGURE 012. <100 KW MARKET OVERVIEW (2016-2028)

FIGURE 013. 100-200 KW MARKET OVERVIEW (2016-2028)

FIGURE 014. >200 KW MARKET OVERVIEW (2016-2028)

FIGURE 015. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET OVERVIEW BY CONNECTOR TYPE

FIGURE 016. SAE COMBO CHARGING SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 017. GB/T MARKET OVERVIEW (2016-2028)

FIGURE 018. CHADEMO MARKET OVERVIEW (2016-2028)

FIGURE 019. SUPERCHARGER MARKET OVERVIEW (2016-2028)

FIGURE 020. ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET OVERVIEW BY APPLICATION

FIGURE 021. PUBLIC MARKET OVERVIEW (2016-2028)

FIGURE 022. PRIVATE MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA ELECTRIC VEHICLE FAST-CHARGING SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Vehicle Fast-Charging System Market research report is 2022-2028.

ABB, Blink Charging Co., BP Chargemaster Ltd, Broadband TelCom Power, Inc., ChargePoint Inc., Delta Electronics, Inc., Efacec Electric Mobility, Signet EV Inc., EVBox, ShenZhen SETEC Power Co., Ltd., Siemens, Star Charge, Tesla Inc., Tritium Pty Ltd, Xi'an TGOOD Intelligent Charging Technology Co Ltd. And other major players.

The Electric Vehicle Fast-Charging System market is segmented into Power, Connector Type, Application, Region. By Power the market is categorized into <100 KW, 100-200 KW, >200 KW. By Connector Type the market is categorized into SAE Combo Charging System, GB/T, CHADeMO, Supercharger. By Application the market is categorized into Public, Private. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

Fast charging systems for electric vehicles are becoming increasingly important to facilitate the transition to zero-emission mobility. The dominant fast charging power for passenger vehicles was 50 kW, while the most recent systems enable charging at speeds of at least 175 kW or even 350 kW. In commercial and logistic fleets, even higher fast charging rates are applied (up to 1 MW)—such as for buses and heavy-duty trucks.

Global Electric Vehicle Fast-Charging System Market Size Was Valued at USD 1.60 Billion in 2021, and is Projected to Reach USD 6.10 Billion by 2028, Growing at A CAGR of 21.08% From 2022 to 2028.