Coherent Optical Equipment Market Synopsis

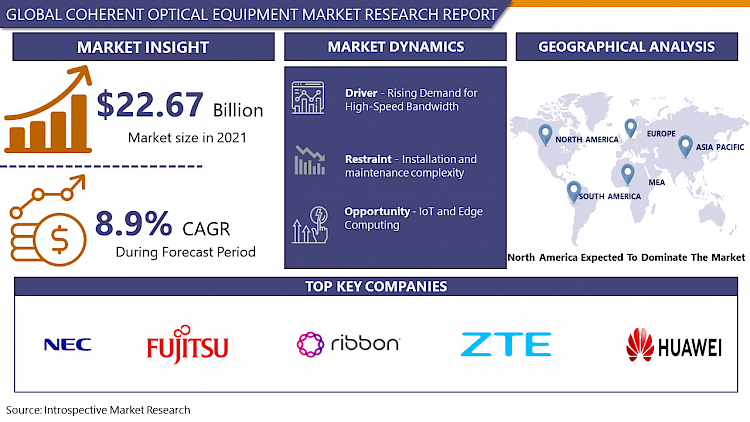

Coherent Optical Equipment Market Size Was Valued at USD 22.67 Billion in 2022, and is Projected to Reach USD 44.84 Billion by 2030, Growing at a CAGR of 8.9% From 2023-2030.

Coherent optical equipment refers to technology used in high-capacity optical communication networks. It employs coherent light, allowing for the simultaneous transmission of multiple data signals over long distances with minimal interference. This equipment utilizes modulation techniques to encode data onto optical carriers, enhancing signal quality and enabling high-speed, reliable data transfer. Its core components include coherent transmitters, receivers, and modulators that ensure precise signal detection and decoding.

- The applications of coherent optical equipment span various sectors, predominantly in telecommunications and networking. It's integral in long-haul and metro networks, enabling the rapid transmission of vast amounts of data, crucial for internet service providers, cloud services, and data centers. Additionally, coherent technology is increasingly vital in submarine communication systems, facilitating high-capacity data transmission across continents. The demand for higher bandwidth, lower latency, and more reliable connectivity continues to drive advancements in coherent optical equipment.

- Current trends in the market showcase a focus on enhancing transmission speeds, expanding network capacities, and reducing power consumption. Innovations are centred on increasing the data rates of coherent systems, deploying advanced modulation formats, and improving spectral efficiency. Moreover, there's a push toward integrating artificial intelligence and machine learning algorithms into coherent systems to optimize network performance and automate maintenance tasks. As data demands surge and technologies evolve, coherent optical equipment remains pivotal in shaping the backbone of modern communication networks.

Coherent Optical Equipment Market Trend Analysis

Rising Demand for High-Speed Bandwidth

- In the digital age, the consumption of data continues to soar exponentially due to various factors, including the proliferation of video streaming services, cloud computing, IoT devices, and the expansion of 5G networks. This surge in data consumption necessitates faster and more efficient data transmission capabilities, a need effectively met by coherent optical equipment.

- Industries reliant on data-intensive applications, such as telecommunications, media, healthcare, finance, and e-commerce, require robust and high-capacity networks to handle the ever-increasing volume of data traffic. Coherent optical technology addresses this demand by enabling the transmission of vast amounts of data at high speeds over long distances with minimal signal degradation.

- Moreover, the ongoing trend toward remote work, digital transformation, and the internet of things (IoT) amplifies the requirement for reliable, high-bandwidth networks. These networks serve as the backbone supporting seamless connectivity, ensuring rapid data transfer, and facilitating real-time communication across global locations. As businesses and consumers alike seek faster, more reliable data connections, the demand for coherent optical equipment continues to surge, making it an indispensable component in modern communication infrastructure. This escalating need for high-speed bandwidth solidifies the position of coherent optical equipment as a critical enabler of today's data-driven world.

IoT and Edge Computing

- IoT devices generate an immense volume of data at the network's edge, necessitating efficient data transmission and low-latency communication. Coherent optical solutions address these demands by enabling high-speed, reliable connectivity that efficiently manages and transports the substantial data flow originating from diverse IoT devices.

- As edge computing continues to gain prominence, pushing computational capabilities closer to the data source, coherent optical technology becomes instrumental in facilitating seamless connectivity between these edge devices and centralized data centers. This connectivity is vital for real-time data processing, analysis, and decision-making, especially in applications where minimal latency is critical, such as autonomous vehicles, smart grids, and healthcare systems.

- Moreover, the proliferation of smart cities, industrial automation, and connected enterprises further accentuates the need for robust, high-bandwidth networks that seamlessly link IoT devices and edge computing nodes. Coherent optical equipment offers the necessary infrastructure to support these interconnected ecosystems, ensuring efficient data transmission, low latency, and reliable connectivity at the network's edge. As industries increasingly rely on IoT and edge computing for innovative solutions, the demand for coherent optical equipment to underpin these networks continues to grow, positioning it as a key enabler of the IoT-driven digital landscape.

Coherent Optical Equipment Market Segment Analysis:

Coherent Optical Equipment Market Segmented on the basis of technology, equipment, application, and end-users.

By Equipment, WDM (Wavelength-division Multiplexer) segment is expected to dominate the market during the forecast period

- Within the coherent optical equipment market, the Wavelength-Division Multiplexing (WDM) segment is anticipated to maintain dominance during the forecast period. WDM technology allows multiple signals to be transmitted simultaneously across different wavelengths within a single optical fibre, effectively multiplying its capacity for data transmission.

- The widespread adoption of WDM stems from its ability to accommodate the surging demand for higher bandwidth in communication networks. By leveraging multiple wavelengths to carry distinct data streams concurrently, WDM significantly enhances network efficiency and capacity without the need for additional physical infrastructure.

- Moreover, continuous advancements in WDM technology, including the development of dense WDM (DWDM) and coherent WDM (C-WDM), further propel its market dominance. These advancements enable higher data rates, increased spectral efficiency, and improved performance in long-haul and metro networks.

- As data consumption continues to skyrocket across various industries, the inherent scalability and efficiency of WDM-based coherent optical equipment position it as a preferred choice for meeting the escalating demands for high-capacity, high-speed data transmission in modern communication networks. Hence, the WDM segment is poised to maintain its market dominance in the coherent optical equipment landscape.

By Application, Networking segment held the largest market share of 51% in 2022

- The Networking segment stands as the leading contributor, holding the largest market share in the coherent optical equipment landscape. This dominance is attributed to the indispensable role of coherent optical technology in building robust, high-capacity networks across various industries and applications.

- Networking applications encompass a broad spectrum, including long-haul and metro networks, data centre interconnects, submarine communication systems, and 5G infrastructure. Coherent optical equipment serves as the backbone of these networks, facilitating the efficient transmission of vast amounts of data at high speeds over extended distances.

- The escalating demand for faster data transmission, increased bandwidth, and reliable connectivity in telecommunications, cloud services, video streaming, IoT, and enterprise networking drives the prominence of coherent optical equipment within the Networking segment. As the need for seamless, high-performance networks continues to surge across diverse sectors, the networking segment remains pivotal, maintaining its substantial market share and driving innovations in coherent optical technology to meet evolving industry demands.

Coherent Optical Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is anticipated to maintain its dominant position in the coherent optical equipment market over the forecast period. This projection is underpinned by several factors, including the region's robust technological infrastructure, early adoption of advanced networking technologies, and substantial investments in communication networks.

- The continuous expansion of 5G networks, coupled with the burgeoning demand for high-speed data transmission in sectors such as telecommunications, cloud services, and data centers, drives the need for coherent optical equipment. North America's proactive approach to integrating cutting-edge technologies and its emphasis on network modernization further solidify its leading position in the coherent optical equipment landscape.

- Moreover, the presence of key market players, technological innovators, and significant research and development initiatives within the region fortify its dominance. These factors collectively position North America at the forefront of coherent optical equipment adoption, with the region expected to sustain its market leadership by continually embracing and driving advancements in high-capacity, high-speed optical communication networks.

Coherent Optical Equipment Market Top Key Players:

- Acacia Communications (US)

- Adva Optical Networking (Germany)

- Applied Optoelectronics, Inc.(US)

- Ciena Corporation (US)

- Cisco Systems, Inc. (US)

- Eci Telecom (Israel)

- Fujitsu Limited (Japan)

- Huawei Technologies Co., Ltd. (China)

- Ii-Vi Incorporated (US)

- Infinera Corporation (US)

- Lumentum Holdings Inc. (US)

- Marvell Technology, Inc. (Bermuda)

- Nec Corporation (Japan)

- Neophotonics Corporation (US)

- Nokia Corporation (Finland)

- Oclaro, Inc. (US)

- Ribbon Communications Operating Company Inc. (US)

- Samsung Electronics (South Korea)

- Telefonaktiebolaget Lm Ericsson (Ericsson) (Sweden)

- Viavi Solutions Inc. (US)

- Xtera Communications, Inc. (US)

- Zte Corporation (China) and Other Major Players

Key Industry Developments in the Coherent Optical Equipment Market:

- In September 2023, Nokia announced a real-world PSE-6s demonstration with lyntia, a large neutral host operator in Spain, who is using the next-generation coherent optics in its live network to effectively increase the capacity, reach and performance of its optical connections between Portugal and Spain.

- In March 2023, Infinera, a pioneer of advanced optical networking solutions, unveiled a new portfolio of coherent optical subsystems and coherent pluggable optical engines designed to help network operators cost-effectively keep up with the relentless growth in bandwidth demand while streamlining operations and reducing carbon footprint. The new solutions include a line of high-performance transmit-receive optical sub-assemblies (TROSAs), innovative programmable digital signal processors (DSPs), and a line of high-performance, intelligent pluggable optical transceivers.

|

Global Coherent Optical Equipment Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 22.67 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.9 % |

Market Size in 2030: |

USD 44.84 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Equipment |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- COHERENT OPTICAL EQUIPMENT MARKET BY TECHNOLOGY (2016-2030)

- COHERENT OPTICAL EQUIPMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- 100G

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- 200G

- 400G+

- 400G ZR

- COHERENT OPTICAL EQUIPMENT MARKET BY EQUIPMENT (2016-2030)

- COHERENT OPTICAL EQUIPMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- WDM (WAVELENGTH-DIVISION MULTIPLEXER)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MODULES/CHIPS

- TEST & MEASUREMENT EQUIPMENT

- OPTICAL AMPLIFIERS

- OPTICAL SWITCHES

- COHERENT OPTICAL EQUIPMENT MARKET BY APPLICATION (2016-2030)

- COHERENT OPTICAL EQUIPMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NETWORKING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DATA CENTER

- ORIGINAL EQUIPMENT MANUFACTURER (OEMS)

- COHERENT OPTICAL EQUIPMENT MARKET BY END USER (2016-2030)

- COHERENT OPTICAL EQUIPMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SERVICE PROVIDER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PUBLIC SECTOR

- INDUSTRIES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- COHERENT OPTICAL EQUIPMENT Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ACACIA COMMUNICATIONS (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ADVA OPTICAL NETWORKING (GERMANY)

- APPLIED OPTOELECTRONICS, INC. (US)

- CIENA CORPORATION (US)

- CISCO SYSTEMS, INC. (US)

- ECI TELECOM (ISRAEL)

- FUJITSU LIMITED (JAPAN)

- HUAWEI TECHNOLOGIES CO., LTD. (CHINA)

- II-VI INCORPORATED (US)

- INFINERA CORPORATION (US)

- LUMENTUM HOLDINGS INC. (US)

- MARVELL TECHNOLOGY, INC. (BERMUDA)

- NEC CORPORATION (JAPAN)

- NEOPHOTONICS CORPORATION (US)

- NOKIA CORPORATION (FINLAND)

- OCLARO, INC. (US)

- RIBBON COMMUNICATIONS OPERATING COMPANY INC. (US)

- SAMSUNG ELECTRONICS (SOUTH KOREA)

- TELEFONAKTIEBOLAGET LM ERICSSON (ERICSSON) (SWEDEN)

- VIAVI SOLUTIONS INC. (US)

- XTERA COMMUNICATIONS, INC. (US)

- ZTE CORPORATION (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL COHERENT OPTICAL EQUIPMENT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TECHNOLOGY

- Historic And Forecasted Market Size By EQUIPMENT

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By END USER

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Coherent Optical Equipment Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 22.67 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.9 % |

Market Size in 2030: |

USD 44.84 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Equipment |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. COHERENT OPTICAL EQUIPMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. COHERENT OPTICAL EQUIPMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. COHERENT OPTICAL EQUIPMENT MARKET COMPETITIVE RIVALRY

TABLE 005. COHERENT OPTICAL EQUIPMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. COHERENT OPTICAL EQUIPMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. COHERENT OPTICAL EQUIPMENT MARKET BY TYPE

TABLE 008. MODULES/CHIPS MARKET OVERVIEW (2016-2028)

TABLE 009. OPTICAL AMPLIFIERS MARKET OVERVIEW (2016-2028)

TABLE 010. OPTICAL SWITCHES MARKET OVERVIEW (2016-2028)

TABLE 011. WAVELENGTH-DIVISION MULTIPLEXER (WDM) MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. COHERENT OPTICAL EQUIPMENT MARKET BY APPLICATION

TABLE 014. OEM’S MARKET OVERVIEW (2016-2028)

TABLE 015. DATA CENTERS MARKET OVERVIEW (2016-2028)

TABLE 016. NETWORKING MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. COHERENT OPTICAL EQUIPMENT MARKET BY END-USER

TABLE 019. PUBLIC SECTOR MARKET OVERVIEW (2016-2028)

TABLE 020. SERVICE PROVIDERS MARKET OVERVIEW (2016-2028)

TABLE 021. INDUSTRIES MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA COHERENT OPTICAL EQUIPMENT MARKET, BY TYPE (2016-2028)

TABLE 023. NORTH AMERICA COHERENT OPTICAL EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 024. NORTH AMERICA COHERENT OPTICAL EQUIPMENT MARKET, BY END-USER (2016-2028)

TABLE 025. N COHERENT OPTICAL EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE COHERENT OPTICAL EQUIPMENT MARKET, BY TYPE (2016-2028)

TABLE 027. EUROPE COHERENT OPTICAL EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 028. EUROPE COHERENT OPTICAL EQUIPMENT MARKET, BY END-USER (2016-2028)

TABLE 029. COHERENT OPTICAL EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC COHERENT OPTICAL EQUIPMENT MARKET, BY TYPE (2016-2028)

TABLE 031. ASIA PACIFIC COHERENT OPTICAL EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 032. ASIA PACIFIC COHERENT OPTICAL EQUIPMENT MARKET, BY END-USER (2016-2028)

TABLE 033. COHERENT OPTICAL EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA COHERENT OPTICAL EQUIPMENT MARKET, BY TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA COHERENT OPTICAL EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA COHERENT OPTICAL EQUIPMENT MARKET, BY END-USER (2016-2028)

TABLE 037. COHERENT OPTICAL EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA COHERENT OPTICAL EQUIPMENT MARKET, BY TYPE (2016-2028)

TABLE 039. SOUTH AMERICA COHERENT OPTICAL EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 040. SOUTH AMERICA COHERENT OPTICAL EQUIPMENT MARKET, BY END-USER (2016-2028)

TABLE 041. COHERENT OPTICAL EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 042. CIENA CORPORATION: SNAPSHOT

TABLE 043. CIENA CORPORATION: BUSINESS PERFORMANCE

TABLE 044. CIENA CORPORATION: PRODUCT PORTFOLIO

TABLE 045. CIENA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. CISCO SYSTEMS INC: SNAPSHOT

TABLE 046. CISCO SYSTEMS INC: BUSINESS PERFORMANCE

TABLE 047. CISCO SYSTEMS INC: PRODUCT PORTFOLIO

TABLE 048. CISCO SYSTEMS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. ECI TELECOM: SNAPSHOT

TABLE 049. ECI TELECOM: BUSINESS PERFORMANCE

TABLE 050. ECI TELECOM: PRODUCT PORTFOLIO

TABLE 051. ECI TELECOM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. FUJITSU LIMITED: SNAPSHOT

TABLE 052. FUJITSU LIMITED: BUSINESS PERFORMANCE

TABLE 053. FUJITSU LIMITED: PRODUCT PORTFOLIO

TABLE 054. FUJITSU LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. HUAWEI TECHNOLOGIES LTD: SNAPSHOT

TABLE 055. HUAWEI TECHNOLOGIES LTD: BUSINESS PERFORMANCE

TABLE 056. HUAWEI TECHNOLOGIES LTD: PRODUCT PORTFOLIO

TABLE 057. HUAWEI TECHNOLOGIES LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. INFINERA CORPORATION: SNAPSHOT

TABLE 058. INFINERA CORPORATION: BUSINESS PERFORMANCE

TABLE 059. INFINERA CORPORATION: PRODUCT PORTFOLIO

TABLE 060. INFINERA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. NEC CORPORATION: SNAPSHOT

TABLE 061. NEC CORPORATION: BUSINESS PERFORMANCE

TABLE 062. NEC CORPORATION: PRODUCT PORTFOLIO

TABLE 063. NEC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. NOKIA CORPORATION: SNAPSHOT

TABLE 064. NOKIA CORPORATION: BUSINESS PERFORMANCE

TABLE 065. NOKIA CORPORATION: PRODUCT PORTFOLIO

TABLE 066. NOKIA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. TELEFONAKTIEBOLAGET LM ERICSSON (ERICSSON): SNAPSHOT

TABLE 067. TELEFONAKTIEBOLAGET LM ERICSSON (ERICSSON): BUSINESS PERFORMANCE

TABLE 068. TELEFONAKTIEBOLAGET LM ERICSSON (ERICSSON): PRODUCT PORTFOLIO

TABLE 069. TELEFONAKTIEBOLAGET LM ERICSSON (ERICSSON): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. ZTE CORPORATION: SNAPSHOT

TABLE 070. ZTE CORPORATION: BUSINESS PERFORMANCE

TABLE 071. ZTE CORPORATION: PRODUCT PORTFOLIO

TABLE 072. ZTE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. ADVA OPTICAL NETWORKING: SNAPSHOT

TABLE 073. ADVA OPTICAL NETWORKING: BUSINESS PERFORMANCE

TABLE 074. ADVA OPTICAL NETWORKING: PRODUCT PORTFOLIO

TABLE 075. ADVA OPTICAL NETWORKING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. CARL ZEISS MEDITEC: SNAPSHOT

TABLE 076. CARL ZEISS MEDITEC: BUSINESS PERFORMANCE

TABLE 077. CARL ZEISS MEDITEC: PRODUCT PORTFOLIO

TABLE 078. CARL ZEISS MEDITEC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. ZYGO CORPORATION: SNAPSHOT

TABLE 079. ZYGO CORPORATION: BUSINESS PERFORMANCE

TABLE 080. ZYGO CORPORATION: PRODUCT PORTFOLIO

TABLE 081. ZYGO CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. VISION ENGINEERING LTD.: SNAPSHOT

TABLE 082. VISION ENGINEERING LTD.: BUSINESS PERFORMANCE

TABLE 083. VISION ENGINEERING LTD.: PRODUCT PORTFOLIO

TABLE 084. VISION ENGINEERING LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 085. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 086. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 087. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. COHERENT OPTICAL EQUIPMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. COHERENT OPTICAL EQUIPMENT MARKET OVERVIEW BY TYPE

FIGURE 012. MODULES/CHIPS MARKET OVERVIEW (2016-2028)

FIGURE 013. OPTICAL AMPLIFIERS MARKET OVERVIEW (2016-2028)

FIGURE 014. OPTICAL SWITCHES MARKET OVERVIEW (2016-2028)

FIGURE 015. WAVELENGTH-DIVISION MULTIPLEXER (WDM) MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. COHERENT OPTICAL EQUIPMENT MARKET OVERVIEW BY APPLICATION

FIGURE 018. OEM’S MARKET OVERVIEW (2016-2028)

FIGURE 019. DATA CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 020. NETWORKING MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. COHERENT OPTICAL EQUIPMENT MARKET OVERVIEW BY END-USER

FIGURE 023. PUBLIC SECTOR MARKET OVERVIEW (2016-2028)

FIGURE 024. SERVICE PROVIDERS MARKET OVERVIEW (2016-2028)

FIGURE 025. INDUSTRIES MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA COHERENT OPTICAL EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE COHERENT OPTICAL EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC COHERENT OPTICAL EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA COHERENT OPTICAL EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA COHERENT OPTICAL EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Coherent Optical Equipment Market research report is 2023-2030.

Acacia Communications (US), Adva Optical Networking (Germany), Applied Optoelectronics, Inc. (US), Ciena Corporation (US), Cisco Systems, Inc. (US), Eci Telecom (Israel), Fujitsu Limited (Japan), Huawei Technologies Co., Ltd. (China), Ii-Vi Incorporated (US), Infinera Corporation (US), Lumentum Holdings Inc. (US), Marvell Technology, Inc. (Bermuda), Nec Corporation (Japan), Neophotonics Corporation (US), Nokia Corporation (Finland), Oclaro, Inc. (US), Ribbon Communications Operating Company Inc. (US), Samsung Electronics (South Korea), Telefonaktiebolaget Lm Ericsson (Ericsson) (Sweden), Viavi Solutions Inc. (US), Xtera Communications, Inc. (US), Zte Corporation (China) and Other Major Players.

The Coherent Optical Equipment Market is segmented into Technology, Equipment, Application, End User and region. By Technology, the market is categorized into 100G, 200G, 400G+, and 400G ZR. By Equipment, the market is categorized into WDM (Wavelength-division Multiplexer), Modules/Chips, Test & Measurement Equipment, Optical Amplifiers and Optical Switches. By Application, the market is categorized into Networking, Data Center, and Original Equipment Manufacturer (OEMs). By End User, the market is categorized into Service Provider, Public Sector, Industries. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Coherent optical equipment refers to technology used in high-capacity optical communication networks. It employs coherent light, allowing for the simultaneous transmission of multiple data signals over long distances with minimal interference. This equipment utilizes modulation techniques to encode data onto optical carriers, enhancing signal quality and enabling high-speed, reliable data transfer. Its core components include coherent transmitters, receivers, and modulators that ensure precise signal detection and decoding.

Coherent Optical Equipment Market Size Was Valued at USD 22.67 Billion in 2022, and is Projected to Reach USD 44.84 Billion by 2030, Growing at a CAGR of 8.9% From 2023-2030.