Cloud Migration Market Overview

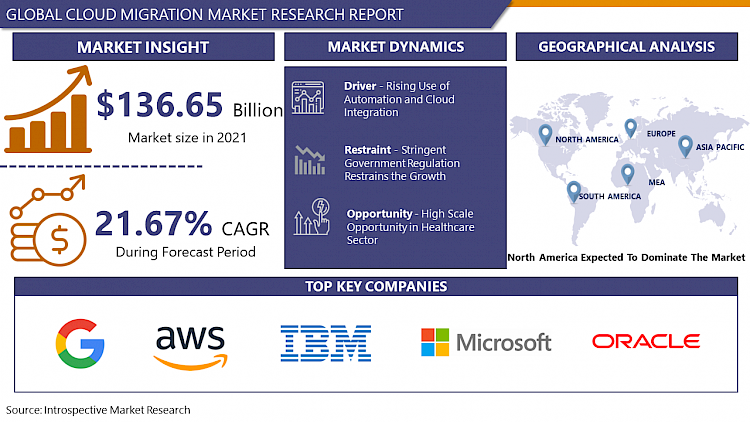

The Global Cloud Migration is expected at USD 136.65 Billion in the year 2021 and is predicted to reach USD 539.38 Billion by 2028, with a CAGR of 21.67% over the forecasted period.

The practice of moving all of an organization's on-premise data, workloads, and applications to a cloud infrastructure is referred to as cloud migration. The approach enables a business to host data and applications in the best feasible IT environment in terms of cost, performance, and security. A business may expand by using cloud migration to handle heavier demands. It successfully closes the gap between the organization's IT capability and business needs. An organization may migrate to the cloud in several ways. Data and programs may be moved from a nearby on-premises data center to the public cloud using a common approach. A cloud migration, or cloud-to-cloud migration, is a process that involves transferring data and applications from one cloud platform or provider to another. The advantages of migrating data, apps and other types of data to the cloud are encouraging numerous firms in the area to use cloud migration services, which is helping the market develop. Major factors anticipated to fuel the growth of the global cloud migration market during the projected period include an increase in the need for business agility and a rise in the usage of automation solutions.

Market Dynamics And Factors For Cloud Migration Market

Drivers:

Rising Use of Automation and Cloud Integration

Services for cloud migration deal with both platform and software services. This section of the value chain includes the platforms and the software vendors. Application development, team collaboration, database integration, and security are all included in PaaS products. These services are known as PaaS service providers, which are the main trends in the market for cloud migration services. There are many different kinds of PaaS suppliers on the market, but they all provide services or apps. The vendors that have subscription-based licenses to provide this service host it. The subscriber uses a web browser to access SaaS. With the development of mobile applications and other programs like CAD and ERP, SaaS has gained popularity. Due to the rise in demand for both services, SaaS and PaaS providers have a substantial impact on the market for cloud computing services. As a result, it is anticipated that throughout the projected period, the aforementioned reasons would fuel demand for cloud migration services.

Restraints:

Stringent Government Regulation Restrains the Growth

Following the upheaval of the previous several years, regulatory authorities around the West are currently playing catch-up. Technology businesses are under increasing pressure to safeguard user privacy and secure consumer data as the fast migration to the cloud continues, from tech-focused antitrust laws in the United States to the Digital Markets Act from the European Union. Cloud service providers top the list of IT firms under review. Because of the epidemic, a record number of enterprises have migrated to the cloud, prompting regulatory agencies to voice legitimate worries about the potential impact of outages and cyberattacks on Western economies. Media coverage of attacks in 2020 on prominent corporations including Marriott Hotels, Magellan Health, and the World Health Organization raised concerns about the speed and security of digitalization. However, organizations are frequently put at risk by old infrastructure rather than digitalization or cloud technologies. Therefore, strict regulation provides a layer of security but also restrains the growth of the sector.

Opportunities:

High Scale Opportunity in Healthcare Sector

In the healthcare sector, cloud migration creates new chances to improve interoperability and outcomes for patients. Cloud solutions are an extension of a healthcare organization's communications infrastructure, and connection should simply "scale up" when more apps are migrated to the cloud, according to HIMSS (Healthcare Information and Management Systems Society) survey analysts. Interoperability and cooperation between physicians in various places are made possible by the fact that cloud-based patient medical and billing data is far more accessible to authorized users than data kept locally. Cloud migration offers handy ways to securely access data and apps from any devices, such as mobile phones, computers, or wearable devices, when healthcare institutions extend to new physical locations. By moving IT platforms and services to the cloud, healthcare firms may avoid making financial investments to replace outdated infrastructure equipment. To cut expenses and time spent on them, the cloud provider handles hardware and software updates and makes sure that apps are supported by the current infrastructure. By contracting out maintenance work to the cloud, providers may spend less on internal IT workers.

Challenges:

Complicated Network Architecture Development for Cloud Migration

Redesigning networks for cloud migration from on-premises demands significant upfront expenditures, which is challenging for SMEs with tight budgets and resources. Additionally, the majority of businesses have found the transition to cloud deployment to be expensive and complicated. For their cloud infrastructure arrangement, businesses must address a variety of concerns in addition to the network architecture. Gaining insight, gauging performance, and managing workloads across various cloud deployment architectures are highly challenging tasks. Due to the deployment structure and techniques needed to construct and manage the cloud migration, complexity is the main issue.

Segmentation Analysis of the Cloud Migration Market

By Service, the SaaS segment is anticipated to dominate the Cloud Migration. The SaaS category includes well-known applications such as Google Apps, Salesforce, and GoToMeeting. Because of the online distribution mechanism, SaaS is a popular option for businesses to reap the cost-cutting benefits of cloud computing. Organizations must pay a large upfront sum when acquiring a perpetual-based license model, however SaaS solutions lower initial upfront costs by spreading the costs over a subscription price that may be paid, for instance, monthly or yearly. Pricing may depend on a variety of use factors, like the volume of transactions or the number of users that download the app. With just an internet connection and the acquisition of login information, the majority of SaaS installations may be set up. A SaaS managed service includes upgrades, technical support, licensing, and hosting, so renewal support fees are often associated with perpetual/on-premise type models and overall total costs are also reduced. Because more traditional licenses come with lower upfront prices, subscription-based models have become more and more common. Therefore, the SaaS segment is expected to grow substantially during the forecasted period.

By Deployment, the Hybrid segment is expected to dominate the Cloud Migration. Businesses may increase computer resources and avoid spending a lot of money to meet sudden spikes in demand by utilizing a hybrid cloud. A corporation may readily expand into new areas thanks to the flexibility that many cloud providers give to quickly deploy infrastructure across many different geographical locations. An application must operate in both an on-premises environment and on resources rented from a service provider, such as AWS, Microsoft Azure, or Google Cloud when using hybrid cloud techniques. The development of a hybrid cloud model is the combination of private and public cloud foundations that enable organizations to transfer workloads between the two interconnected conditions, even if the corporate hybrid cloud architecture depends on what best matches the organizational demands. With a hybrid cloud, businesses have the flexibility to provide on-demand access to information that isn't tied to a single place for their remote workers. By transferring sensitive information to servers located on-site and making some tools and services accessible via a hybrid cloud that employees can use from wherever they are, businesses can protect their secret data.

By End-User, the BFSI segment accounted for the largest share in the end-user segment. Banking and Financial organizations are also accelerating the migration toward cloud solutions owing to the benefits such as flexibility, agility, and integration of emerging technologies and the FinTech ecosystems. Given their potential to deliver such crucial benefits, it is hardly surprising that cloud adoption is set to grow exponentially with organizations leaning toward software-as-a-service (SaaS) models in the BFSI industry. The bank decreased yearly infrastructure costs by 15%, increased the number of active mobile users by 20%, and improved time-to-market by 40%. Due to functional complexity, regulatory requirements, and security constraints, core applications are hosted either on-premises or on private cloud IaaS models. Core modernization is proposed following a thorough risk analysis and business appraisal. In these situations, cloud migration must be addressed incrementally because it is complicated and expensive and must lower transition risks. Both public and private cloud (IaaS) deployment strategies are available for core banking systems and products, which are constantly changing. To take advantage of cloud storage, processing power, and cost-effective operations, many enterprises are thinking about putting their vast and complicated data onto the cloud (big data as a service, data lakes).

Regional Analysis for the Cloud Migration Market

North America is likely to dominate the Cloud Migration Due to the region's rising internet penetration and rapid acceptance of modern technologies like artificial intelligence and machine learning, it can be said that advanced technologies like these have spread quickly throughout the area. According to IMB, 95% of firms in North America have moved their crucial IT infrastructure and apps to the cloud. Additionally, over 80% of local businesses plan to migrate some of their apps to the cloud in the upcoming year. Because of the extensive use of AI on many operational levels due to the modern industrial landscape in North America, there is an increasing need for cloud migration. The organizations are also significantly impacted by BYOD as they see the benefits of cost-saving, productivity, and flexibility. The lighting manufacturer OSRAM used cloud migration services for both new and old applications to get an adaptable IT infrastructure that could compete. With this adoption, the corporation claims to save seven figures annually, and numerous fiercely competitive new enterprises succeed. Operators of hyperscale cloud data centers are progressively dominating the cloud environment, according to Cisco's Global Cloud Index research. For instance, according to Credit Suisse, 47% of hyper-scale data centers are in Canada, and the United States accounts for 47% of all such facilities.

The Asia-Pacific region is growing at a fast pace in the Cloud Migration. India and China have made significant strides in promoting cloud-based technology usage. Google announced a ten-billion-dollar investment in a digitization fund to help India's digital economy grow faster in July 2020. This indicates that cloud migration service providers will have new business prospects in the region. In the Asia Pacific, there has been a significant trend toward cloud technology. By 2024, the region's total cloud spending is anticipated to reach USD 200 billion, with cloud investment expanding at a faster rate. Cloudification is a technology and a business transformation approach that applies to both public and private clouds. This pattern is anticipated to persist, with a significant movement toward the cloud at every level of the technological stack. Strong double-digit growth rates are anticipated in the hardware categories that power private and hybrid cloud deployments throughout the areas our study has mostly examined. The biggest markets for IT purchases are ANZ, India, and Singapore, which are predicted to account for over USD 50 billion in cloud spending by 2024. Public cloud services are anticipated to account for 50% of all IT investments in Australia. Key markets where cloud spending is anticipated to increase at a considerably quicker rate include India, Indonesia, and Malaysia. This is faster than anticipated in wealthy economies like Singapore and ANZ. For instance, CloudMile, a regional cloud, and AI services company, is providing free cloud migration to small and medium-sized businesses in Singapore, Malaysia, and the Philippines. CloudMile will help SMEs as they begin cloud migration, a crucial first step to achieving digital transformation, thanks to its strong capabilities in cloud, AI, machine learning, and big data analytics.

COVID-19 Impact Analysis on the Cloud Migration Market

When cloud providers declined to only 31% annually by the end of 2019, the cloud migration market was also negatively impacted. As the industry matures, this rate was expected to (slowly) decline even more in 2020 and 2021. Despite this, cloud growth continued to outpace that of many other industries. Given the fall in expenditure across several sectors brought on by the COVID-19 pandemic and the ensuing global recession, it would not have been unexpected to see cloud spending decline by a few percentage points in 2020. The cloud market, in contrast, has proved very durable. According to some criteria, growth was essentially unchanged in 2020, while by other measures, it accelerated beyond 2019 despite the worst economic decline in recent history. The most likely explanation is that companies are moving to the cloud to save money, become more agile, and spur innovation. COVID-19, lockdowns, and work from anywhere (WFA) has increased demand, and it is predicted that revenue growth will remain at or above from 2021.

Top Key Players Covered In Cloud Migration Market

- Oracle Corporation

- Microsoft Corporation

- IBM Corporation

- Amazon Web Services

- Google Inc.

- Cisco Systems

- RiverMeadow Software

- Rackspace US

- Informatica

- OVH US LLC

Key Industry Developments In The Cloud Migration Market

- March 2021, With the introduction of new Oracle Cloud Lift Services, Oracle Inc. clients now have greater access to technical expertise and cloud engineering tools for expeditious workload migration to Oracle Cloud Infrastructure (OCI). All current and future Oracle Cloud customers globally are now able to use these resources from Oracle at no additional cost.

- December 2021, Deloitte agreed to buy nearly all of e BIAS’s assets. BIAS is a leader in the Oracle Cloud Infrastructure (OCI) sector with skilled cloud specialists situated in the US and India.

|

Global Cloud Migration Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 136.65 Bn. |

|

Forecast Period 2022-28 CAGR: |

21.67% |

Market Size in 2028: |

USD 539.38 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By Deployment |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Service

3.2 By Deployment

3.3 By End-User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Cloud Migration Market by Service

5.1 Cloud Migration Market Overview Snapshot and Growth Engine

5.2 Cloud Migration Market Overview

5.3 SaaS

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 SaaS: Grographic Segmentation

5.4 PaaS

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 PaaS: Grographic Segmentation

5.5 IaaS

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 IaaS: Grographic Segmentation

Chapter 6: Cloud Migration Market by Deployment

6.1 Cloud Migration Market Overview Snapshot and Growth Engine

6.2 Cloud Migration Market Overview

6.3 Private

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Private: Grographic Segmentation

6.4 Public

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Public: Grographic Segmentation

6.5 Hybrid

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Hybrid: Grographic Segmentation

Chapter 7: Cloud Migration Market by End-User

7.1 Cloud Migration Market Overview Snapshot and Growth Engine

7.2 Cloud Migration Market Overview

7.3 Manufacturing

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Manufacturing: Grographic Segmentation

7.4 BFSI

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 BFSI: Grographic Segmentation

7.5 IT & Telecom

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 IT & Telecom: Grographic Segmentation

7.6 Retail

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Retail: Grographic Segmentation

7.7 Healthcare

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2016-2028F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Healthcare: Grographic Segmentation

7.8 Logistics

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size (2016-2028F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Logistics: Grographic Segmentation

7.9 Education

7.9.1 Introduction and Market Overview

7.9.2 Historic and Forecasted Market Size (2016-2028F)

7.9.3 Key Market Trends, Growth Factors and Opportunities

7.9.4 Education: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Cloud Migration Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Cloud Migration Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Cloud Migration Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 ORACLE CORPORATION

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 MICROSOFT CORPORATION

8.4 IBM CORPORATION

8.5 AMAZON WEB SERVICES

8.6 GOOGLE INC.

8.7 CISCO SYSTEMS

8.8 RIVERMEADOW SOFTWARE

8.9 RACKSPACE

8.10 INFORMATICA

8.11 OVH US LLC

8.12 OTHER MAJOR PLAYERS

Chapter 9: Global Cloud Migration Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Service

9.2.1 SaaS

9.2.2 PaaS

9.2.3 IaaS

9.3 Historic and Forecasted Market Size By Deployment

9.3.1 Private

9.3.2 Public

9.3.3 Hybrid

9.4 Historic and Forecasted Market Size By End-User

9.4.1 Manufacturing

9.4.2 BFSI

9.4.3 IT & Telecom

9.4.4 Retail

9.4.5 Healthcare

9.4.6 Logistics

9.4.7 Education

Chapter 10: North America Cloud Migration Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Service

10.4.1 SaaS

10.4.2 PaaS

10.4.3 IaaS

10.5 Historic and Forecasted Market Size By Deployment

10.5.1 Private

10.5.2 Public

10.5.3 Hybrid

10.6 Historic and Forecasted Market Size By End-User

10.6.1 Manufacturing

10.6.2 BFSI

10.6.3 IT & Telecom

10.6.4 Retail

10.6.5 Healthcare

10.6.6 Logistics

10.6.7 Education

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Cloud Migration Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Service

11.4.1 SaaS

11.4.2 PaaS

11.4.3 IaaS

11.5 Historic and Forecasted Market Size By Deployment

11.5.1 Private

11.5.2 Public

11.5.3 Hybrid

11.6 Historic and Forecasted Market Size By End-User

11.6.1 Manufacturing

11.6.2 BFSI

11.6.3 IT & Telecom

11.6.4 Retail

11.6.5 Healthcare

11.6.6 Logistics

11.6.7 Education

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Cloud Migration Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Service

12.4.1 SaaS

12.4.2 PaaS

12.4.3 IaaS

12.5 Historic and Forecasted Market Size By Deployment

12.5.1 Private

12.5.2 Public

12.5.3 Hybrid

12.6 Historic and Forecasted Market Size By End-User

12.6.1 Manufacturing

12.6.2 BFSI

12.6.3 IT & Telecom

12.6.4 Retail

12.6.5 Healthcare

12.6.6 Logistics

12.6.7 Education

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Cloud Migration Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Service

13.4.1 SaaS

13.4.2 PaaS

13.4.3 IaaS

13.5 Historic and Forecasted Market Size By Deployment

13.5.1 Private

13.5.2 Public

13.5.3 Hybrid

13.6 Historic and Forecasted Market Size By End-User

13.6.1 Manufacturing

13.6.2 BFSI

13.6.3 IT & Telecom

13.6.4 Retail

13.6.5 Healthcare

13.6.6 Logistics

13.6.7 Education

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Cloud Migration Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Service

14.4.1 SaaS

14.4.2 PaaS

14.4.3 IaaS

14.5 Historic and Forecasted Market Size By Deployment

14.5.1 Private

14.5.2 Public

14.5.3 Hybrid

14.6 Historic and Forecasted Market Size By End-User

14.6.1 Manufacturing

14.6.2 BFSI

14.6.3 IT & Telecom

14.6.4 Retail

14.6.5 Healthcare

14.6.6 Logistics

14.6.7 Education

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Cloud Migration Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 136.65 Bn. |

|

Forecast Period 2022-28 CAGR: |

21.67% |

Market Size in 2028: |

USD 539.38 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By Deployment |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CLOUD MIGRATION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CLOUD MIGRATION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CLOUD MIGRATION MARKET COMPETITIVE RIVALRY

TABLE 005. CLOUD MIGRATION MARKET THREAT OF NEW ENTRANTS

TABLE 006. CLOUD MIGRATION MARKET THREAT OF SUBSTITUTES

TABLE 007. CLOUD MIGRATION MARKET BY SERVICE

TABLE 008. SAAS MARKET OVERVIEW (2016-2028)

TABLE 009. PAAS MARKET OVERVIEW (2016-2028)

TABLE 010. IAAS MARKET OVERVIEW (2016-2028)

TABLE 011. CLOUD MIGRATION MARKET BY DEPLOYMENT

TABLE 012. PRIVATE MARKET OVERVIEW (2016-2028)

TABLE 013. PUBLIC MARKET OVERVIEW (2016-2028)

TABLE 014. HYBRID MARKET OVERVIEW (2016-2028)

TABLE 015. CLOUD MIGRATION MARKET BY END-USER

TABLE 016. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 017. BFSI MARKET OVERVIEW (2016-2028)

TABLE 018. IT & TELECOM MARKET OVERVIEW (2016-2028)

TABLE 019. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 020. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 021. LOGISTICS MARKET OVERVIEW (2016-2028)

TABLE 022. EDUCATION MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA CLOUD MIGRATION MARKET, BY SERVICE (2016-2028)

TABLE 024. NORTH AMERICA CLOUD MIGRATION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 025. NORTH AMERICA CLOUD MIGRATION MARKET, BY END-USER (2016-2028)

TABLE 026. N CLOUD MIGRATION MARKET, BY COUNTRY (2016-2028)

TABLE 027. EUROPE CLOUD MIGRATION MARKET, BY SERVICE (2016-2028)

TABLE 028. EUROPE CLOUD MIGRATION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 029. EUROPE CLOUD MIGRATION MARKET, BY END-USER (2016-2028)

TABLE 030. CLOUD MIGRATION MARKET, BY COUNTRY (2016-2028)

TABLE 031. ASIA PACIFIC CLOUD MIGRATION MARKET, BY SERVICE (2016-2028)

TABLE 032. ASIA PACIFIC CLOUD MIGRATION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 033. ASIA PACIFIC CLOUD MIGRATION MARKET, BY END-USER (2016-2028)

TABLE 034. CLOUD MIGRATION MARKET, BY COUNTRY (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA CLOUD MIGRATION MARKET, BY SERVICE (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA CLOUD MIGRATION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA CLOUD MIGRATION MARKET, BY END-USER (2016-2028)

TABLE 038. CLOUD MIGRATION MARKET, BY COUNTRY (2016-2028)

TABLE 039. SOUTH AMERICA CLOUD MIGRATION MARKET, BY SERVICE (2016-2028)

TABLE 040. SOUTH AMERICA CLOUD MIGRATION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 041. SOUTH AMERICA CLOUD MIGRATION MARKET, BY END-USER (2016-2028)

TABLE 042. CLOUD MIGRATION MARKET, BY COUNTRY (2016-2028)

TABLE 043. ORACLE CORPORATION: SNAPSHOT

TABLE 044. ORACLE CORPORATION: BUSINESS PERFORMANCE

TABLE 045. ORACLE CORPORATION: PRODUCT PORTFOLIO

TABLE 046. ORACLE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. MICROSOFT CORPORATION: SNAPSHOT

TABLE 047. MICROSOFT CORPORATION: BUSINESS PERFORMANCE

TABLE 048. MICROSOFT CORPORATION: PRODUCT PORTFOLIO

TABLE 049. MICROSOFT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. IBM CORPORATION: SNAPSHOT

TABLE 050. IBM CORPORATION: BUSINESS PERFORMANCE

TABLE 051. IBM CORPORATION: PRODUCT PORTFOLIO

TABLE 052. IBM CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. AMAZON WEB SERVICES: SNAPSHOT

TABLE 053. AMAZON WEB SERVICES: BUSINESS PERFORMANCE

TABLE 054. AMAZON WEB SERVICES: PRODUCT PORTFOLIO

TABLE 055. AMAZON WEB SERVICES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. GOOGLE INC.: SNAPSHOT

TABLE 056. GOOGLE INC.: BUSINESS PERFORMANCE

TABLE 057. GOOGLE INC.: PRODUCT PORTFOLIO

TABLE 058. GOOGLE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. CISCO SYSTEMS: SNAPSHOT

TABLE 059. CISCO SYSTEMS: BUSINESS PERFORMANCE

TABLE 060. CISCO SYSTEMS: PRODUCT PORTFOLIO

TABLE 061. CISCO SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. RIVERMEADOW SOFTWARE: SNAPSHOT

TABLE 062. RIVERMEADOW SOFTWARE: BUSINESS PERFORMANCE

TABLE 063. RIVERMEADOW SOFTWARE: PRODUCT PORTFOLIO

TABLE 064. RIVERMEADOW SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. RACKSPACE: SNAPSHOT

TABLE 065. RACKSPACE: BUSINESS PERFORMANCE

TABLE 066. RACKSPACE: PRODUCT PORTFOLIO

TABLE 067. RACKSPACE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. INFORMATICA: SNAPSHOT

TABLE 068. INFORMATICA: BUSINESS PERFORMANCE

TABLE 069. INFORMATICA: PRODUCT PORTFOLIO

TABLE 070. INFORMATICA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. OVH US LLC: SNAPSHOT

TABLE 071. OVH US LLC: BUSINESS PERFORMANCE

TABLE 072. OVH US LLC: PRODUCT PORTFOLIO

TABLE 073. OVH US LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 074. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 075. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 076. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CLOUD MIGRATION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CLOUD MIGRATION MARKET OVERVIEW BY SERVICE

FIGURE 012. SAAS MARKET OVERVIEW (2016-2028)

FIGURE 013. PAAS MARKET OVERVIEW (2016-2028)

FIGURE 014. IAAS MARKET OVERVIEW (2016-2028)

FIGURE 015. CLOUD MIGRATION MARKET OVERVIEW BY DEPLOYMENT

FIGURE 016. PRIVATE MARKET OVERVIEW (2016-2028)

FIGURE 017. PUBLIC MARKET OVERVIEW (2016-2028)

FIGURE 018. HYBRID MARKET OVERVIEW (2016-2028)

FIGURE 019. CLOUD MIGRATION MARKET OVERVIEW BY END-USER

FIGURE 020. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 021. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 022. IT & TELECOM MARKET OVERVIEW (2016-2028)

FIGURE 023. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 024. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 025. LOGISTICS MARKET OVERVIEW (2016-2028)

FIGURE 026. EDUCATION MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA CLOUD MIGRATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE CLOUD MIGRATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC CLOUD MIGRATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA CLOUD MIGRATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA CLOUD MIGRATION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Cloud Migration Market research report is 2022-2028.

Oracle Corporation, Microsoft Corporation, IBM Corporation, Amazon Web Services, Google Inc, and Other major players.

The Cloud Migration Market is segmented into Service, Deployment, End-User, and region. By Service, the market is categorized into SaaS, PaaS, and IaaS. By Deployment, the market is categorized into Private, Public, and Hybrid. By End-User, the market is categorized into manufacturing, BFSI, IT & Telecom, Retail, Healthcare, Logistics, and Education. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Moving data, programs, or other business components to a cloud computing environment is known as cloud migration.

The global Cloud Migration Market was valued at USD 136.65 Billion in 2021 and is predicted to grow at a CAGR of 21.67 % to USD 539.38 Billion by 2028.