Blockchain in Retail Market Overview

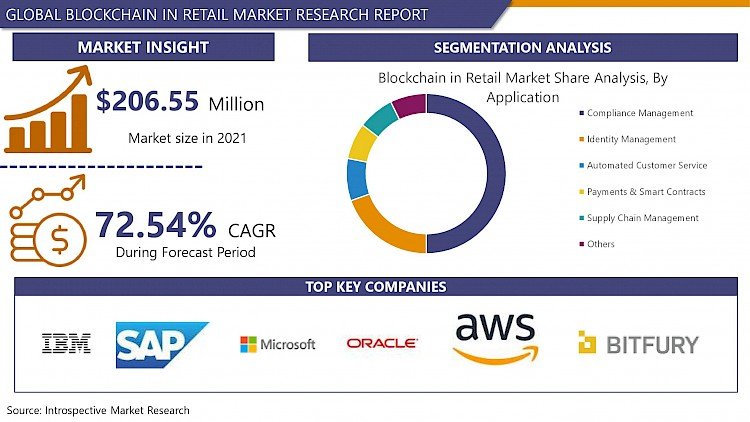

Blockchain in Retail market was valued at USD 206.55 million in 2021 and is expected to reach USD 9402.73 million by the year 2028, at a CAGR of 72.54%.

A blockchain in retail is a system that encourages more trustworthy and authentic interactions between the company and the customer. The main advantage of this system is that it promotes loyalty and thorough transparency.

Blockchain in retail collaborates with current systems to provide real-time data that enables a better understanding of the customers and easy transactions. blockchain in retail provides facilities like real-time delivery and services in record time for the retailers.

According to the analyst, the main factors that are driving the growth of the blockchain in retail market are the increasing adoption of blockchain-as-a-service and smart contract services in the retailers. Also, the growing use of technology and supply chain management in the retailers in the management industry is also one of the few drivers of the blockchain in retail market.

By the end of 2028, the Blockchain in Retail market size is estimated to be at USD 9130.26 million. The major factor that is driving the market is the urgency for simplified business processes.

The Blockchain in Retail market is segmented by Providers (Application Provider, Middleware Provider, and Infrastructure Provider), by Component (Platform and Services), By Organization Size (Large Enterprises and Small & Medium Enterprises), By Application (Compliance Management, Identity Management, Automated Customer Service, Payments & Smart Contracts, Supply Chain Management and Others). The market is further analyzed on the basis of regional analysis and divided into major regions like North-America, Latin America, Asia-Pacific, Europe and MEA.

Impact of COVID-19 on Blockchain in Retail Market

As the pandemic hit the globe, the rise of online retailers increased due to the presence of major companies in blockchain in retail market and the organizations more secured and precautious of the company's revenue. With the emergence of the e-commerce industry and the retailers now more inclined towards digitalizing the blockchain in retail market, the growth in the lockdown period for the blockchain in retail market is flourishing across the globe. The introspective market research provides a more detailed analysis and impact of COVID-19 in the blockchain in retail report.

Market Segmentation

Component Insights:

By component, blockchain in retail market is segmented into Platform and Service. The Platform segment has accounted for the highest CAGR in the market of 72.32% with a market share of 56.19% and an estimated market size of USD 1704.07 million in the year 2026.

The growth of the platform component is mainly because of the growth in the adoption of blockchain software among retailers due to the urgency for the safe and secure transmission of data across the supply chain. Also, the easy accessibility and availability of cost-effective solutions is also the key factor driving the demand for blockchain platforms across numerous retailers. Further, the services segment is expected to exhibit the highest growth rate throughout the blockchain in retail forecast period.

Applications Insights:

The segments smart contracts dominate the blockchain in retail market with a market share of 29.36% and a CAGR of 72.39% with estimated market size of USD 893.74 million in the year 2026. The segment Automated Customer Services is the second largest segment followed by supply chain management with a CAGR of 76.45% and 75.80% respectively.

Regional Insights:

Blockchain in Retail market is growing rapidly in the North-America and Asia-Pacific region equally. North-America region is accounted for the largest blockchain in retail market share across the globe with a CAGR of 72.36% and a market size of USD 27.18 million in the year 2019. But in the forecast period, due to the high demand from the regions like China, Japan, Australia, and India, Asia-Pacific is expected to continue the growth of blockchain in retail market with the highest CAGR of 72.39% and estimated market size of USD 916.87 million in the year 2026.

Major Key Players Considered in the Market

- IBM

- SAP

- Microsoft

- Oracle

- AWS

- Bitfury

- Auxesis Group

- Cegeka

- BTL

- Guardtime

- Coin Base

- Loyyal

- Sofocle

- BigChainDB

- RecordsKeeper

- BitPay

- Abra

- Reply

- Provenance

- ModulTrade

- Blockverify

- OGYDocs

- Warranteer

- Amazon Web Services Inc.

- Capgemini SE

- Accenture PLC

- Cognizant Technology Solutions Corp.

- Blockchain Foundary, and other major players.

Salient Features of the Blockchain in Retail Market

Blockchain in Retail market was valued at USD 206.55 million in 2021 and is expected to reach USD 9402.73 million by the year 2028, at a CAGR of 72.54%.

- The increased adoption in the blockchain in retail supply management and smart contract services is increasing the blockchain in retail market.

- Different multinational retail and supply chain management corporations are introducing and using blockchain in retail technologies across multiple business processes to reduce the costs of verification, execution, arbitration, and to prevent fraud.

- The provider segment is sub-segmented into application provider, middleware provider, and infrastructure provider. Among these, the application provider is the fastest-growing segment with the highest CAGR across the globe.

|

Global Blockchain in Retail Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 206.55 Mn. |

|

Forecast Period 2022-28 CAGR: |

72.54% |

Market Size in 2028: |

USD 9402.73 Mn. |

|

|

By Provider |

|

|

|

Segments Covered: |

By Application |

|

|

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Provider

3.2 By Component

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Blockchain in Retail Market by Provider

5.1 Blockchain in Retail Market Overview Snapshot and Growth Engine

5.2 Blockchain in Retail Market Overview

5.3 Application Providers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Application Providers: Grographic Segmentation

5.4 Middleware Provider

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Middleware Provider: Grographic Segmentation

5.5 Infrastructure Provider

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Infrastructure Provider: Grographic Segmentation

Chapter 6: Blockchain in Retail Market by Component

6.1 Blockchain in Retail Market Overview Snapshot and Growth Engine

6.2 Blockchain in Retail Market Overview

6.3 Platform

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Platform: Grographic Segmentation

6.4 Services

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Services: Grographic Segmentation

Chapter 7: Blockchain in Retail Market by Application

7.1 Blockchain in Retail Market Overview Snapshot and Growth Engine

7.2 Blockchain in Retail Market Overview

7.3 Compliance Management

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Compliance Management: Grographic Segmentation

7.4 Identity Management

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Identity Management: Grographic Segmentation

7.5 Automated Customer Service

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Automated Customer Service: Grographic Segmentation

7.6 Payments & Smart Contracts

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Payments & Smart Contracts: Grographic Segmentation

7.7 Supply Chain Management

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2016-2028F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Supply Chain Management: Grographic Segmentation

7.8 Others

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size (2016-2028F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Blockchain in Retail Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Blockchain in Retail Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Blockchain in Retail Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 IBM

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 SAP

8.4 MICROSOFT

8.5 ORACLE

8.6 AWS

8.7 BITFURY

8.8 AUXESIS GROUP

8.9 CEGEKA

8.10 BTL

8.11 GUARDTIME

8.12 COIN BASE

8.13 LOYYAL

8.14 SOFOCLE

8.15 BIGCHAINDB

8.16 RECORDSKEEPER

8.17 BITPAY

8.18 ABRA

8.19 REPLY

8.20 PROVENANCE

8.21 MODULTRADE

8.22 BLOCKVERIFY

8.23 OGYDOCS

8.24 WARRANTEER

8.25 AMAZON WEB SERVICES INC.

8.26 CAPGEMINI SE

8.27 ACCENTURE PLC

8.28 COGNIZANT TECHNOLOGY SOLUTIONS CORP.

8.29 BLOCKCHAIN FOUNDARY

8.30 OTHER MAJOR PLAYERS

Chapter 9: Global Blockchain in Retail Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Provider

9.2.1 Application Providers

9.2.2 Middleware Provider

9.2.3 Infrastructure Provider

9.3 Historic and Forecasted Market Size By Component

9.3.1 Platform

9.3.2 Services

9.4 Historic and Forecasted Market Size By Application

9.4.1 Compliance Management

9.4.2 Identity Management

9.4.3 Automated Customer Service

9.4.4 Payments & Smart Contracts

9.4.5 Supply Chain Management

9.4.6 Others

Chapter 10: North America Blockchain in Retail Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Provider

10.4.1 Application Providers

10.4.2 Middleware Provider

10.4.3 Infrastructure Provider

10.5 Historic and Forecasted Market Size By Component

10.5.1 Platform

10.5.2 Services

10.6 Historic and Forecasted Market Size By Application

10.6.1 Compliance Management

10.6.2 Identity Management

10.6.3 Automated Customer Service

10.6.4 Payments & Smart Contracts

10.6.5 Supply Chain Management

10.6.6 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Blockchain in Retail Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Provider

11.4.1 Application Providers

11.4.2 Middleware Provider

11.4.3 Infrastructure Provider

11.5 Historic and Forecasted Market Size By Component

11.5.1 Platform

11.5.2 Services

11.6 Historic and Forecasted Market Size By Application

11.6.1 Compliance Management

11.6.2 Identity Management

11.6.3 Automated Customer Service

11.6.4 Payments & Smart Contracts

11.6.5 Supply Chain Management

11.6.6 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Blockchain in Retail Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Provider

12.4.1 Application Providers

12.4.2 Middleware Provider

12.4.3 Infrastructure Provider

12.5 Historic and Forecasted Market Size By Component

12.5.1 Platform

12.5.2 Services

12.6 Historic and Forecasted Market Size By Application

12.6.1 Compliance Management

12.6.2 Identity Management

12.6.3 Automated Customer Service

12.6.4 Payments & Smart Contracts

12.6.5 Supply Chain Management

12.6.6 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Blockchain in Retail Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Provider

13.4.1 Application Providers

13.4.2 Middleware Provider

13.4.3 Infrastructure Provider

13.5 Historic and Forecasted Market Size By Component

13.5.1 Platform

13.5.2 Services

13.6 Historic and Forecasted Market Size By Application

13.6.1 Compliance Management

13.6.2 Identity Management

13.6.3 Automated Customer Service

13.6.4 Payments & Smart Contracts

13.6.5 Supply Chain Management

13.6.6 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Blockchain in Retail Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Provider

14.4.1 Application Providers

14.4.2 Middleware Provider

14.4.3 Infrastructure Provider

14.5 Historic and Forecasted Market Size By Component

14.5.1 Platform

14.5.2 Services

14.6 Historic and Forecasted Market Size By Application

14.6.1 Compliance Management

14.6.2 Identity Management

14.6.3 Automated Customer Service

14.6.4 Payments & Smart Contracts

14.6.5 Supply Chain Management

14.6.6 Others

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Blockchain in Retail Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 206.55 Mn. |

|

Forecast Period 2022-28 CAGR: |

72.54% |

Market Size in 2028: |

USD 9402.73 Mn. |

|

|

By Provider |

|

|

|

Segments Covered: |

By Application |

|

|

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BLOCKCHAIN IN RETAIL MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BLOCKCHAIN IN RETAIL MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BLOCKCHAIN IN RETAIL MARKET COMPETITIVE RIVALRY

TABLE 005. BLOCKCHAIN IN RETAIL MARKET THREAT OF NEW ENTRANTS

TABLE 006. BLOCKCHAIN IN RETAIL MARKET THREAT OF SUBSTITUTES

TABLE 007. BLOCKCHAIN IN RETAIL MARKET BY PROVIDER

TABLE 008. APPLICATION PROVIDERS MARKET OVERVIEW (2016-2028)

TABLE 009. MIDDLEWARE PROVIDER MARKET OVERVIEW (2016-2028)

TABLE 010. INFRASTRUCTURE PROVIDER MARKET OVERVIEW (2016-2028)

TABLE 011. BLOCKCHAIN IN RETAIL MARKET BY COMPONENT

TABLE 012. PLATFORM MARKET OVERVIEW (2016-2028)

TABLE 013. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 014. BLOCKCHAIN IN RETAIL MARKET BY APPLICATION

TABLE 015. COMPLIANCE MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 016. IDENTITY MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 017. AUTOMATED CUSTOMER SERVICE MARKET OVERVIEW (2016-2028)

TABLE 018. PAYMENTS & SMART CONTRACTS MARKET OVERVIEW (2016-2028)

TABLE 019. SUPPLY CHAIN MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 020. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA BLOCKCHAIN IN RETAIL MARKET, BY PROVIDER (2016-2028)

TABLE 022. NORTH AMERICA BLOCKCHAIN IN RETAIL MARKET, BY COMPONENT (2016-2028)

TABLE 023. NORTH AMERICA BLOCKCHAIN IN RETAIL MARKET, BY APPLICATION (2016-2028)

TABLE 024. N BLOCKCHAIN IN RETAIL MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE BLOCKCHAIN IN RETAIL MARKET, BY PROVIDER (2016-2028)

TABLE 026. EUROPE BLOCKCHAIN IN RETAIL MARKET, BY COMPONENT (2016-2028)

TABLE 027. EUROPE BLOCKCHAIN IN RETAIL MARKET, BY APPLICATION (2016-2028)

TABLE 028. BLOCKCHAIN IN RETAIL MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC BLOCKCHAIN IN RETAIL MARKET, BY PROVIDER (2016-2028)

TABLE 030. ASIA PACIFIC BLOCKCHAIN IN RETAIL MARKET, BY COMPONENT (2016-2028)

TABLE 031. ASIA PACIFIC BLOCKCHAIN IN RETAIL MARKET, BY APPLICATION (2016-2028)

TABLE 032. BLOCKCHAIN IN RETAIL MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA BLOCKCHAIN IN RETAIL MARKET, BY PROVIDER (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA BLOCKCHAIN IN RETAIL MARKET, BY COMPONENT (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA BLOCKCHAIN IN RETAIL MARKET, BY APPLICATION (2016-2028)

TABLE 036. BLOCKCHAIN IN RETAIL MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA BLOCKCHAIN IN RETAIL MARKET, BY PROVIDER (2016-2028)

TABLE 038. SOUTH AMERICA BLOCKCHAIN IN RETAIL MARKET, BY COMPONENT (2016-2028)

TABLE 039. SOUTH AMERICA BLOCKCHAIN IN RETAIL MARKET, BY APPLICATION (2016-2028)

TABLE 040. BLOCKCHAIN IN RETAIL MARKET, BY COUNTRY (2016-2028)

TABLE 041. IBM: SNAPSHOT

TABLE 042. IBM: BUSINESS PERFORMANCE

TABLE 043. IBM: PRODUCT PORTFOLIO

TABLE 044. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. SAP: SNAPSHOT

TABLE 045. SAP: BUSINESS PERFORMANCE

TABLE 046. SAP: PRODUCT PORTFOLIO

TABLE 047. SAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. MICROSOFT: SNAPSHOT

TABLE 048. MICROSOFT: BUSINESS PERFORMANCE

TABLE 049. MICROSOFT: PRODUCT PORTFOLIO

TABLE 050. MICROSOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ORACLE: SNAPSHOT

TABLE 051. ORACLE: BUSINESS PERFORMANCE

TABLE 052. ORACLE: PRODUCT PORTFOLIO

TABLE 053. ORACLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. AWS: SNAPSHOT

TABLE 054. AWS: BUSINESS PERFORMANCE

TABLE 055. AWS: PRODUCT PORTFOLIO

TABLE 056. AWS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. BITFURY: SNAPSHOT

TABLE 057. BITFURY: BUSINESS PERFORMANCE

TABLE 058. BITFURY: PRODUCT PORTFOLIO

TABLE 059. BITFURY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. AUXESIS GROUP: SNAPSHOT

TABLE 060. AUXESIS GROUP: BUSINESS PERFORMANCE

TABLE 061. AUXESIS GROUP: PRODUCT PORTFOLIO

TABLE 062. AUXESIS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. CEGEKA: SNAPSHOT

TABLE 063. CEGEKA: BUSINESS PERFORMANCE

TABLE 064. CEGEKA: PRODUCT PORTFOLIO

TABLE 065. CEGEKA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. BTL: SNAPSHOT

TABLE 066. BTL: BUSINESS PERFORMANCE

TABLE 067. BTL: PRODUCT PORTFOLIO

TABLE 068. BTL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. GUARDTIME: SNAPSHOT

TABLE 069. GUARDTIME: BUSINESS PERFORMANCE

TABLE 070. GUARDTIME: PRODUCT PORTFOLIO

TABLE 071. GUARDTIME: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. COIN BASE: SNAPSHOT

TABLE 072. COIN BASE: BUSINESS PERFORMANCE

TABLE 073. COIN BASE: PRODUCT PORTFOLIO

TABLE 074. COIN BASE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. LOYYAL: SNAPSHOT

TABLE 075. LOYYAL: BUSINESS PERFORMANCE

TABLE 076. LOYYAL: PRODUCT PORTFOLIO

TABLE 077. LOYYAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. SOFOCLE: SNAPSHOT

TABLE 078. SOFOCLE: BUSINESS PERFORMANCE

TABLE 079. SOFOCLE: PRODUCT PORTFOLIO

TABLE 080. SOFOCLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. BIGCHAINDB: SNAPSHOT

TABLE 081. BIGCHAINDB: BUSINESS PERFORMANCE

TABLE 082. BIGCHAINDB: PRODUCT PORTFOLIO

TABLE 083. BIGCHAINDB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. RECORDSKEEPER: SNAPSHOT

TABLE 084. RECORDSKEEPER: BUSINESS PERFORMANCE

TABLE 085. RECORDSKEEPER: PRODUCT PORTFOLIO

TABLE 086. RECORDSKEEPER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. BITPAY: SNAPSHOT

TABLE 087. BITPAY: BUSINESS PERFORMANCE

TABLE 088. BITPAY: PRODUCT PORTFOLIO

TABLE 089. BITPAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. ABRA: SNAPSHOT

TABLE 090. ABRA: BUSINESS PERFORMANCE

TABLE 091. ABRA: PRODUCT PORTFOLIO

TABLE 092. ABRA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. REPLY: SNAPSHOT

TABLE 093. REPLY: BUSINESS PERFORMANCE

TABLE 094. REPLY: PRODUCT PORTFOLIO

TABLE 095. REPLY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. PROVENANCE: SNAPSHOT

TABLE 096. PROVENANCE: BUSINESS PERFORMANCE

TABLE 097. PROVENANCE: PRODUCT PORTFOLIO

TABLE 098. PROVENANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. MODULTRADE: SNAPSHOT

TABLE 099. MODULTRADE: BUSINESS PERFORMANCE

TABLE 100. MODULTRADE: PRODUCT PORTFOLIO

TABLE 101. MODULTRADE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. BLOCKVERIFY: SNAPSHOT

TABLE 102. BLOCKVERIFY: BUSINESS PERFORMANCE

TABLE 103. BLOCKVERIFY: PRODUCT PORTFOLIO

TABLE 104. BLOCKVERIFY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. OGYDOCS: SNAPSHOT

TABLE 105. OGYDOCS: BUSINESS PERFORMANCE

TABLE 106. OGYDOCS: PRODUCT PORTFOLIO

TABLE 107. OGYDOCS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. WARRANTEER: SNAPSHOT

TABLE 108. WARRANTEER: BUSINESS PERFORMANCE

TABLE 109. WARRANTEER: PRODUCT PORTFOLIO

TABLE 110. WARRANTEER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. AMAZON WEB SERVICES INC.: SNAPSHOT

TABLE 111. AMAZON WEB SERVICES INC.: BUSINESS PERFORMANCE

TABLE 112. AMAZON WEB SERVICES INC.: PRODUCT PORTFOLIO

TABLE 113. AMAZON WEB SERVICES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 113. CAPGEMINI SE: SNAPSHOT

TABLE 114. CAPGEMINI SE: BUSINESS PERFORMANCE

TABLE 115. CAPGEMINI SE: PRODUCT PORTFOLIO

TABLE 116. CAPGEMINI SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 116. ACCENTURE PLC: SNAPSHOT

TABLE 117. ACCENTURE PLC: BUSINESS PERFORMANCE

TABLE 118. ACCENTURE PLC: PRODUCT PORTFOLIO

TABLE 119. ACCENTURE PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 119. COGNIZANT TECHNOLOGY SOLUTIONS CORP.: SNAPSHOT

TABLE 120. COGNIZANT TECHNOLOGY SOLUTIONS CORP.: BUSINESS PERFORMANCE

TABLE 121. COGNIZANT TECHNOLOGY SOLUTIONS CORP.: PRODUCT PORTFOLIO

TABLE 122. COGNIZANT TECHNOLOGY SOLUTIONS CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 122. BLOCKCHAIN FOUNDARY: SNAPSHOT

TABLE 123. BLOCKCHAIN FOUNDARY: BUSINESS PERFORMANCE

TABLE 124. BLOCKCHAIN FOUNDARY: PRODUCT PORTFOLIO

TABLE 125. BLOCKCHAIN FOUNDARY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 125. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 126. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 127. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 128. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BLOCKCHAIN IN RETAIL MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BLOCKCHAIN IN RETAIL MARKET OVERVIEW BY PROVIDER

FIGURE 012. APPLICATION PROVIDERS MARKET OVERVIEW (2016-2028)

FIGURE 013. MIDDLEWARE PROVIDER MARKET OVERVIEW (2016-2028)

FIGURE 014. INFRASTRUCTURE PROVIDER MARKET OVERVIEW (2016-2028)

FIGURE 015. BLOCKCHAIN IN RETAIL MARKET OVERVIEW BY COMPONENT

FIGURE 016. PLATFORM MARKET OVERVIEW (2016-2028)

FIGURE 017. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 018. BLOCKCHAIN IN RETAIL MARKET OVERVIEW BY APPLICATION

FIGURE 019. COMPLIANCE MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 020. IDENTITY MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 021. AUTOMATED CUSTOMER SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 022. PAYMENTS & SMART CONTRACTS MARKET OVERVIEW (2016-2028)

FIGURE 023. SUPPLY CHAIN MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA BLOCKCHAIN IN RETAIL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE BLOCKCHAIN IN RETAIL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC BLOCKCHAIN IN RETAIL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA BLOCKCHAIN IN RETAIL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA BLOCKCHAIN IN RETAIL MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Blockchain in Retail Market research report is 2022-2028.

IBM, SAP, Microsoft, Oracle, AWS, Bitfury, and other major players.

The Blockchain in Retail Market is segmented into Provider, Application, Component, and Region. By Provider, the market is categorized into Application Providers, Middleware Provider, and Infrastructure Provider. By Application, the market is categorized into Compliance Management, Identity Management, Automated Customer Service, Payments & Smart Contracts, Supply Chain Management, and Others. By Component, the market is categorized into Platform, and Services. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Retail Within the retail sector, blockchain is the generic word for disruptive technology that captures digital transactions cryptographically on a distributed ledger. Businesses benefit from blockchain technology in four ways: reduced costs, faster payments, increased transparency, and improved security.

Blockchain in Retail Market was valued at USD 206.55 Million in 2021 and is expected to reach USD 9402.73 Million by the year 2028, at a CAGR of 72.54%.