3D Bioprinting Market Synopsis

3D Bioprinting Market Size Was Valued at USD 1.19 Billion in 2022, and is Projected to Reach USD 4.42 Billion by 2030, Growing at a CAGR of 17.84% From 2023-2030.

- 3D bioprinting has been an emanate field represented by various biologically applied deposition and assembling systems, that includes direct writing, photolithography, microstamping, extrusion, laser writing, electro-printing, stereolithography, microfluidics, and inkjet deposition.

- Healthcare is one of the major applications where 3D bioprinting is bringing a significant change. This is primarily due to the increasing investments in these applications, such as model and organ prototyping and production across the globe, and growing innovations in healthcare through 3D printing. The company has been creating its name by offering pharmaceutical companies with their exVive3D Liver Tissue for medicine toxicity testing.

- They had also merged with various leading companies, including Merck and L’Oréal in the health space and are preparing on launching their exVive3D Kidney Tissue product. With the 3D bioprinting process, an organ can be designed using modelling software, and then printed with biomaterials, such as hydrogels and polymers, in addition to the patient’s cells.

- The need for organ transplantation across the world has increased in recent years, owing to increasing diseases requiring transplants. According to latest NHS (National Health Service) figures, the average time a person spends on the waiting for a kidney transplant is around 2 and a half to 3 years.

- Some leading players are also increasingly exploring 3D bioprinting, as it also reduces the risks associated with anesthesia during long surgeries and helps improve healthcare services. For instance, In August 2019, different scientists created a first-of-its-kind method which is utilized to bring the field of tissue engineering one step closer to being able to 3D print a full-sized, adult human heart.

3D Bioprinting Market Trend Analysis

Increasing Geriatric Population

- The maturating population is poised as one of the most significant social transformations of the twenty-first century. Globally, the population aged 60 or above is growing faster than all younger age groups. According to the data by the World Population Prospects, the number of people aged 60 years or above is expected to be more than double by 2050, and it is growing faster than the age groups consisting of youth, worldwide.

- This trend has an increasing demand for caregivers providing 24-hour care, not only at hospitals or nursing homes but also at apartments and private homes. Health-related issues, such as incidences of gangrene that are related to diabetes, osteoarthritis, and peripheral vascular diseases, are more common among the geriatric population. As they have lower immunity levels and are prone to neurological diseases, cardiac problems, cancers, and spinal injuries, therefore their growth is a high impact-rendering driver for the growth of 3D bioprinting market.

- The cost of researching new therapies has steadily mounted over the past few years. If the current drug discovery process remains unchanged, companies’ returns on these investments will continue to shrink. In light of growing costs, some organizations have overcome or even eliminated their R&D departments, opting to contract these services instead.

Growing Demand for Regenerative Medicine and Stem Cell Research

- Growing stem cell research activities and financial support from various public-private organizations are turning the growth of the stem cell and regenerative medicine industry over the globe. A supportive regulatory environment in emerging economies, the presence of a large number of stem cell product pipelines, and applications of regenerative medicine in treating diseases are the prime factors contributing to the growing adoption of stem cell and regenerative medicine globally.

- 3D bioprinting is utilized in numerous applications in regenerative medicine. It is applied in the creation of body parts such as cartilage, heart, and liver, among other organs, for the treatment of various disease conditions. In addition, stem cells are also utilized on a major scale for bioprinting various bones and tissues. These cells can modify easily to growth factors and develop into the required 3D structures.

- Regenerative medicine aims to replace or repair damaged tissues and organs, often utilizing stem cells. 3D bioprinting provides a precise method for creating complex, three-dimensional structures with cells and biomaterials, enabling the production of tissues and organs for transplantation.

3D Bioprinting Market Segment Analysis:

3D Bioprinting Market Segmented on the basis of type, application, and end-users.

By Technology, Syringe segment is expected to dominate the market during the forecast period

- Syringe-based 3D bioprinting allows for precise control over the deposition of bioink, which is the material containing cells and other biocompatible substances. This level of control is essential when creating intricate three-dimensional structures, especially when dealing with delicate biological materials.

- Syringe-based systems are often more versatile in handling various types of bioinks. Researchers and companies working on 3D bioprinting may choose syringe-based systems because they can accommodate a wide range of biomaterials, including different types of cells and support materials.

- Syringe-based 3D bioprinters are generally considered user-friendly, making them accessible to a broader range of researchers and laboratories. The simplicity of the syringe-based systems facilitates experimentation and innovation in different research settings.

- Syringe-based 3D bioprinting is often more scalable, allowing for the production of larger tissue constructs or even organs. This scalability is crucial when aiming for clinical applications or larger-scale tissue engineering projects.

By Application, Drug Testing segment held the largest share of 38.04 % in 2022

- 3D bioprinting technology enables the creation of three-dimensional tissue models that closely mimic the structure and function of human organs. These models offer a more accurate representation of in vivo conditions compared to traditional two-dimensional cell cultures. This enhanced accuracy is particularly crucial in drug testing, where the effects of pharmaceutical compounds on human tissues need to be reliably assessed.

- The use of 3D bioprinted tissues allows for more efficient and ethical drug testing by reducing the reliance on animal models. This aligns with growing concerns about animal welfare and the desire to develop alternative testing methods that are more predictive of human responses.

- 3D bioprinting enables the creation of personalized tissue models using a patient's own cells. This allows researchers to study how specific individuals may respond to certain drugs, contributing to the field of personalized medicine. Additionally, these 3D models can be used to simulate disease conditions, providing valuable insights into disease progression and potential drug treatments.

- 3D bioprinting technologies have advanced to a level where they can support high-throughput screening of drug candidates. This is essential for pharmaceutical companies looking to test numerous compounds efficiently and identify potential drug candidates with therapeutic efficacy and minimal side effects.

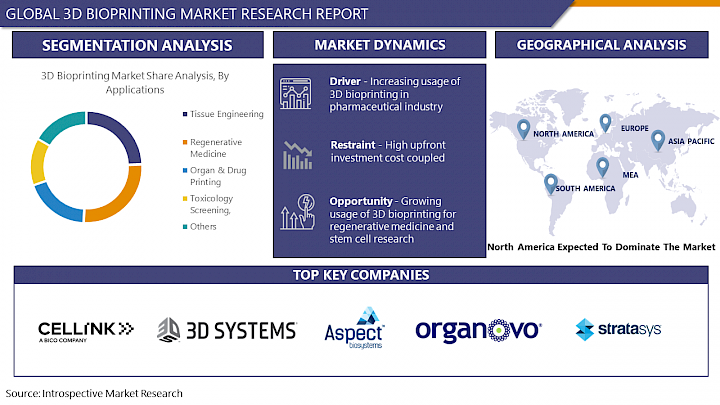

3D Bioprinting Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America, particularly the US, is home to some of the world's leading research institutions, universities, and biotechnology companies. The region's robust research and development infrastructure facilitates innovation in the field of 3D bioprinting.

- The availability of significant investment in the biotechnology and healthcare sectors in North America has fueled advancements in 3D bioprinting technology. Venture capital funding and support from government agencies contribute to the growth of bioprinting research and commercialization.

- Many key players in the 3D bioprinting industry, including companies developing bioprinters, biomaterials, and related technologies, are headquartered or have a significant presence in North America. These companies play a pivotal role in driving innovation and market growth.

- Collaborations between academic institutions and industry are common in North America, fostering an environment of knowledge exchange and technology transfer. Such collaborations accelerate the translation of research findings into practical applications, including advancements in 3D bioprinting.

- North America generally has a regulatory environment that supports innovation in the healthcare and biotechnology sectors. Regulatory agencies, such as the U.S. Food and Drug Administration (FDA), work closely with industry players to ensure the safety and efficacy of new technologies, including those related to 3D bioprinting.

3D Bioprinting Market Top Key Players:

- Organovo Holdings, Inc. (US)

- EnvisionTEC (US)

- Stratasys Ltd. (US)

- Allevi (US)

- nScrypt Inc. (US)

- Digilab Inc. (US)

- Biobots (US)

- TeVido BioDevices (US)

- Axolotl Biosciences (Mexico)

- Nano3D Biosciences, Inc. (US)

- CELLINK AB (US)

- Advanced Solutions Life Sciences (US)

- 3D Systems Corporation (US)

- Aspect Biosystems Ltd. (Canada)

- Materialise NV (Belgium)

- regenHU Ltd. (Switzerland)

- Poietis (France)

- GeSiM (Germany)

- 3Dynamic Systems Ltd. (UK)

- 3D Bioprinting Solutions (Russia)

- Bioprinting Research Center (Spain)

- CELLINK AB (Sweden)

- Cyfuse Biomedical K.K. (Japan)

- regenovo Biotechnology Co., Ltd. (China)

- Rokit Healthcare (South Korea), and Other Major Players.

Key Industry Developments in the 3D Bioprinting Market:

In July 2022, Eli Lilly & Corporation, a well-known international pharmaceutical company, and Triastek, Inc. founded a collaboration to leverage 3D printing technology. The tailored release of drugs into the gut will be the primary focus of the assignment. To hold drug stability during formulation outcome, 3D printing, and drug release, Triastek will concentrate on performing a detailed examination of excipient quality and process parameters.

In June 2022, REGEMAT 3D, a company at the forefront of personalized bio fabrication solutions, revealed a collaboration with Huma biologics, a business delivering human-derived biomaterials for regenerative medicine, in answer to the increasing need to fit a broader life sciences consumer base of the industry partners and academic institutions in the European bioprinting and drug testing market.

|

Global 3D Bioprinting Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.19 Bn. |

|

Forecast Period 2023-30 CAGR: |

17.84% |

Market Size in 2030: |

USD 4.42Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- 3D BIOPRINTING MARKET BY TECHNOLOGY (2016-2030)

- 3D BIOPRINTING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MAGNETIC LEVITATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- EXTRUSION BASED

- INKJET-BASED

- LASER-ASSISTED

- SYRINGE-BASED

- 3D BIOPRINTING MARKET BY APPLICATION (2016-2030)

- 3D BIOPRINTING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TISSUE ENGINEERING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- REGENERATIVE MEDICINE

- ORGAN & DRUG TESTING

- TOXICOLOGY SCREENING

- 3D BIOPRINTING MARKET BY END USERS (2016-2030)

- 3D BIOPRINTING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESEARCH

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ORGANIZATIONS & ACADEMIC INSTITUTES

- BIOPHARMACEUTICAL COMPANIES

- HOSPITALS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- 3D Bioprinting Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ORGANOVO HOLDINGS, INC. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ENVISIONTEC (US)

- STRATASYS LTD. (US)

- ALLEVI (US)

- NSCRYPT INC. (US)

- DIGILAB INC. (US)

- BIOBOTS (US)

- TEVIDO BIODEVICES (US)

- AXOLOTL BIOSCIENCES (MEXICO)

- NANO3D BIOSCIENCES, INC. (US)

- CELLINK AB (US)

- ADVANCED SOLUTIONS LIFE SCIENCES (US)

- 3D SYSTEMS CORPORATION (US)

- ASPECT BIOSYSTEMS LTD. (CANADA)

- MATERIALISE NV (BELGIUM)

- REGENHU LTD. (SWITZERLAND)

- POIETIS (FRANCE)

- GESIM (GERMANY)

- 3DYNAMIC SYSTEMS LTD. (UK)

- 3D BIOPRINTING SOLUTIONS (RUSSIA)

- COMPETITIVE LANDSCAPE

- GLOBAL 3D Bioprinting MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- UK

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global 3D Bioprinting Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.19 Bn. |

|

Forecast Period 2023-30 CAGR: |

17.84% |

Market Size in 2030: |

USD 4.42Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the 3D Bioprinting Market research report is 2023-2030.

Organovo Holdings, Inc. (US), EnvisionTEC (US), Stratasys Ltd. (US), Allevi (US), nScrypt Inc. (US), Digilab Inc. (US), Biobots (US), TeVido BioDevices (US), Axolotl Biosciences (Mexico), Nano3D Biosciences, Inc. (US), CELLINK AB (US), Advanced Solutions Life Sciences (US), 3D Systems Corporation (US), Aspect Biosystems Ltd. (Canada), Materialise NV (Belgium), regenHU Ltd. (Switzerland), Poietis (France), GeSiM (Germany), 3Dynamic Systems Ltd. (UK), 3D Bioprinting Solutions (Russia), Bioprinting Research Center (Spain), CELLINK AB (Sweden), Cyfuse Biomedical K.K. (Japan), regenovo Biotechnology Co., Ltd. (China), Rokit Healthcare (South Korea).and Other Major Players.

The 3D Bioprinting Market is segmented into Technology, Application, End Users and region. By Technology, the market is categorized into Magnetic Levitation, Extrusion based, Inkjet-based, Laser-assisted, Syringe-based. By Application, the market is categorized into Tissue Engineering, Regenerative Medicine, Organ & Drug Testing, Toxicology Screening. By End Users, the market is categorized into Research Organizations & Academic Institutes, Biopharmaceutical companies, Hospitals. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

3D bioprinting has been an emanate field represented by various biologically applied deposition and assembling systems, that includes direct writing, photolithography, microstamping, extrusion, laser writing, electro-printing, stereolithography, microfluidics, and inkjet deposition

3D Bioprinting Market Size Was Valued at USD 1.19 Billion in 2022, and is Projected to Reach USD 4.42 Billion by 2030, Growing at a CAGR of 17.84% From 2023-2030.